Baxter International Inc. (NYSE: BAX) stands as a prominent global leader in the healthcare industry, specializing in critical care, hospital products, renal care, and pharmaceutical solutions. As of June 2, 2025, the company’s shares are trading at approximately $30.50 USD. Understanding the potential trajectory of BAX stock requires a comprehensive look at its historical performance, the broader market landscape, and analytical projections. This analysis aims to provide a detailed outlook on BAX’s price forecast, considering both short-term and long-term horizons, while emphasizing the inherent complexities and uncertainties of financial markets.

Understanding Baxter International (BAX)

Baxter International is a diversified healthcare company with a rich history of over 90 years. Its portfolio includes a wide array of products and therapies used in hospitals and clinics, as well as by patients at home. Key areas of focus for Baxter include intravenous solutions and administration sets, sterile injectables, inhaled anesthetics, renal care products for kidney dialysis, and surgical products. The company’s mission revolves around saving and sustaining lives, which positions it within a vital and continuously evolving sector. Baxter operates globally, deriving a significant portion of its revenue from international markets, which exposes it to various geopolitical and economic factors, but also offers diversified growth opportunities.

The healthcare sector, in which Baxter operates, is often considered relatively stable due to the non-discretionary nature of healthcare services. However, it is not immune to pressures such as regulatory changes, reimbursement challenges, intense competition, and the constant need for innovation. Baxter’s success relies heavily on its ability to develop new products, maintain strong relationships with healthcare providers, manage supply chains effectively, and navigate the complex regulatory environments of the many countries it serves. Its financial health is influenced by factors like healthcare spending trends, demographics (e.g., aging populations requiring more care), and the adoption of new medical technologies.

Historical Performance of BAX Stock

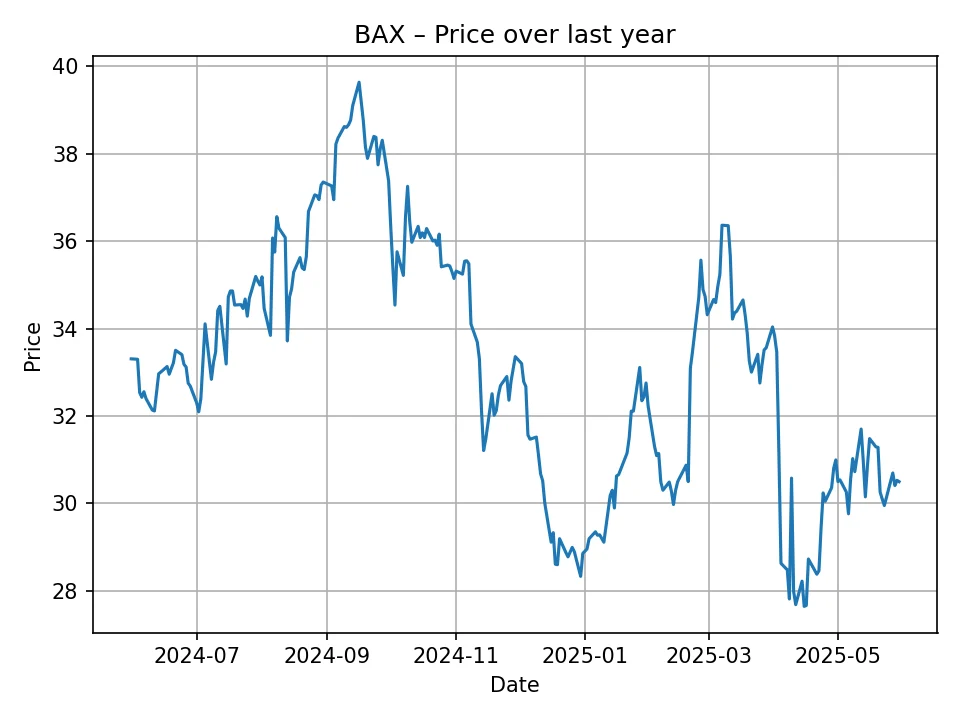

Examining the past performance of BAX stock offers valuable context for its current valuation and future projections. Over the past 12 months, Baxter International’s share price has experienced notable fluctuations. Beginning in early June 2024, the stock generally traded in the low to mid-$30s, showing periods of moderate ascent followed by pullbacks. For instance, prices hovered around $33-$34 USD in early to mid-2024, with occasional spikes reaching into the high-$30s, even touching around $39 USD at one point. This indicates phases of investor optimism, possibly driven by positive company news, sector-wide tailwinds, or broader market rallies.

