Verisign (VRSN) stands as a foundational pillar of the internet, operating critical infrastructure that enables countless online interactions daily. As the exclusive registry operator for the .com and .net top-level domains, along with two of the internet’s 13 root nameservers, Verisign plays an indispensable role in maintaining the global accessibility and stability of the internet. Its unique position grants it significant influence over the domain name system, making its financial performance and stock trajectory a subject of keen interest for investors tracking the digital economy.

The current price of Verisign stock is $275.76 USD, as of June 4, 2025. This article delves into the historical performance of VRSN over the past year and presents an in-depth price forecast for the next 12 months and the upcoming decade, utilizing advanced algorithmic analysis.

Understanding Verisign’s Market Position and Historical Performance

Verisign’s business model is built on recurring revenue generated from domain name registrations and renewals. This provides a high degree of predictability and stability, distinguishing it from many other technology companies subject to rapid product cycles or volatile consumer trends. The company’s critical function ensures a continuous demand for its services, tied directly to the persistent growth of the internet itself.

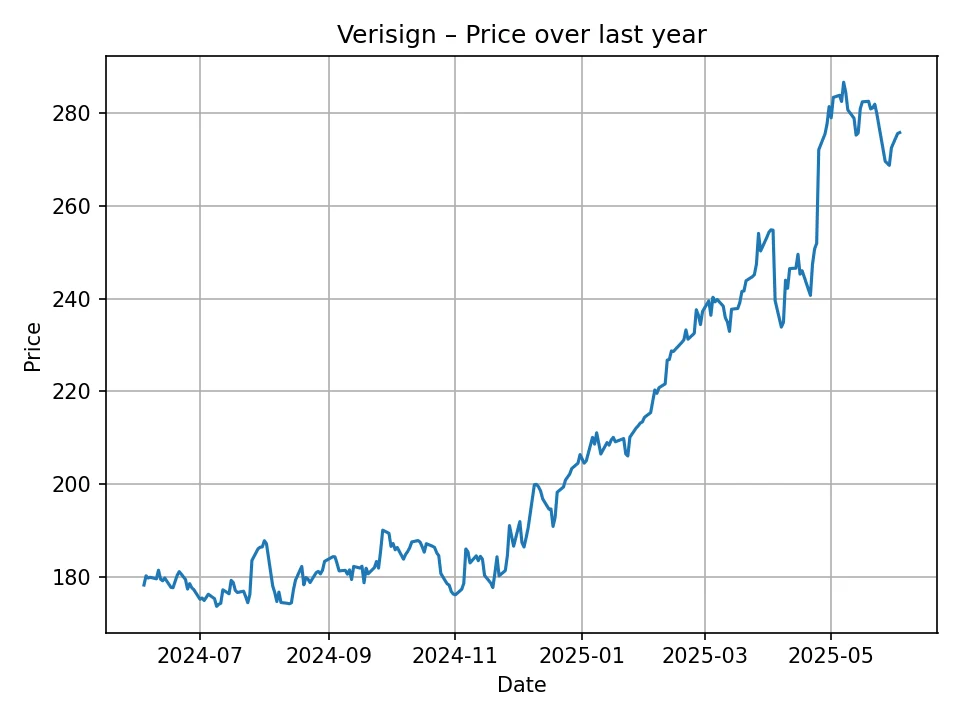

Looking back at the past 12 months, Verisign’s stock has demonstrated a notable upward trajectory, albeit with periods of consolidation and occasional dips. The historical data shows a remarkable ascent from the lower end of the $170s in the first half of the preceding year to its current levels approaching $280. This significant appreciation reflects a combination of factors: consistent execution on its core business, a stable regulatory environment, and the broader market’s increasing valuation of essential infrastructure plays.

Initial prices in the provided historical data hovered around the $170-$180 USD range, with some minor fluctuations. There were periods of consolidation, where the stock traded sideways, but overall, a clear pattern of higher lows and higher highs emerged. For instance, after trading consistently below $190 for several months, a notable breakout occurred, pushing the price beyond the $200 mark. This momentum continued, with the stock breaching $210, then $220, and subsequently establishing new trading ranges at progressively higher valuations.

