Texas Instruments, often simply referred to as TI, stands as a venerable titan within the global semiconductor industry. With a rich history stretching back decades, the company has solidified its position as a leading designer and manufacturer of analog and embedded processing chips. These aren’t just obscure components; they are the fundamental building blocks powering a vast array of modern technologies, from the sophisticated sensors in autonomous vehicles and the intricate control systems in industrial automation, to the everyday devices we rely on, such as smartphones, laptops, and home appliances. TI’s business model, strategically focused on high-volume, long-lifecycle products that are less susceptible to the extreme cyclical swings often seen in memory or digital logic, has historically provided a resilient and robust revenue stream. This fundamental strength, combined with a persistent commitment to research and development and a reputation for manufacturing excellence, underscores why Texas Instruments remains a cornerstone for investors seeking exposure to the crucial yet evolving technology sector.

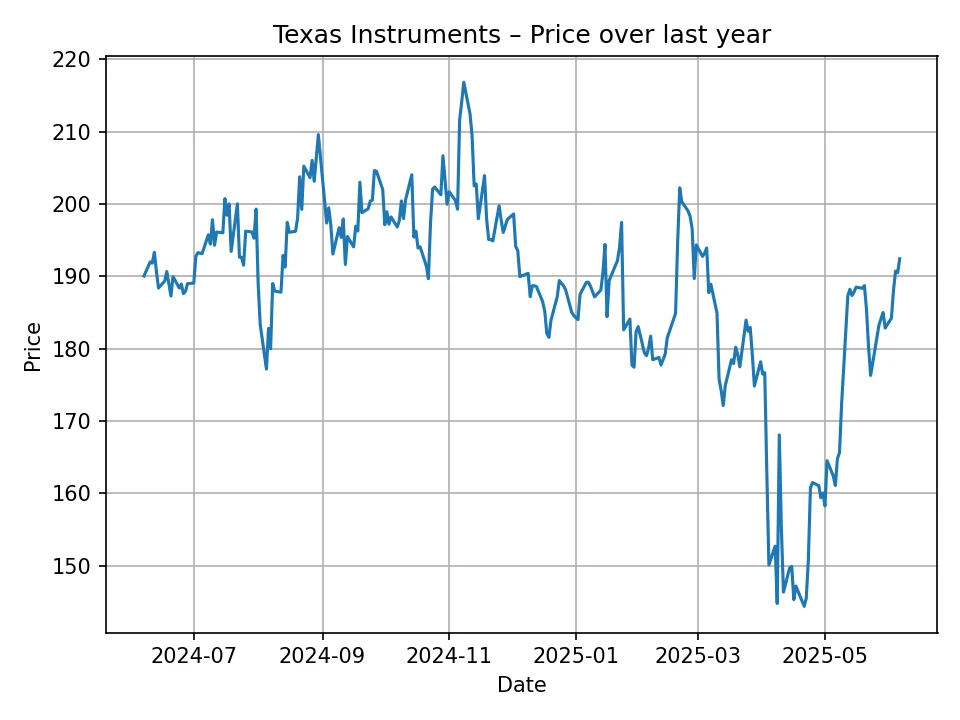

As of June 8, 2025, Texas Instruments shares are trading at 192.42 USD. To contextualize this valuation and inform future price predictions, a thorough examination of the company’s recent historical performance is essential. Over the past twelve months, the stock has experienced notable fluctuations, reflecting the broader dynamics of both the semiconductor industry and global macroeconomic conditions. A detailed analysis of the daily closing prices reveals a period of considerable volatility, which is not uncommon for technology stocks, especially those deeply embedded in industrial and automotive supply chains.

