News Corp (Class B), traded under the ticker symbol NWSA, stands as a prominent global media and information services company. As of June 5, 2025, its stock is priced at 32.16 USD. This article delves into a comprehensive price prediction for NWSA, analyzing its historical performance, identifying key influencing factors, and presenting both short-term monthly forecasts and long-term annual projections powered by the proprietary EchoPredict algorithm. For investors and market observers, understanding the trajectory of a company like News Corp, deeply embedded in evolving sectors such as news, digital real estate, and book publishing, is crucial for informed decision-making.

Understanding News Corp (Class B): A diversified Media Giant

News Corp is a diversified media powerhouse with a significant global footprint, operating across several key segments. Its portfolio includes:

* News Media: Iconic brands like The Wall Street Journal, Barron’s, The New York Post, and The Times (UK), alongside various Australian news publications. This segment is characterized by its reliance on advertising revenue and digital subscriptions, constantly adapting to the shifting consumption habits of news.

* Digital Real Estate Services: This is a high-growth segment, primarily driven by REA Group in Australia and Move, Inc. (operator of realtor.com®) in the U.S. These platforms benefit from the ongoing digitalization of real estate transactions and advertising.

* Book Publishing: HarperCollins Publishers, one of the world’s leading English-language publishers, falls under this segment. It navigates both traditional print and the rapidly expanding digital book market.

* Subscription Video Services: Foxtel in Australia, offering sports, entertainment, and news, represents a significant portion of its subscription-based revenue.

News Corp’s strategy involves leveraging its powerful brands, accelerating digital transformation, and capitalizing on the shift towards subscription-based models. Its diverse revenue streams theoretically offer a degree of resilience against downturns in any single market, though each segment faces its unique set of challenges and opportunities.

Historical Performance Analysis: A Look Back at NWSA’s Journey

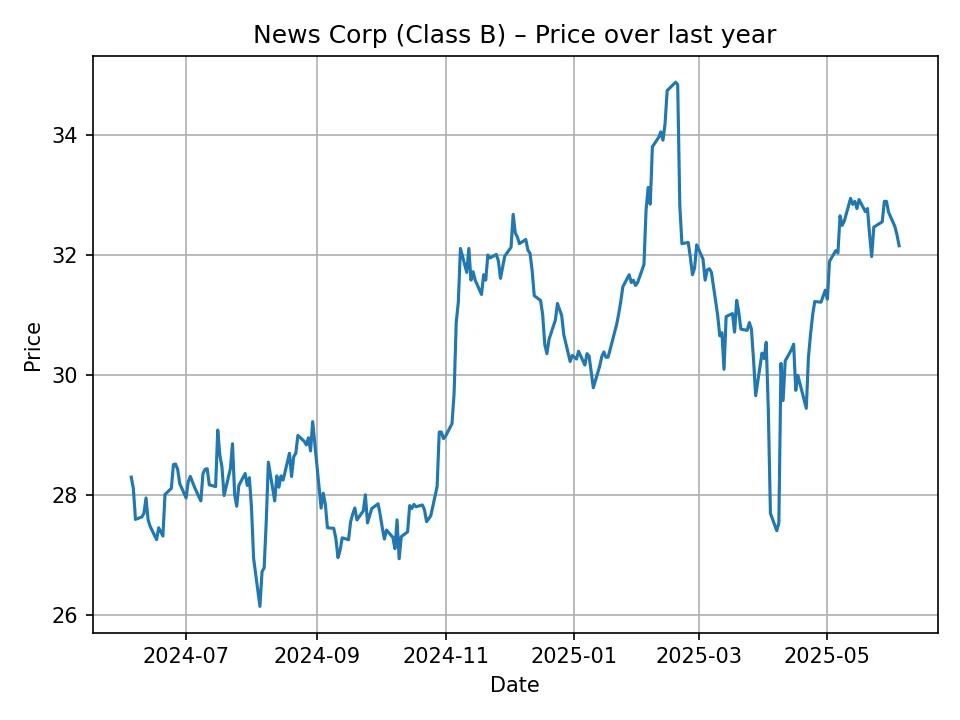

Over the past 12 months, News Corp (Class B) has experienced a range of price movements, reflecting both broader market sentiment and company-specific developments. Analyzing the provided daily historical data, we can observe distinct patterns and key price points that offer context for current and future valuations.