The latter part of the 12-month period shows an acceleration in growth, with the stock making significant leaps from the $230s to the $250s, and most recently, into the $270s. This robust performance underscores investor confidence in Verisign’s long-term revenue visibility and its integral role in the digital landscape. The ability to steadily increase prices for .com and .net domains, as approved by ICANN, further supports its revenue growth and profitability.

Key Factors Influencing Verisign’s Stock Price

Several fundamental factors underpin Verisign’s valuation and will continue to influence its stock price moving forward:

- Global Internet Growth: The continuous expansion of internet users and online businesses directly translates to an increased demand for domain names, Verisign’s primary revenue source. Emerging markets, in particular, offer significant growth potential.

- Domain Name Registrations and Renewals: The volume of new registrations and, more importantly, the renewal rates of existing domains are direct indicators of Verisign’s revenue health. High renewal rates signal strong customer retention and stable recurring income.

- Pricing Agreements: Verisign’s ability to periodically increase prices for .com and .net domains, subject to agreements with ICANN (Internet Corporation for Assigned Names and Numbers) and the U.S. Department of Commerce, is a crucial driver of revenue growth. These agreements provide a clear roadmap for future pricing power.

- Technological Advancements and Security: While primarily an infrastructure provider, Verisign’s investment in security infrastructure and its ability to defend against cyber threats affecting the DNS are vital for maintaining trust and stability. Any major security incidents could impact perception, though historically the company has demonstrated resilience.

- Regulatory Environment: Verisign operates under specific regulatory frameworks due to its unique position. Changes in these agreements or increased regulatory scrutiny could impact its operations or pricing power.

- Competitive Landscape: Although Verisign holds a near-monopoly in the .com and .net spaces, the broader domain name market includes competition from other top-level domains (TLDs). However, the established brand equity and universal recognition of .com and .net provide a significant competitive moat.

- Economic Conditions: Broader economic conditions, such as global GDP growth and business investment, can indirectly affect the rate of new domain registrations. However, the essential nature of domain names tends to make Verisign relatively resilient to minor economic downturns.

- Shareholder Returns: Verisign’s strong free cash flow generation often leads to significant share repurchases, which can boost earnings per share and support stock price appreciation.

PriceCast Algorithm: Predictive Insights for Verisign

The price forecasts presented below have been generated using the PriceCast algorithm, a proprietary analytical tool designed to project future stock prices based on a comprehensive evaluation of historical data, market trends, and a range of quantitative indicators. While the specifics of the algorithm remain confidential, it incorporates various statistical models, machine learning techniques, and market dynamics to identify potential price movements. The algorithm processes vast amounts of historical trading data, looking for patterns, momentum, and correlations that can inform future projections. It’s important to understand that such models provide probabilistic outcomes and are not guarantees of future performance.

Verisign (VRSN) 12-Month Price Forecast (Monthly)