Looking back at the historical data, the lowest point observed for Texas Instruments stock within the last 12 months was approximately 144.38 USD. This significant dip likely corresponded to periods of heightened market uncertainty, perhaps driven by concerns over global economic slowdowns, inventory corrections within the semiconductor industry, or specific geopolitical events impacting supply chains or demand. Conversely, the stock reached a peak of around 216.82 USD during the same period. Such surges often align with optimistic market sentiment, strong quarterly earnings reports, positive industry outlooks, or breakthroughs in specific end markets where TI’s components are critical. The average closing price over these 250 trading days was approximately 179.85 USD. The current price of 192.42 USD is therefore above this historical average, suggesting a recent upward momentum or a more favorable market perception compared to the average over the past year. This range, from the low 140s to over 215, underscores the stock’s dynamic nature and sensitivity to various market drivers. Investors should carefully consider these past movements, understanding that while history does not precisely repeat itself, it offers valuable insights into the stock’s potential responsiveness to future events. The journey through these highs and lows reflects the complex interplay of internal company performance and external market forces.

Key Factors Influencing Texas Instruments’ Stock Price

Understanding the future trajectory of Texas Instruments’ stock price requires a comprehensive look at the multifaceted factors that exert influence over the semiconductor industry and, specifically, TI’s operations. These factors can be broadly categorized into industry trends, company-specific strategies, and overarching macroeconomic conditions.

Industry Trends and Dynamics

The semiconductor industry is notoriously cyclical, characterized by periods of robust demand and supply shortages followed by oversupply and price corrections. Texas Instruments, while somewhat insulated by its focus on analog and embedded processing, is not entirely immune to these cycles. Current industry trends include:

- Persistent Demand in Key Sectors: The structural demand for semiconductors continues to grow, driven by megatrends such as artificial intelligence (AI), the Internet of Things (IoT), automotive electrification and autonomous driving, industrial automation, and the global build-out of 5G infrastructure. TI’s analog and embedded chips are foundational to these innovations, ensuring a steady, long-term demand curve for its products. The increasing complexity and integration of electronic components in these applications further solidify TI’s market position.

- Supply Chain Resilience: Recent global events have highlighted the fragility of semiconductor supply chains. Companies are increasingly focused on diversification and regionalization of manufacturing. TI’s strategy of increasing its internal manufacturing capacity, particularly its transition to 300mm wafer fabs, provides a significant competitive advantage. This approach enhances control over production, mitigates supply risks, and offers better cost efficiency, which can positively impact profit margins and investor confidence.

- Geopolitical Landscape: The geopolitical environment, particularly tensions between major economic powers, continues to shape the semiconductor industry. Trade policies, export controls, and national incentives (such as the U.S. CHIPS Act and similar initiatives in Europe and Asia) can profoundly affect manufacturing locations, market access, and R&D investments. TI, with its strong presence in the U.S. and a global customer base, must navigate these complexities carefully. The push for domestic semiconductor production in various regions could create new opportunities or challenges, depending on the specific policies adopted.

- Intense Competition: While TI holds strong market positions in its niches, competition remains fierce. Key rivals such as Analog Devices, NXP Semiconductors, STMicroelectronics, and various other specialized chipmakers constantly innovate to gain market share. TI’s ability to maintain its competitive edge hinges on continuous innovation, cost leadership, and strong customer relationships.

Company-Specific Strategies and Financial Health

Texas Instruments’ internal strengths and strategic decisions play a crucial role in its stock performance:

- Focus on Analog and Embedded Processing: Unlike companies heavily reliant on highly cyclical memory or logic chips, TI’s core business in analog and embedded processing tends to be more stable. These components are essential for a wide range of applications and have longer product lifecycles, leading to more predictable revenue streams. This strategic focus makes TI a more stable investment within the often-volatile semiconductor sector.

- Manufacturing Efficiency and Expansion: TI’s long-term strategy involves significant investment in its own manufacturing capabilities, moving towards 300mm wafer fabrication. This move is designed to reduce manufacturing costs, improve supply chain control, and enhance the ability to meet growing demand. The capital-intensive nature of this strategy implies higher upfront costs but promises long-term profitability and resilience. Successful execution of this strategy will be a key driver for future growth and profitability.

- Robust Financial Management: Texas Instruments is renowned for its strong financial discipline. The company consistently generates significant free cash flow, which it strategically returns to shareholders through consistent dividend increases and share buybacks. TI is a notable “dividend aristocrat,” having increased its dividend for many consecutive years, a testament to its stable earnings and commitment to shareholder value. A healthy balance sheet and strong cash generation provide a buffer against economic downturns and allow for strategic investments.

