Federal Realty Investment Trust (FRT) stands as a prominent entity in the real estate investment trust (REIT) sector, distinguished by its focus on high-quality retail properties and mixed-use developments. With a rich history spanning over 60 years, FRT has carved out a niche in owning, managing, and redeveloping prime retail assets, primarily in densely populated, affluent coastal markets. This strategic positioning allows the company to benefit from robust consumer spending patterns and strong tenant demand, making it a cornerstone for investors seeking exposure to the resilient retail real estate segment.

The core of FRT’s business model revolves around its meticulously curated portfolio of shopping centers and mixed-use properties. These assets are characterized by their strong demographics, high barriers to entry, and a diverse array of essential and experiential tenants. Unlike traditional enclosed malls, FRT’s properties often feature open-air formats, combining retail, dining, entertainment, and sometimes residential components. This mixed-use approach enhances foot traffic, extends dwell times, and creates vibrant community hubs, providing a competitive advantage in a dynamically evolving retail landscape. The company’s consistent track record of dividend growth, earning it the coveted status of a ‘Dividend Aristocrat’ within the REIT space, underscores its financial discipline and stable cash flow generation, attracting income-focused investors. Understanding FRT’s intrinsic value and future trajectory necessitates a thorough examination of its historical performance, the broader economic currents shaping the real estate market, and a data-driven outlook on its potential price movements.

Historical Price Performance of Federal Realty Investment Trust (FRT)

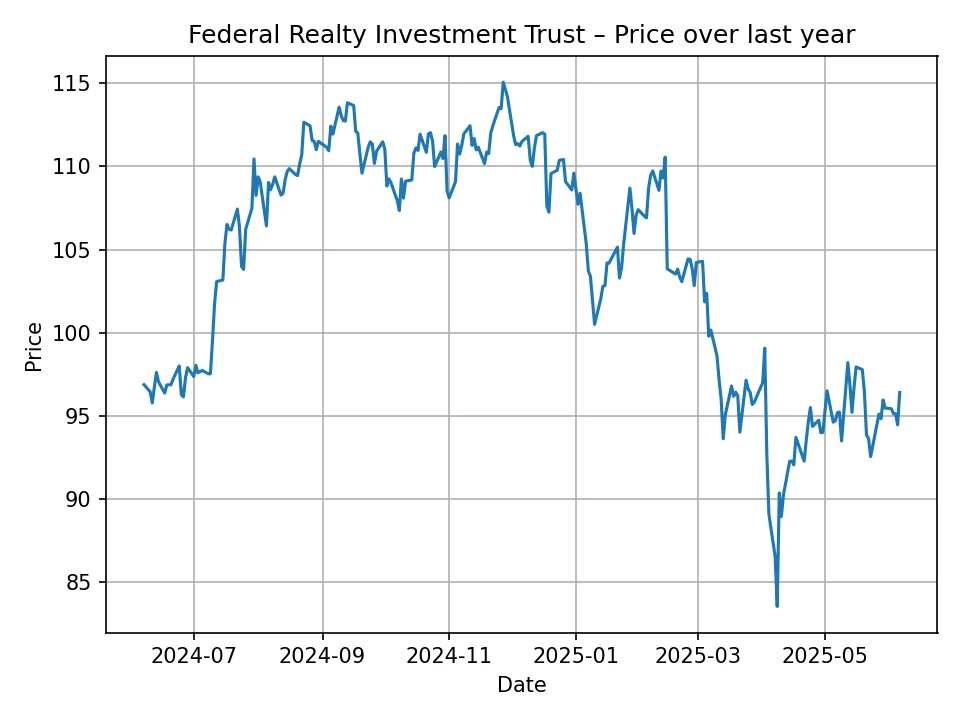

To provide context for future projections, it is crucial to analyze Federal Realty Investment Trust’s (FRT) recent historical price performance. Over the past 12 months, the stock has exhibited notable fluctuations, reflecting both broader market sentiment and specific sector dynamics. As of the last available historical data point, FRT’s price stood at approximately $96.42 USD. During this period, the stock navigated a range of market conditions, demonstrating both resilience and susceptibility to economic headwinds.