However, the latter part of the 12-month period leading up to June 2025 reveals a distinct downward trend. From its peak in late 2024, the stock began a more consistent decline, breaking below its previous support levels and reaching its current price of $30.50 USD. This recent performance suggests a period of investor caution or possibly re-evaluation of the company’s immediate growth prospects or profitability outlook. Factors contributing to such a decline could include disappointing quarterly earnings, revised financial guidance, increased competitive pressures, or broader macroeconomic headwinds impacting the healthcare supply chain or demand. The historical data underscores the volatility inherent in even established stocks like BAX and highlights the importance of not just looking at absolute values but also the direction and momentum of price movements. The journey from around $33 USD a year ago to $30.50 USD today reflects a challenging period for the stock, indicating that the market has repriced BAX downwards based on recent developments or expectations.

Key Factors Influencing BAX Stock Price

Several critical factors shape the valuation and future trajectory of Baxter International’s stock. Understanding these elements is essential for any investor considering BAX.

Industry-Specific Dynamics

- Healthcare Spending Trends: Global healthcare expenditures are influenced by an aging population, rising chronic disease prevalence, and technological advancements. Favorable trends here can boost demand for Baxter’s products.

- Regulatory Environment: The medical device and pharmaceutical industries are heavily regulated. Changes in approval processes, safety standards, or product labeling can significantly impact Baxter’s operations and market access.

- Reimbursement Policies: Policies from government payers (e.g., Medicare, Medicaid) and private insurers regarding product reimbursement levels directly affect Baxter’s profitability and market access.

- Competition: The healthcare market is highly competitive. Baxter faces pressure from established rivals and innovative startups. Its ability to maintain market share and pricing power depends on product differentiation and operational efficiency.

Company-Specific Performance

- Research and Development (R&D): Innovation is paramount in healthcare. Baxter’s pipeline of new products and technologies, particularly in high-growth areas, is crucial for long-term revenue growth. Delays or failures in R&D can negatively impact investor sentiment.

- Financial Results: Quarterly and annual earnings reports, including revenue growth, profit margins, and cash flow, are closely scrutinized by investors. Consistent performance and positive outlooks tend to drive stock prices up.

- Strategic Initiatives: Acquisitions, divestitures, and partnerships can reshape Baxter’s portfolio and market position. For example, recent strategic moves to optimize its business segments have been under investor focus.

- Supply Chain Resilience: Given the global nature of its operations and the criticality of its products, disruptions in the supply chain (e.g., raw material shortages, geopolitical tensions) can impact production and delivery, affecting financial performance.

Broader Economic and Market Factors

- Interest Rates: Higher interest rates can increase borrowing costs for companies and make growth stocks less attractive as investors seek safer, yield-bearing alternatives.

- Inflation: Rising inflation can increase operating costs (e.g., labor, materials) for Baxter, potentially eroding profit margins if these costs cannot be passed on to customers.

- Global Economic Health: Economic downturns can affect healthcare spending patterns, particularly for elective procedures or capital equipment, though essential medical supplies remain in demand.

- Investor Sentiment: General market sentiment, often influenced by macroeconomic news, geopolitical events, and overall risk appetite, can lead to sector-wide movements that affect BAX irrespective of its individual performance.

Short-Term BAX Price Forecast (Next 12 Months)

Based on the provided linear model for monthly price projections, the short-term outlook for Baxter International (BAX) suggests a continuation of the declining trend observed in recent historical data. A linear model provides a straightforward, trend-based extrapolation, offering a basic estimate of future price movements. However, it’s important to remember that such models do not account for sudden market shifts, company-specific news, or broader economic changes that can significantly alter a stock’s trajectory.

Here is the monthly price forecast for BAX shares:

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-06 | 30.68 |

| 2025-07 | 30.36 |

| 2025-08 | 30.04 |

| 2025-09 | 29.72 |

| 2025-10 | 29.40 |

| 2025-11 | 29.09 |

| 2025-12 | 28.78 |

| 2026-01 | 28.47 |

| 2026-02 | 28.17 |

| 2026-03 | 27.87 |

| 2026-04 | 27.58 |

| 2026-05 | 27.28 |

The forecast indicates a gradual but consistent decline from the current price of $30.50 USD. By May 2026, the model projects BAX to trade around $27.28 USD. This suggests that if the underlying trends driving the stock’s recent performance persist, investors might witness further price erosion in the coming year. This declining forecast could stem from various factors, such as continued pressure on sales in specific product categories, increasing competition, or a general market re-evaluation of Baxter’s growth prospects in the near term. It is critical for investors to monitor Baxter’s quarterly earnings calls, management guidance, and any announcements regarding its strategic initiatives, as these can provide real-time indicators that may deviate from this linear projection.