- Research & Development (R&D): Continuous investment in R&D is vital for innovation and staying ahead in the rapidly evolving technology landscape. TI’s ability to develop new products and solutions that address emerging customer needs in areas like power management, connectivity, and sensing will be critical for sustaining long-term growth.

Macroeconomic Conditions

Broader economic forces exert considerable influence on TI’s financial performance:

- Global Economic Growth: TI’s products are used across numerous industries globally. A strong global economy, characterized by robust industrial production, healthy consumer spending, and increased capital expenditures, generally translates into higher demand for TI’s chips. Conversely, economic slowdowns or recessions can dampen demand across multiple sectors, impacting sales and profitability.

- Inflation and Interest Rates: Rising inflation can increase manufacturing costs, including raw materials, energy, and labor, potentially squeezing profit margins. Central bank policies, particularly interest rate hikes, can affect borrowing costs for TI and its customers, and can also influence investor sentiment towards growth stocks. Higher interest rates can make future earnings less attractive, potentially putting downward pressure on stock valuations.

- Currency Fluctuations: While TI primarily reports in USD, its global operations mean that currency exchange rates can impact reported revenues and costs from international sales and manufacturing. Significant shifts in major currencies could slightly affect profitability.

- Consumer Confidence and Spending: Although TI operates primarily in the B2B space, demand for its components is ultimately tied to consumer and enterprise demand for finished electronic products. Strong consumer confidence fuels spending on electronics, automotive, and other goods that incorporate TI’s chips.

Together, these factors form a complex web of influences that shape Texas Instruments’ stock performance. Investors must monitor these elements closely to make informed decisions.

Monthly Price Forecast for Texas Instruments (Next 12 Months)

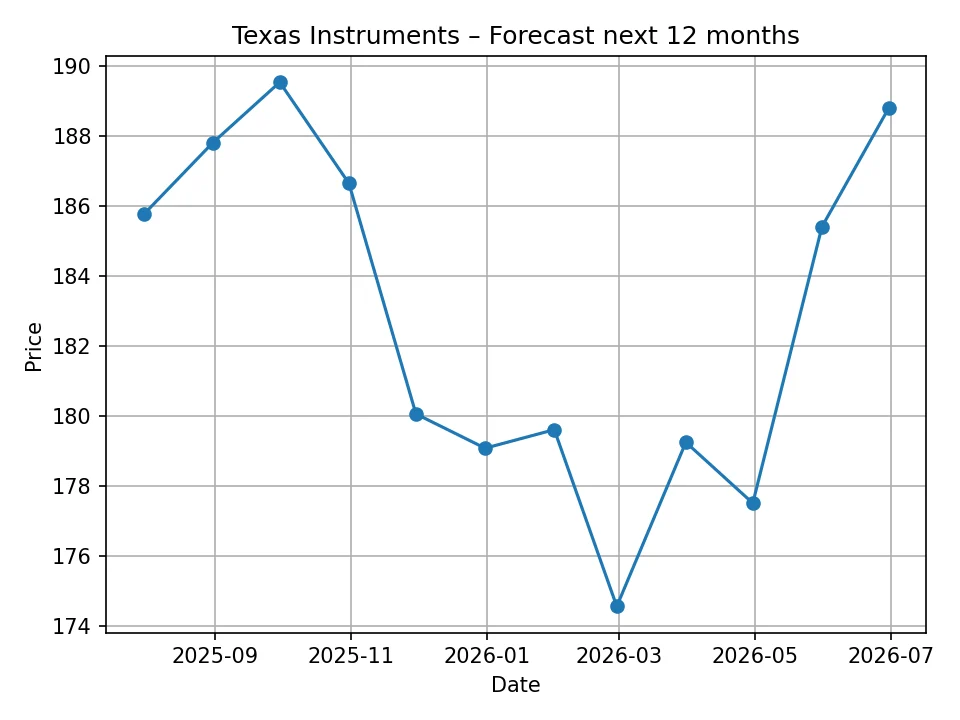

Leveraging the proprietary NovaCast algorithm, a forward-looking perspective on Texas Instruments’ stock price for the next 12 months, from July 2025 to June 2026, has been generated. This short-term forecast provides a detailed month-by-month outlook, offering insights into potential fluctuations and trends.