The stock price during this period has fluctuated, with a low point around 26.14 USD and a high reaching approximately 34.88 USD. The current price of 32.16 USD places it closer to the higher end of its 52-week range, indicating a generally positive momentum leading up to June 2025.

Early in the historical dataset, the stock hovered primarily in the 27-29 USD range, showing periods of moderate stability interspersed with minor dips and recoveries. This period likely reflected market uncertainties or steady operational performance without significant catalysts. There were instances of sharper declines, testing support levels in the mid-26 USD range, which could have been triggered by broader market corrections, specific earnings reports that underperformed expectations, or general investor apprehension regarding the media sector. However, the stock demonstrated resilience, often recovering from these troughs.

A notable shift appears roughly halfway through the 12-month period, where the stock began to show a more pronounced upward trend. From the lower 30 USDs, it steadily climbed, eventually breaking into the mid-30 USD range. This upward trajectory suggests positive investor sentiment, possibly driven by strong financial results from key segments like digital real estate, successful digital transformation efforts within its news media division, or strategic announcements that were well-received by the market. The ability to sustain prices above the 30 USD mark indicates a re-evaluation of its intrinsic value by investors, perhaps anticipating continued growth in its digital segments or improved advertising market conditions.

The volatility observed suggests that NWSA is susceptible to market-wide fluctuations and sector-specific news, typical of media companies. However, the overall movement from the lower 28-29 USD range to the current 32.16 USD demonstrates a positive appreciation in value over the past year. This sustained growth, even with interim corrections, implies a fundamental strength that investors are increasingly recognizing. The journey from its lower points to its current standing highlights the company’s efforts to adapt to the evolving media landscape and its success in diversifying revenue streams, particularly through its digital real estate assets. This historical context is vital in evaluating the credibility and potential of future price predictions, as it demonstrates the stock’s capacity for both resilience and growth.

Key Factors Influencing News Corp’s Stock Price

The valuation of News Corp’s stock is a complex interplay of several interconnected factors, ranging from company-specific operational performance to broader macroeconomic and industry trends. Understanding these influences is essential for any investor considering NWSA.

1. Digital Transformation and Subscription Growth

A primary driver for News Corp’s future valuation lies in its continued success in digital transformation. In the News Media segment, the shift from declining print advertising and circulation to robust digital subscription models is critical. The Wall Street Journal and The Times (UK) have shown considerable progress here, but extending this success across other publications and minimizing reliance on traditional ad revenue is vital. The more successful News Corp is in convincing readers to pay for quality digital content, the more stable and predictable its revenue streams become. Similarly, in the Subscription Video Services segment (Foxtel), the transition to streaming (Binge, Kayo Sports) is crucial for retaining and attracting younger audiences who are moving away from traditional pay-TV. Growth in digital subscribers, average revenue per user (ARPU), and retention rates will directly impact investor confidence.

2. Performance of Digital Real Estate Services

The Digital Real Estate Services segment, particularly REA Group and realtor.com®, is often considered the jewel in News Corp’s crown due to its high growth and profitability. The performance of these platforms is closely tied to the health of the global real estate markets, including transaction volumes, property prices, and digital advertising spend by real estate professionals. Factors such as interest rates, housing affordability, and consumer confidence in buying and selling homes directly influence listing volumes and agent spending on advertising and lead generation services on these platforms. Sustained growth in this segment, especially through innovation (e.g., AI-powered tools for agents, enhanced consumer search experiences), will be a significant positive catalyst for NWSA’s stock. Any downturns in key housing markets or increased competition could, however, pose a challenge.

3. Advertising Market Dynamics

Across its News Media and to some extent its Subscription Video Services, advertising revenue remains a significant component. The global advertising market is highly sensitive to economic cycles. During economic downturns, companies tend to cut marketing budgets, impacting media companies. Conversely, a strong economy typically leads to increased ad spending. Beyond the macroeconomic cycle, structural shifts in advertising, such as the increasing dominance of large tech platforms (Google, Meta), competition from digital-native media, and the ongoing shift from traditional linear advertising to programmatic and digital video ads, also impact News Corp. Its ability to capture a larger share of digital ad spend and leverage its unique first-party data will be crucial.