Long-Term BAX Price Forecast (Next 10 Years)

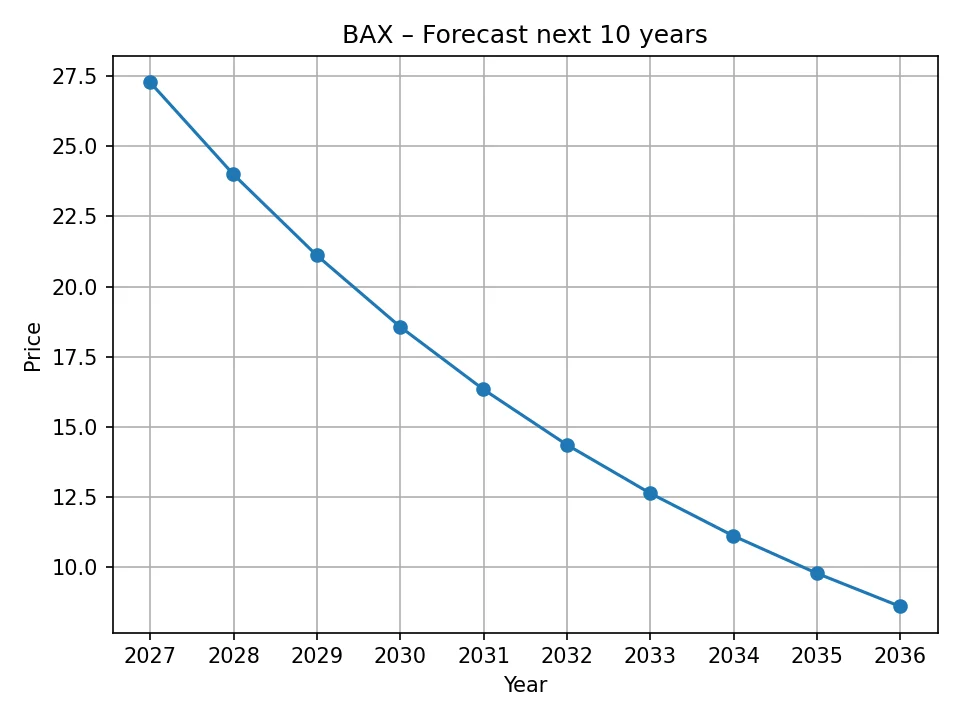

Extending the linear model to a 10-year horizon provides a theoretical long-term trend, but it’s crucial to acknowledge the significant limitations of such a simplistic projection over an extended period. Financial markets are dynamic, and a linear model cannot account for innovation, market disruptions, economic cycles, or major strategic shifts that are almost certain to occur over a decade. Therefore, this long-term forecast should be viewed as a baseline trend based on current data, not a definitive prediction.

Here is the annual price forecast for BAX shares:

| Year | Projected Price (USD) |

|---|---|

| 2026 | 27.28 |

| 2027 | 24.00 |

| 2028 | 21.11 |

| 2029 | 18.57 |

| 2030 | 16.34 |

| 2031 | 14.37 |

| 2032 | 12.64 |

| 2033 | 11.12 |

| 2034 | 9.79 |

| 2035 | 8.61 |

The linear model projects a substantial downward trend for BAX over the next decade. From an estimated $27.28 USD in 2026, the price is forecasted to decline steadily, reaching approximately $8.61 USD by 2035. This dramatic long-term decline, if it were to materialize, would imply significant challenges for Baxter International, such as sustained loss of market share, failure to innovate, increased competition, or severe economic pressures impacting the healthcare sector.

However, it is vital to reiterate that such a linear extrapolation over 10 years rarely holds true for complex entities like a global healthcare company. Companies actively work to counter negative trends through strategic adjustments, R&D investments, cost optimizations, and market expansions. A more sophisticated long-term analysis would incorporate diverse growth drivers, potential new product approvals, shifts in global healthcare policy, and the company’s ability to adapt to technological advancements. Therefore, while this forecast provides a snapshot of a possible trajectory if current dynamics remain unchanged, investors should regard it with extreme caution and conduct thorough independent research.

Risks and Opportunities for Baxter International

Investing in Baxter International, like any publicly traded company, comes with a set of inherent risks and potential opportunities. A balanced view requires acknowledging both.

Potential Risks

- Intense Competition: The medical device and pharmaceutical sectors are highly competitive. New entrants, innovative products from rivals, and aggressive pricing strategies can erode Baxter’s market share and profitability.

- Regulatory Scrutiny: Stricter regulations, product recalls, or delays in regulatory approvals can impose significant costs, disrupt operations, and damage Baxter’s reputation. Compliance failures can lead to substantial fines.

- Product Obsolescence: Rapid advancements in medical technology mean that existing products can quickly become obsolete. Baxter must continually invest in R&D to stay competitive, a process that is both costly and uncertain.