The forecast suggests a degree of near-term volatility and a gradual downward trend in the latter half of 2025 before a slight recovery towards mid-2026. From the current price of 192.42 USD, the projection indicates a slight dip in July 2025 to 185.76 USD, followed by a moderate rebound in August to 187.81 USD and a peak within this 12-month period in September 2025 at 189.54 USD. This initial period suggests some stabilization and modest growth.

However, the outlook for late 2025 and early 2026 appears more challenging. The forecast predicts a decline in October to 186.65 USD, accelerating into November (180.06 USD) and December (179.08 USD). This potential correction could be influenced by seasonal factors, expected market corrections, or a deceleration in demand from certain end markets, particularly as companies adjust their inventory levels towards the end of the year. The trend continues into the new year, with January 2026 showing a minor uptick to 179.61 USD before another notable decline in February 2026, reaching the lowest point in this 12-month forecast at 174.56 USD. Such a low point might reflect anticipated broader economic headwinds or specific industry-wide corrections in the semiconductor sector.

Following this trough, the forecast indicates a gradual recovery. March 2026 sees the price improve to 179.25 USD, with a slight dip in April to 177.51 USD. The trend then shifts more positively, with May 2026 projected at 185.41 USD and June 2026 closing the 12-month period at 188.81 USD. This recovery in the latter part of the forecast suggests a potential rebound in market conditions or renewed demand, possibly as inventory levels normalize or as new product cycles gain momentum.

Overall, the monthly forecast portrays a dynamic period ahead for Texas Instruments, characterized by an initial attempt at stabilization, a subsequent period of moderate decline, and then a gradual recovery. Investors focusing on the short to medium term should be prepared for potential fluctuations and consider the reasons behind such projected movements, which may include adjustments in supply chains, shifts in consumer or industrial spending patterns, or broader market sentiment regarding technology stocks. The low point of 174.56 USD in February 2026 and the high of 189.54 USD in September 2025 define the expected range for the coming year, indicating that the stock may trade below its current price for much of the next 12 months before partially recovering.

Here is the detailed monthly forecast for Texas Instruments stock:

| Month | Forecasted Price (USD) |

|---|---|

| 2025-07 | 185.76 |

| 2025-08 | 187.81 |

| 2025-09 | 189.54 |

| 2025-10 | 186.65 |

| 2025-11 | 180.06 |

| 2025-12 | 179.08 |

| 2026-01 | 179.61 |

| 2026-02 | 174.56 |

| 2026-03 | 179.25 |

| 2026-04 | 177.51 |

| 2026-05 | 185.41 |

| 2026-06 | 188.81 |

Annual Price Forecast for Texas Instruments (Next 10 Years)