4. Macroeconomic Environment

Broader economic conditions exert considerable influence. Inflationary pressures can increase operating costs (e.g., paper, energy, labor) while potentially dampening consumer spending on subscriptions and advertising. Interest rate hikes, aimed at combating inflation, can cool down the real estate market, directly impacting the Digital Real Estate Services segment. A strong economy, characterized by low unemployment and robust consumer confidence, generally benefits media companies through increased advertising and higher discretionary spending on subscriptions. Conversely, a recession or significant economic slowdown could put downward pressure on NWSA’s stock.

5. Technological Innovation and Competition

The media and information services industries are in constant flux due to rapid technological advancements. News Corp must continuously innovate to remain competitive. This includes adopting artificial intelligence for content creation, personalization, and monetization; leveraging data analytics for audience insights; and optimizing digital delivery platforms. Emerging competitors, from new streaming services to niche digital news outlets and proptech startups, continually challenge established players. News Corp’s investment in technology, its agility in adapting to new consumption patterns, and its ability to fend off competitive threats will be key determinants of its long-term success and stock performance.

6. Content Investment and Strategic Initiatives

News Corp’s ability to maintain high-quality, exclusive content (news, sports rights, book titles) is paramount to attracting and retaining subscribers and advertisers. Significant investments in content creation, journalistic integrity, and editorial talent are ongoing necessities. Strategic initiatives, such as mergers, acquisitions, or divestitures of non-core assets, can also significantly impact the stock. Successful integration of new acquisitions or the strategic shedding of underperforming assets can unlock value, while missteps can lead to write-downs and investor skepticism.

7. Regulatory and Political Landscape

As a major media conglomerate, News Corp operates within a heavily regulated environment. Changes in media ownership rules, antitrust regulations, content censorship policies, or data privacy laws could impact its operations and profitability. Furthermore, the political landscape in its key markets (U.S., UK, Australia) can influence public trust in news media, advertising regulations, and even government spending on public information campaigns, all of which can indirectly affect News Corp’s bottom line.

In summary, while News Corp benefits from its diversified portfolio and strong brand equity, its future stock performance hinges on its ability to execute its digital strategy, maintain growth in its high-performing real estate segment, navigate volatile advertising markets, and adapt to the ever-evolving technological and regulatory landscape.

EchoPredict: An Algorithmic Approach to Price Forecasting

The price predictions presented in this article are generated using EchoPredict, a sophisticated proprietary algorithm designed for financial market forecasting. EchoPredict processes extensive datasets, including historical price movements, trading volumes, market volatility, and a range of technical indicators. By identifying complex patterns and relationships within this data, the algorithm attempts to project future price trends. While highly advanced, it’s important to remember that all algorithmic predictions are based on historical probabilities and do not account for unforeseen market disruptions or black swan events. They serve as valuable tools for analysis but should always be considered alongside fundamental company analysis and broader market intelligence.

Short-Term Outlook: Monthly Price Forecast for News Corp (Class B)