Looking back at the daily historical data, FRT experienced periods of both growth and contraction. The stock reached a high of approximately $115.07 USD, illustrating investor confidence during more optimistic market phases. Conversely, it dipped to a low of about $83.56 USD, likely influenced by concerns regarding interest rates, inflationary pressures, or broader economic deceleration impacting consumer spending and retail operations. The price movements were not always linear; rather, they reflected the interplay of supply and demand, often reacting sharply to economic data releases, company earnings reports, and shifts in investor sentiment regarding the retail real estate sector.

Key trends observed include an initial period of relatively stable trading around the mid-$90s to low-$100s, followed by a notable surge that pushed the stock towards its 12-month highs. This upward momentum was likely fueled by positive economic indicators, perhaps easing inflation concerns, or a renewed interest in dividend-paying assets like REITs. However, this peak was often followed by periods of consolidation or corrective pullbacks, bringing the price back down. Towards the latter part of the 12-month cycle, the stock experienced renewed volatility, with prices oscillating within a defined range. This type of price action is typical for REITs, which are sensitive to interest rate changes and the overall health of the economy. A rising interest rate environment, for instance, can increase borrowing costs for REITs and make their dividends less attractive compared to fixed-income alternatives, putting downward pressure on stock prices. Conversely, expectations of stable or declining interest rates can provide a tailwind. The overall trajectory over the past year highlights the dynamic nature of FRT’s stock, influenced by a complex blend of macroeconomic factors and company-specific fundamentals.

Key Factors Influencing FRT’s Future Price

The future price trajectory of Federal Realty Investment Trust (FRT) will be shaped by a confluence of macroeconomic forces, sector-specific dynamics within retail real estate, and company-specific operational performance. A holistic understanding of these elements is crucial for anticipating FRT’s potential movements.

Macroeconomic Factors

- Interest Rates: REITs like FRT are particularly sensitive to interest rate fluctuations. Higher interest rates can increase borrowing costs for property acquisitions and developments, impacting profitability. Moreover, they can make fixed-income investments, such as bonds, more attractive, potentially drawing capital away from dividend-paying stocks like REITs, thus exerting downward pressure on their share prices. Conversely, stable or declining rates typically serve as a positive catalyst.

- Inflation: While inflation can erode purchasing power, for REITs, it can also translate into higher rental income as leases are renewed or adjusted for inflation. However, if inflation outpaces rent growth or leads to significantly higher operating expenses, it can negatively impact net operating income. The ability of FRT to pass through increased costs to tenants and achieve rental growth above inflation will be key.

- Consumer Spending and Economic Growth: As a retail REIT, FRT’s performance is intrinsically linked to the health of the consumer and the broader economy. Robust economic growth generally leads to higher employment, increased disposable income, and stronger consumer spending, all of which benefit retail tenants and, by extension, FRT through higher sales, greater occupancy rates, and stronger rent collection. A recessionary environment, however, could lead to reduced consumer spending, tenant bankruptcies, and higher vacancy rates.

- Unemployment Rates: Low unemployment rates are indicative of a strong labor market, which supports consumer confidence and spending. High unemployment can suppress retail activity, making it challenging for FRT’s tenants to thrive, potentially leading to lease defaults or renegotiations.

Sector-Specific Factors (Retail REITs)

- E-commerce Penetration vs. Brick-and-Mortar Resilience: The ongoing shift to e-commerce poses a continuous challenge to traditional retail. However, FRT’s focus on necessity-based retail, services, and experiential tenants (e.g., grocery stores, pharmacies, restaurants, fitness centers) in affluent, dense markets provides a degree of insulation. The resilience of physical retail, especially in well-located centers that offer convenience and a community feel, is crucial.