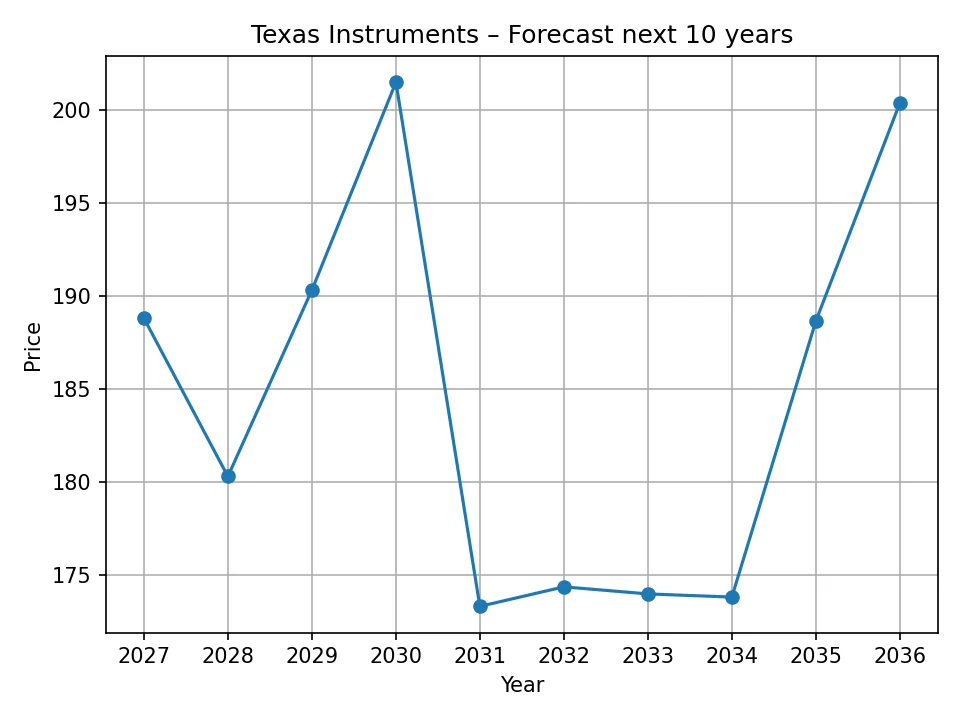

Extending the outlook further, the NovaCast algorithm provides an annual price forecast for Texas Instruments over the next decade, from 2026 through 2035. This long-term projection offers a broad perspective on the stock’s potential trajectory, highlighting periods of both growth and contraction that could reflect the cyclical nature of the semiconductor industry and broader economic trends.

The forecast for 2026 indicates a price of 188.81 USD, which aligns with the concluding price of the 12-month monthly forecast. This suggests a relatively stable start to the long-term outlook, staying close to the current price. However, 2027 is projected to see a notable decline to 180.30 USD, indicating a potential correction or a period of slower growth for the company or the broader market. This dip could be attributed to a number of factors, such as the natural unwinding of a semiconductor up-cycle, intensified competition, or a general slowdown in global demand for electronic goods.

Following this potential pullback, the forecast shows a period of recovery and significant growth. For 2028, the price is projected to rebound to 190.34 USD, surpassing the 2027 level. The most optimistic point in this 10-year forecast is 2029, with a predicted price of 201.51 USD. This surge could be indicative of a new wave of technological adoption driving semiconductor demand, such as advancements in AI integration across industries, accelerated adoption of electric vehicles, or major investments in industrial automation. This peak demonstrates the potential for Texas Instruments to achieve new highs in the medium-term future, leveraging its core strengths and market position.

However, the forecast also anticipates a significant downturn thereafter. The year 2030 is projected to see a sharp decline to 173.31 USD, marking the lowest point in the entire 10-year forecast. This considerable drop could be a reflection of a deeper and more prolonged semiconductor downturn, a major global economic recession, or a significant shift in market dynamics that temporarily impacts TI’s growth drivers. The subsequent years, 2031 (174.36 USD), 2032 (173.98 USD), and 2033 (173.81 USD), show a period of stagnation and continued low prices, indicating that the recovery from the 2030 low may be protracted. This suggests a sustained period where TI might face ongoing challenges, potentially from oversupply, geopolitical friction, or a maturation of some of its key end markets.

Towards the end of the forecast period, there is a renewed positive momentum. For 2034, the price is projected to recover to 188.65 USD, a significant rebound from the lows of the early 2030s. Finally, by 2035, the forecast suggests further growth to 200.37 USD, bringing the stock close to its previous peak of 2029. This late-stage recovery indicates that despite periods of significant challenge, the underlying demand for Texas Instruments’ core products and its long-term strategic investments are expected to eventually drive sustained value creation.

In summary, the 10-year annual forecast for Texas Instruments portrays a volatile yet ultimately resilient path. It suggests periods of strong growth interspersed with significant corrections, echoing the inherent cyclicality of the semiconductor industry. Investors with a long-term horizon might find these dips as potential entry points, assuming the company’s fundamental strengths and its role in essential technologies remain robust. The forecasts highlight the importance of patience and a strategic long-term view when investing in a company like Texas Instruments, which operates at the forefront of technological advancement.