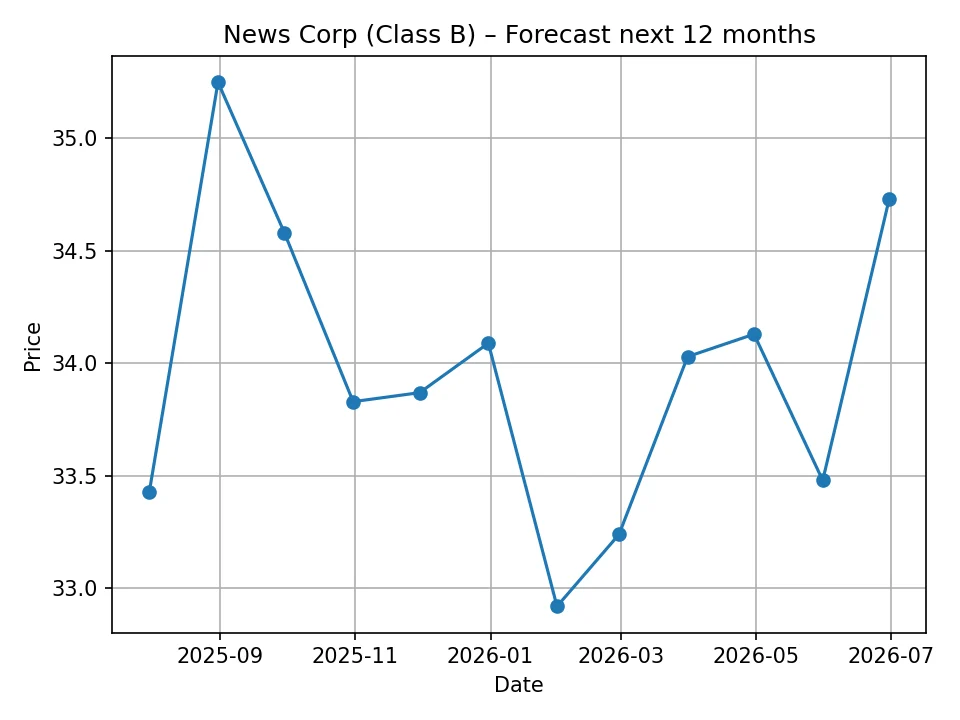

The following table provides a detailed monthly forecast for News Corp (Class B) stock over the next 12 months, from July 2025 to June 2026, generated by the EchoPredict algorithm. This short-term projection offers insights into the anticipated immediate performance of NWSA.

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-07 | 33.43 |

| 2025-08 | 35.25 |

| 2025-09 | 34.58 |

| 2025-10 | 33.83 |

| 2025-11 | 33.87 |

| 2025-12 | 34.09 |

| 2026-01 | 32.92 |

| 2026-02 | 33.24 |

| 2026-03 | 34.03 |

| 2026-04 | 34.13 |

| 2026-05 | 33.48 |

| 2026-06 | 34.73 |

Based on the EchoPredict algorithm, News Corp (Class B) is projected to experience a generally positive short-term trend. From its current price of 32.16 USD, the stock is expected to see an initial uplift, reaching 33.43 USD in July 2025 and accelerating to a peak of 35.25 USD in August 2025 within this 12-month window. This initial surge suggests a continuation of the positive momentum observed in its recent historical data, possibly fueled by anticipated strong quarterly earnings reports or favorable market conditions for its digital segments.

Following this peak in August, the forecast indicates a slight pullback in September (34.58 USD) and October (33.83 USD), suggesting a period of consolidation or mild profit-taking. However, the price is expected to stabilize and resume a moderate upward trajectory towards the end of 2025, reaching 34.09 USD by December.

Entering 2026, the forecast predicts a dip to 32.92 USD in January, which could be attributed to typical post-holiday market adjustments or year-end financial reporting cycles. Nevertheless, the stock is projected to rebound, gradually climbing back towards the 34 USD range by March and April 2026. The period culminates in June 2026 with a projected price of 34.73 USD, indicating a net gain over the 12-month period.

This short-term forecast suggests that while there might be minor fluctuations and periods of slight retracement, the underlying trend for NWSA stock appears to be positive. The algorithm anticipates continued growth, likely driven by the ongoing strength of its digital real estate services and the gradual improvement in the digital advertising landscape. Investors should monitor quarterly earnings, strategic digital initiatives, and broader market sentiment as key indicators that could align with or deviate from these monthly projections.

Long-Term Outlook: Annual Price Forecast for News Corp (Class B)