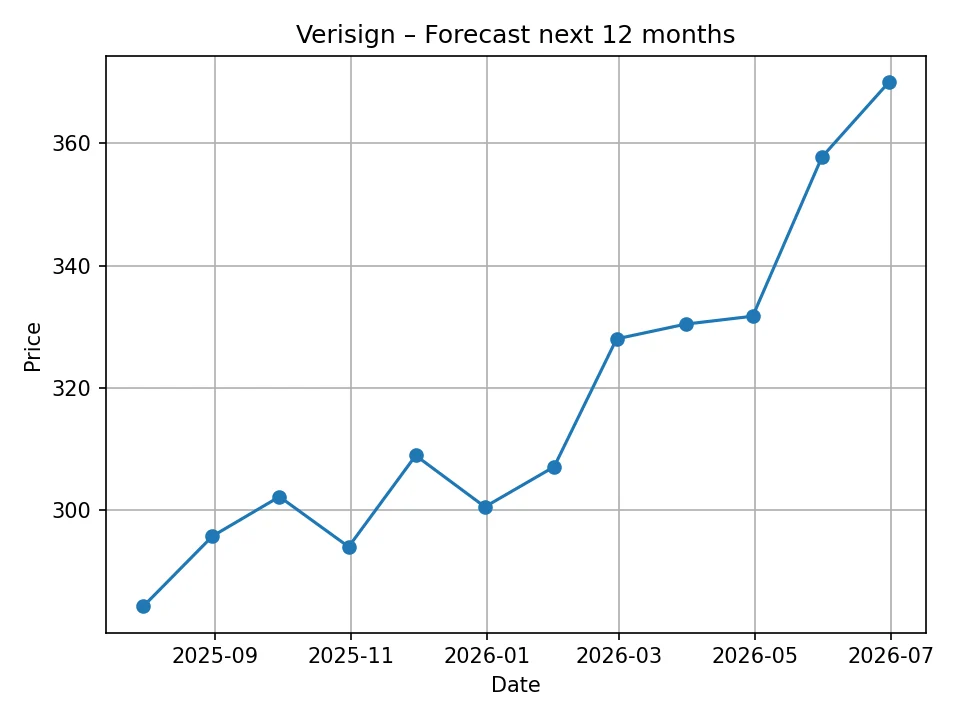

The PriceCast algorithm projects continued positive momentum for Verisign over the next year. The monthly forecast indicates a steady, upward trend, beginning from the current price and consistently increasing. This suggests that the underlying growth drivers for Verisign’s business are expected to remain strong, leading to continued investor confidence.

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-07 | $284.31 |

| 2025-08 | $295.79 |

| 2025-09 | $302.24 |

| 2025-10 | $294.05 |

| 2025-11 | $308.98 |

| 2025-12 | $300.58 |

| 2026-01 | $307.13 |

| 2026-02 | $328.05 |

| 2026-03 | $330.46 |

| 2026-04 | $331.75 |

| 2026-05 | $357.77 |

| 2026-06 | $370.01 |

The forecast suggests that VRSN could cross the $300 USD threshold within the next few months, indicating robust near-term growth. While there are minor fluctuations projected (e.g., a slight dip in October and December 2025), the overall trend remains firmly positive. By June 2026, the algorithm anticipates a significant increase, with the stock potentially reaching $370.01 USD, representing a substantial gain from its current price. This short-term outlook highlights the continued attractiveness of Verisign as a stable growth investment within the technology sector.

Verisign (VRSN) 10-Year Price Forecast (Annual)