Here is the detailed annual forecast for Texas Instruments stock:

| Year | Forecasted Price (USD) |

|---|---|

| 2026 | 188.81 |

| 2027 | 180.30 |

| 2028 | 190.34 |

| 2029 | 201.51 |

| 2030 | 173.31 |

| 2031 | 174.36 |

| 2032 | 173.98 |

| 2033 | 173.81 |

| 2034 | 188.65 |

| 2035 | 200.37 |

Risks and Opportunities in the Decade Ahead

While the NovaCast algorithm provides a data-driven projection for Texas Instruments’ stock price, it is crucial for investors to understand the qualitative risks and opportunities that could significantly impact the company’s performance and, by extension, its share value. These factors, which are often difficult to quantify in algorithms, play a vital role in real-world market dynamics.

Potential Risks

- Economic Downturns: The semiconductor industry is highly sensitive to global economic health. A prolonged global recession or a significant slowdown in key markets (e.g., automotive, industrial, consumer electronics) could lead to decreased demand for TI’s products, impacting sales and profitability. The forecast’s dips in the early 2030s could reflect such anticipated economic contractions.

- Intensified Competition and Pricing Pressure: Despite its strong market position, TI faces fierce competition from both established players and emerging entrants. Aggressive pricing strategies by competitors or technological leapfrogging could erode TI’s market share and pressure profit margins.

- Supply Chain Vulnerabilities: While TI is increasing its internal manufacturing, it still relies on a complex global supply chain for raw materials, equipment, and certain outsourced processes. Geopolitical conflicts, natural disasters, or pandemics could disrupt these chains, leading to production delays and increased costs.

- Technological Obsolescence: The technology sector evolves rapidly. If TI fails to innovate sufficiently or adapt to new technological paradigms (e.g., shifts in chip architectures, new materials, or computing models), its products could become obsolete, diminishing its competitive advantage.

- Geopolitical Tensions and Trade Wars: Escalating trade disputes or heightened geopolitical tensions, particularly between the U.S. and China, could lead to new tariffs, export restrictions, or market access challenges, directly impacting TI’s global operations and sales.

- Inflationary Pressures: Sustained high inflation can increase the cost of manufacturing (energy, materials, labor) and capital expenditures for new fabs, potentially compressing TI’s margins even if demand remains strong.

Significant Opportunities

- Expansion in High-Growth End Markets: TI’s analog and embedded processing chips are fundamental to rapidly expanding sectors like electric vehicles (EVs), advanced driver-assistance systems (ADAS), industrial automation, renewable energy systems, and 5G infrastructure. Continued growth in these areas presents substantial long-term revenue opportunities.

- Internal Manufacturing Advantages: The strategic shift to 300mm wafer fabrication and increased internal production capacity is a significant long-term differentiator. This allows TI greater control over costs, quality, and supply, making it more resilient to external disruptions and potentially boosting profitability over the long term.

- Innovation and Product Diversification: Continuous investment in R&D allows TI to develop next-generation products that address evolving customer needs and expand its total addressable market. New product introductions that enable advancements in AI, IoT, and power management could unlock new growth avenues.

- Capital Allocation Strategy: TI’s commitment to returning capital to shareholders through consistent dividend growth and share buybacks enhances shareholder value. This strategy, backed by strong free cash flow generation, makes the stock attractive to income-focused investors and can support share prices.

- Benefiting from Regional Chip Incentives: Government initiatives like the U.S. CHIPS Act aim to boost domestic semiconductor manufacturing. TI, with its substantial manufacturing presence in the U.S., stands to benefit from potential subsidies, tax credits, and R&D funding, which could reduce production costs and enhance competitiveness.

- Long Product Lifecycles: Unlike rapidly commoditizing digital logic or memory chips, TI’s analog and embedded products often have very long lifecycles (decades for some industrial or automotive applications). This provides more stable, predictable revenue streams and allows for higher gross margins over time.