- Supply Chain Vulnerabilities: Global supply chains are susceptible to disruptions from geopolitical events, natural disasters, and pandemics. Any interruption can impact Baxter’s ability to produce and deliver essential medical products.

- Economic Downturns: While healthcare is generally resilient, severe economic contractions can lead to reduced healthcare spending, particularly for elective procedures, or impact the financial health of hospitals and clinics, thereby affecting demand for Baxter’s products.

- Cybersecurity Threats: As a technology-driven healthcare company, Baxter faces increasing risks from cyberattacks, which could compromise sensitive data, disrupt operations, or lead to reputational damage.

Potential Opportunities

- Aging Global Population: The increasing global elderly population drives a growing demand for healthcare products and services, particularly in areas like chronic disease management and renal care, where Baxter has a strong presence.

- Emerging Markets Growth: Expanding healthcare infrastructure and increasing access to medical care in developing economies present significant untapped market opportunities for Baxter’s products.

- Product Innovation: Successful development and launch of new, cutting-edge products, especially in areas like connected care, digital health solutions, and advanced therapies, can open new revenue streams and strengthen market leadership.

- Strategic Acquisitions and Partnerships: Targeted acquisitions can enhance Baxter’s product portfolio, expand its geographic reach, or provide access to new technologies, thereby fueling growth.

- Operational Efficiency: Continuous efforts to streamline operations, optimize manufacturing processes, and reduce costs can improve profit margins and enhance shareholder value.

- Increased Focus on Home Healthcare: A growing trend towards delivering healthcare services in outpatient and home settings aligns well with Baxter’s strengths in home dialysis and other patient-friendly solutions.

Investment Considerations for BAX

For investors contemplating Baxter International stock, it is crucial to synthesize the various factors discussed. While the linear forecast models indicate a bearish trend for BAX over both the short and long term, it is paramount to recognize the limitations of such models. These models provide a mechanistic extrapolation of past trends and do not account for qualitative factors, management actions, or unforeseen market developments that can significantly alter a company’s prospects.

Investors should look beyond simplistic price predictions and conduct their own comprehensive due diligence. This includes analyzing Baxter’s latest financial reports, assessing its product pipeline, understanding its competitive landscape, and evaluating management’s strategic vision. A company with a strong foundation in a resilient industry like healthcare, even one facing temporary headwinds, can often rebound given effective leadership and strategic adjustments.

Consider the following:

- Valuation Metrics: Compare BAX’s current valuation (e.g., P/E ratio, price-to-sales) against its historical averages and industry peers to determine if it is undervalued or overvalued.

- Dividend Policy: Baxter has a history of paying dividends, which can appeal to income-focused investors, providing a return even during periods of modest stock price appreciation or decline.

- Analyst Consensus: Review reports from multiple financial analysts covering Baxter to get a broader perspective on its prospects. While not definitive, a consensus can offer valuable insights.

- Macroeconomic Outlook: Assess the general economic environment and its potential impact on the healthcare sector and Baxter’s specific business segments.

- Long-Term Strategy: Understand Baxter’s long-term growth initiatives, including investments in R&D, market expansion, and efforts to improve operational efficiency.

Ultimately, investing in BAX or any stock carries risk, and past performance is not indicative of future results. The linear forecast provides a stark warning if current trends persist. However, Baxter International’s history as a foundational player in global healthcare means it possesses significant resources and capabilities to adapt and potentially reverse negative trends. Any investment decision should align with an individual’s risk tolerance and financial goals, ideally as part of a diversified portfolio.

Conclusion

Baxter International (BAX), currently trading at $30.50 USD, operates within the vital and evolving global healthcare sector. While the company possesses a strong foundation and a diversified product portfolio, its recent historical performance has shown a declining trend. The linear price forecast models, both for the next 12 months and the next 10 years, project a continued downward trajectory, indicating that BAX could face significant challenges if current market dynamics and company-specific pressures persist without counteracting measures.

The short-term forecast suggests a potential drop to approximately $27.28 USD by May 2026, while the long-term projection sees a more dramatic decline to around $8.61 USD by 2035. It is crucial for investors to treat these linear projections with extreme caution, as they are simplified extrapolations that do not account for the myriad of complex factors influencing a dynamic company like Baxter. The company’s ability to innovate, adapt to regulatory changes, manage competition, and execute strategic initiatives will be far more influential in determining its actual long-term share price.

Potential investors should thoroughly research Baxter’s financial health, strategic plans, and the broader healthcare industry trends. While the forecasts suggest headwinds, Baxter’s established presence and focus on essential healthcare products offer potential for resilience and future growth, provided it can successfully navigate its challenges and capitalize on emerging opportunities. Diversification and a long-term investment horizon, coupled with continuous monitoring of company performance and market conditions, remain fundamental principles for navigating the complexities of stock market investments.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.