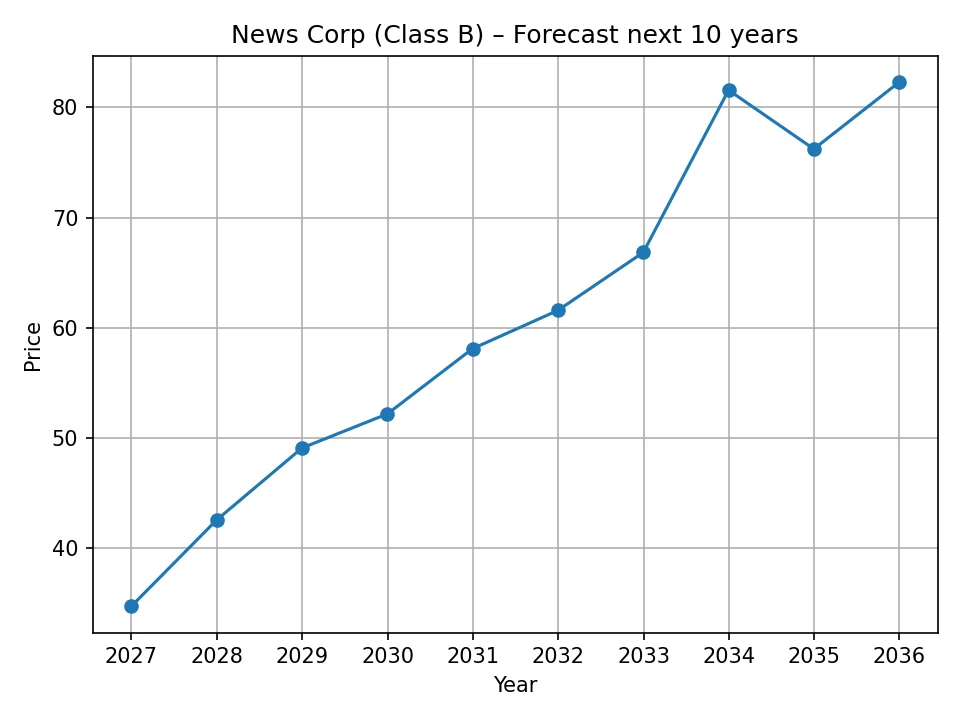

The long-term forecast for News Corp (Class B) extends a decade into the future, providing a broader perspective on the stock’s potential trajectory. These annual projections, generated by the EchoPredict algorithm, help in understanding the sustained growth potential of NWSA, assuming prevailing market conditions and company strategies continue to evolve positively.

| Year | Projected Price (USD) |

|---|---|

| 2026 | 34.73 |

| 2027 | 42.56 |

| 2028 | 49.10 |

| 2029 | 52.19 |

| 2030 | 58.11 |

| 2031 | 61.58 |

| 2032 | 66.85 |

| 2033 | 81.57 |

| 2034 | 76.23 |

| 2035 | 82.29 |

The long-term forecast paints a compelling picture of significant growth for News Corp (Class B). Starting with a projected annual average of 34.73 USD for 2026 (aligning with the end of the monthly forecast), the EchoPredict algorithm anticipates a robust upward trend throughout the decade.

The most striking aspect of this long-term projection is the consistent and substantial increase year-over-year for the initial years. By 2027, the price is expected to jump to 42.56 USD, crossing a significant psychological barrier. This momentum continues, with projections reaching 49.10 USD in 2028 and surpassing the 50 USD mark to 52.19 USD in 2029. This sustained early-decade growth suggests that the algorithm identifies strong underlying fundamentals and an expanding market capitalization potential for News Corp. It implies that the company’s strategic shift towards digital revenue streams, particularly within its highly profitable digital real estate segment, will continue to bear fruit, coupled with a successful monetization of its news and content assets.

By the turn of the decade, in 2030, NWSA is forecast to reach 58.11 USD, approaching the 60 USD threshold. The growth trend further accelerates into the early 2030s, with a projection of 61.58 USD in 2031 and a strong climb to 66.85 USD in 2032. This period of robust growth could be underpinned by sustained innovation, successful expansion into new digital markets, or strategic acquisitions that consolidate its market position.

A particularly strong surge is predicted for 2033, with the price leaping to 81.57 USD. This significant increase could signify a major breakthrough in one of its segments, a widespread recognition of its diversified value, or a period of exceptionally favorable economic conditions for the media and digital services industries. While there’s a slight anticipated correction to 76.23 USD in 2034, it remains at a substantially elevated level. The forecast culminates in 2035 with a projected price of 82.29 USD, representing a remarkable long-term appreciation from its current value.

This long-term outlook suggests that the EchoPredict algorithm envisions News Corp successfully navigating the complexities of the evolving media landscape. It implies that the company will continue to benefit from the digitalization of news and real estate, consolidate its position in key markets, and effectively monetize its vast content library. For long-term investors, this forecast suggests that NWSA could be a strong candidate for capital appreciation, provided the company continues to execute its strategy and adapt to future challenges effectively.

Risks and Opportunities in the Decade Ahead

While the forecasts suggest a positive trajectory for News Corp (Class B), it’s imperative to consider the inherent risks and opportunities that could shape its actual performance over the coming decade.

Opportunities:

- Accelerated Digital Transformation: News Corp has proven its ability to pivot towards digital. Further acceleration in digital subscriptions, particularly for its flagship news brands, and expanding the reach of its digital real estate platforms into untapped markets or through new service offerings (e.g., mortgage services, property management tools) could unlock significant value.