By weighing these risks against the opportunities, investors can gain a more nuanced understanding of Texas Instruments’ potential performance beyond algorithmic predictions. The company’s resilience, strategic focus, and financial strength suggest that it is well-positioned to navigate challenges and capitalize on long-term growth trends in the semiconductor industry.

Broader Market Context and Investment Considerations

When evaluating the price forecasts for Texas Instruments (TXN), it is important to place them within the broader context of the financial markets and the semiconductor sector. Texas Instruments is a foundational component of numerous exchange-traded funds (ETFs) and mutual funds that track the technology and semiconductor industries, making its performance influential on these broader benchmarks. Historically, TXN has often been viewed as a more stable, dividend-paying stalwart compared to some of the higher-beta growth stocks within the tech space. Its focus on analog and embedded processing, which tends to be less cyclical than other semiconductor segments, typically provides a degree of resilience during market downturns, although it can also mean less explosive growth during boom cycles compared to innovative leaders in emerging, high-growth areas.

The forecasts provided by the NovaCast algorithm represent a sophisticated, data-driven analysis of historical price movements and patterns. However, it is crucial to understand that no algorithmic model can perfectly predict the future. Financial markets are influenced by an intricate web of factors, many of which are qualitative and unpredictable. Geopolitical events, sudden technological breakthroughs or disruptions, unexpected regulatory changes, shifts in consumer behavior on a global scale, and “black swan” events can all introduce significant volatility that even the most advanced algorithms cannot foresee. Therefore, while these forecasts offer valuable insights and potential scenarios, they should not be considered definitive guarantees of future performance.

Investors should consider Texas Instruments’ long-term fundamental strengths. The company’s commitment to manufacturing excellence, particularly its aggressive build-out of 300mm fabs, aims to enhance efficiency, reduce costs, and secure supply chains. This strategic foresight can create a lasting competitive advantage. Furthermore, its consistent dividend growth and share buyback programs underscore a management team focused on delivering shareholder value through strong free cash flow generation. These attributes are often attractive to long-term, value-oriented investors seeking stability and reliable returns in the technology sector.

For those considering an investment in Texas Instruments, combining the insights from these quantitative forecasts with a thorough qualitative analysis is paramount. Diligent research into the company’s latest earnings reports, management commentary, industry trends, and the broader economic outlook will provide a more holistic view. Diversification across a portfolio is always a prudent strategy, and any investment decision should align with an individual’s personal financial goals, risk tolerance, and investment horizon. The semiconductor industry is a cornerstone of the modern economy, and Texas Instruments remains a key player within it, presenting both challenges and opportunities for investors navigating the complex market landscape.

In conclusion, Texas Instruments presents a compelling case for investors seeking exposure to the vital semiconductor industry. Our analysis of the current price and historical trends indicates a stock that has experienced significant movement over the past year, currently trading above its 12-month average. The monthly forecast from our NovaCast algorithm suggests a period of near-term fluctuations, with a projected dip in late 2025 and early 2026 before a modest recovery. The annual forecast, extending over the next decade, portrays a dynamic journey with periods of growth, notably peaking around 2029, followed by significant corrections in the early 2030s, and then a renewed upward trend towards 2035.

These projections are underpinned by a detailed examination of the intricate factors influencing Texas Instruments, including the evolving landscape of the semiconductor industry, the company’s robust operational strategies, and the broader macroeconomic environment. While growth in key end markets like automotive and industrial automation, coupled with TI’s self-manufacturing advantages and strong financial health, present significant opportunities, investors must also be mindful of risks such as economic downturns, intense competition, and geopolitical uncertainties. The forecasts reflect the complex interplay of these elements, suggesting that while the path may not be linear, Texas Instruments’ long-term fundamentals remain strong. As with all investment decisions, a holistic approach that combines quantitative analysis with qualitative insights and personal financial planning is crucial.

Please note that the price forecasts provided in this article are generated by our proprietary NovaCast algorithm and are based on historical data patterns and current market conditions. We are not responsible for the accuracy of these price forecasts, nor do we provide financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Readers are strongly advised to conduct their own comprehensive due diligence and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.