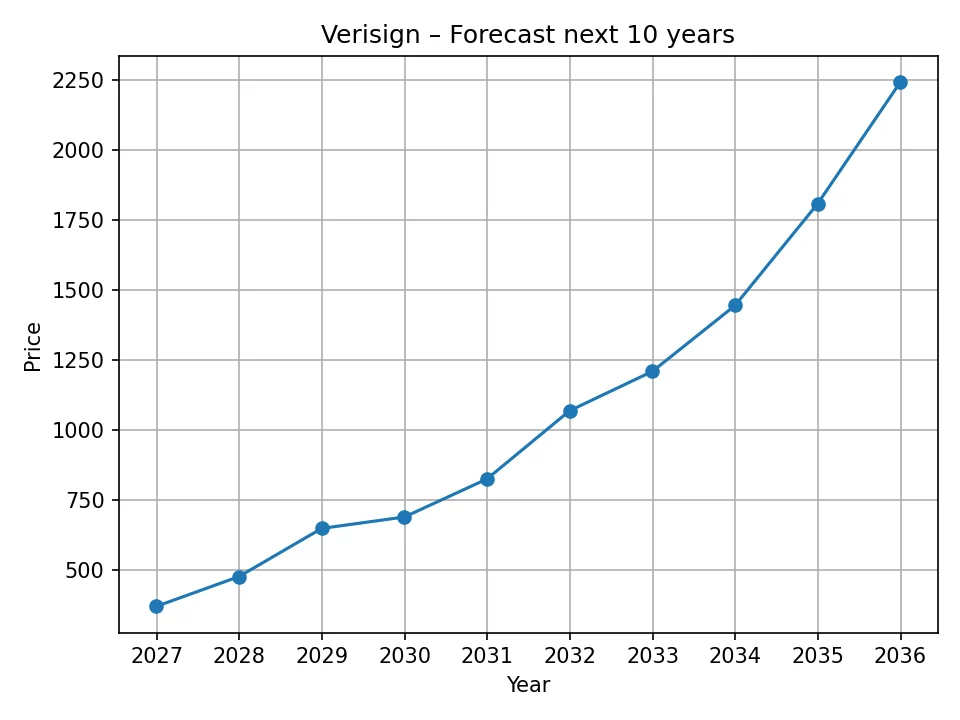

The long-term forecast for Verisign presents an even more compelling picture, suggesting substantial appreciation over the next decade. This projection aligns with the expectation that Verisign’s essential services will continue to be in high demand as the internet expands and becomes more integral to global commerce and communication.

| Year | Projected Price (USD) |

|---|---|

| 2026 | $370.01 |

| 2027 | $476.31 |

| 2028 | $648.34 |

| 2029 | $688.98 |

| 2030 | $824.75 |

| 2031 | $1068.20 |

| 2032 | $1208.77 |

| 2033 | $1443.99 |

| 2034 | $1807.25 |

| 2035 | $2240.70 |

The annual forecast projects continuous, strong growth for Verisign, with the stock potentially more than doubling by 2028 and continuing its upward trajectory into the thousands of dollars per share by the end of the decade. By 2031, the price is projected to exceed $1,000 USD, indicating a transition to a significantly higher valuation tier. The compounded growth rate suggested by these figures underscores the long-term compounding power derived from Verisign’s stable, recurring revenue streams and its monopolistic position in critical internet infrastructure.

This long-term outlook implies that the PriceCast algorithm identifies Verisign as a robust compounder, capable of delivering significant returns over extended periods. The consistent year-over-year growth in projected prices suggests that the fundamental drivers of Verisign’s business, such as steady internet growth and favorable regulatory environments, are expected to persist and strengthen.

Investment Considerations and Risks

While the outlook for Verisign appears highly favorable based on these algorithmic projections, it is crucial for investors to consider the inherent risks and dynamics of the market. No investment is without risk, and even companies with strong fundamentals can be affected by unforeseen circumstances.

Potential risks for Verisign include:

* Regulatory Changes: Although current agreements are stable, future regulatory shifts or changes in ICANN’s policies could impact Verisign’s domain pricing or operational framework.

* Technological Disruption: While highly unlikely given the entrenched nature of DNS, any fundamental shift in how internet addresses are resolved could theoretically pose a long-term risk.

* Cybersecurity Threats: A major, sustained attack on the core DNS infrastructure, even if successfully mitigated, could cause temporary market concern.

* Macroeconomic Headwinds: Severe global economic downturns could marginally slow the rate of new domain registrations, although renewals tend to be more resilient.

* Competition from New TLDs: While .com and .net remain dominant, the proliferation of new generic top-level domains (gTLDs) could slightly fragment the market, though their impact on Verisign’s core business has been limited so far.

Investors should always conduct their own thorough due diligence, research, and analysis before making any investment decisions. Financial forecasts, including those generated by sophisticated algorithms, are predictive in nature and are subject to market volatility, economic shifts, and unforeseen events. They should be used as one component of a broader investment strategy, ideally in consultation with a qualified financial advisor.

Disclaimer: The price forecasts presented in this article for Verisign (VRSN) are generated by a proprietary analytical algorithm known as PriceCast. These projections are based on historical data analysis, statistical modeling, and identified market trends. It is crucial to understand that all investment forecasts are speculative and inherently subject to market volatility, economic conditions, and unforeseen events. We are not responsible for the accuracy of these price predictions or any investment decisions made based on this information. Investors should conduct their own comprehensive research and consult with a professional financial advisor before making any investment.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.