- AI Integration: The effective integration of Artificial Intelligence across its operations presents a massive opportunity. AI can enhance content creation efficiency, personalize user experiences, optimize advertising placements, and improve data analytics for better decision-making in real estate listings. Leveraging AI for internal efficiencies and new product development could drive profitability.

- Diversification Strength: The company’s diversified portfolio provides a hedge. Should traditional news media face headwinds, strong performance in digital real estate services (REA Group, realtor.com®) can offset declines. This inherent diversification can lead to more stable long-term growth compared to pure-play media companies.

- Emerging Markets: Expansion into emerging digital markets for its real estate services or even news media, where digital adoption is growing rapidly, could provide new avenues for revenue and audience growth.

- Strategic Partnerships and Acquisitions: News Corp could pursue strategic partnerships or acquisitions that bolster its digital capabilities, expand its geographic reach, or enhance its content offerings, further consolidating its market position.

Risks:

- Declining Traditional Media: Despite digital efforts, the structural decline in print advertising and circulation for its news media segment remains a long-term challenge. If digital growth doesn’t sufficiently offset these declines, it could pressure overall revenue and profitability.

- Advertising Market Volatility: The advertising market is notoriously cyclical and competitive. Economic downturns, increased competition from tech giants for ad dollars, or shifts in advertiser preferences could negatively impact revenue across its news and video segments.

- Real Estate Market Sensitivity: The digital real estate segment, while strong, is highly sensitive to interest rates, economic stability, and housing market conditions. A significant downturn in global real estate markets could directly impact this key growth driver.

- Regulatory Scrutiny and Content Policies: As a major media entity, News Corp faces ongoing regulatory scrutiny regarding media concentration, content moderation, and data privacy. Potential legislative changes or increased oversight could impact its operational freedom and profitability.

- Technological Disruption: The pace of technological change is relentless. New platforms, content formats, or distribution models could emerge that disrupt existing business models. Failure to adapt quickly to these disruptions could lead to market share loss.

- Competition: News Corp faces intense competition across all its segments. In news, it competes with other traditional outlets and digital-native players. In real estate, proptech startups and established listing sites vie for market share. In publishing and video, the landscape is increasingly fragmented and competitive.

These opportunities and risks highlight that while the trajectory looks promising, continuous strategic execution, innovation, and adaptability will be paramount for News Corp to realize its long-term projected growth. Investors should monitor these factors closely as they evaluate the company’s performance against the EchoPredict forecasts.

Conclusion

News Corp (Class B) (NWSA) finds itself at a pivotal juncture, navigating the evolving media landscape while capitalizing on its strong presence in digital real estate. As of June 5, 2025, with a current price of 32.16 USD, the company’s historical performance over the past 12 months has shown resilience and a positive upward trend, reflecting its strategic shift towards digital revenue streams.

The EchoPredict algorithm projects a generally optimistic outlook for NWSA. In the short term, the monthly forecast anticipates an initial surge, potentially reaching 35.25 USD in August 2025, followed by periods of minor consolidation but largely maintaining a positive trajectory, concluding at 34.73 USD by June 2026. This suggests that the company’s immediate future is viewed favorably, likely driven by continued digital growth and stable market conditions.

Looking further ahead, the long-term annual forecast is even more compelling, projecting substantial growth over the next decade. From 34.73 USD in 2026, the algorithm forecasts NWSA to reach 82.29 USD by 2035. This significant long-term appreciation underscores the belief in News Corp’s ability to capitalize on its diversified portfolio, particularly its high-growth digital real estate segment, and to successfully adapt to the ongoing digital transformation within the media industry.

While these projections offer a valuable perspective, it’s crucial to acknowledge the dynamic nature of financial markets. The actual performance of News Corp’s stock will be influenced by a multitude of factors, including macroeconomic shifts, industry-specific trends, the company’s strategic execution, and its ability to innovate and manage competitive pressures effectively. Investors should consider these forecasts as one component of a comprehensive investment analysis, always conducting their own thorough due diligence.

Disclaimer: The price predictions provided in this article are generated by a proprietary algorithmic model, EchoPredict, based on historical data and recognized forecasting techniques. These forecasts are for informational purposes only and do not constitute financial advice. Stock prices are subject to market risks and unforeseen circumstances. We are not responsible for any investment decisions made based on the information contained herein. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.