- Tenant Health and Bankruptcies: The financial health of FRT’s tenants directly impacts its rental income and occupancy rates. Major tenant bankruptcies or store closures can lead to significant vacancies and rental abatements. FRT’s strategy of maintaining a diverse and high-quality tenant base helps mitigate this risk.

- Lease Rates and Occupancy Levels: The ability to command strong lease rates and maintain high occupancy levels is fundamental to FRT’s profitability. Strong demand for space in its prime locations allows for positive leasing spreads (new rents higher than expiring rents), which is a key growth driver.

- Development and Redevelopment Pipeline: FRT’s strategy includes significant redevelopment efforts to modernize its existing portfolio and create more vibrant mixed-use properties. The success and timely execution of these projects are vital for future growth and increasing asset values, but they also carry execution risks and significant capital expenditure.

Company-Specific Factors

- Portfolio Quality and Diversification: FRT’s emphasis on high-quality, strategically located assets in supply-constrained markets provides a competitive moat. The diversification across property types (shopping centers, mixed-use) and tenant categories (retail, office, residential within mixed-use) reduces reliance on any single segment.

- Dividend Policy and Payout: FRT is renowned for its consistent dividend growth, a testament to its strong financial management and stable cash flows. Its status as a Dividend Aristocrat attracts a specific class of investors. Any changes to this policy or challenges to its ability to sustain payouts could significantly impact investor perception and stock price.

- Management Effectiveness: The leadership team’s strategic decisions regarding property acquisitions, dispositions, redevelopment initiatives, capital allocation, and tenant relationships are paramount. Effective management ensures efficient operations and strategic growth.

- Debt Levels and Financial Health: A strong balance sheet, manageable debt levels, and access to capital are critical for a REIT. FRT’s ability to finance its operations and growth plans at favorable rates is directly linked to its financial strength and credit ratings. Prudent financial management ensures stability and investor confidence.

In summary, FRT’s price will reflect the delicate balance between the macroeconomic environment, the evolving landscape of retail real estate, and the company’s own operational and strategic prowess. Monitoring these factors will be essential for investors.

Methodology for Price Prediction: The CleverCast Algorithm

The price predictions for Federal Realty Investment Trust (FRT) presented in this analysis are generated using an advanced, proprietary forecasting model known as the CleverCast algorithm. This sophisticated algorithm is designed to process and interpret a vast array of financial and economic data points, offering a data-driven outlook on future stock prices. Unlike simpler linear models, CleverCast incorporates a complex interplay of various influencing factors, leveraging machine learning techniques to identify patterns and relationships that might not be immediately apparent to human analysis.

At its core, the CleverCast algorithm analyzes FRT’s extensive historical price data, including daily trading volumes, volatility metrics, and price momentum indicators. This historical perspective allows the model to learn from past market behavior and identify recurring trends or cycles. Beyond purely price-based analysis, CleverCast also integrates a broad spectrum of macroeconomic indicators. These include, but are not limited to, interest rate forecasts from central banks, inflation rates, GDP growth projections, consumer confidence indices, and unemployment figures. By understanding how these broader economic forces have historically impacted the REIT sector and FRT specifically, the algorithm can adjust its predictions to reflect anticipated shifts in the economic landscape.

Furthermore, the algorithm considers sector-specific data relevant to retail real estate, such as national retail sales trends, e-commerce penetration rates, and vacancy rates in prime retail locations. It also attempts to factor in company-specific information, to the extent that it can be quantified or inferred from historical data, such as dividend policies, earnings reports, and significant operational announcements. Through a process of continuous learning and adaptation, CleverCast weighs these diverse inputs, assigns probabilities to different outcomes, and generates a most likely price path. It is important to emphasize that while CleverCast utilizes cutting-edge analytical techniques, all predictive models are based on assumptions and past performance, and thus cannot guarantee future results. The forecasts presented here represent the algorithm’s best estimate under the prevailing conditions and data available.

12-Month Price Forecast for Federal Realty Investment Trust (FRT)

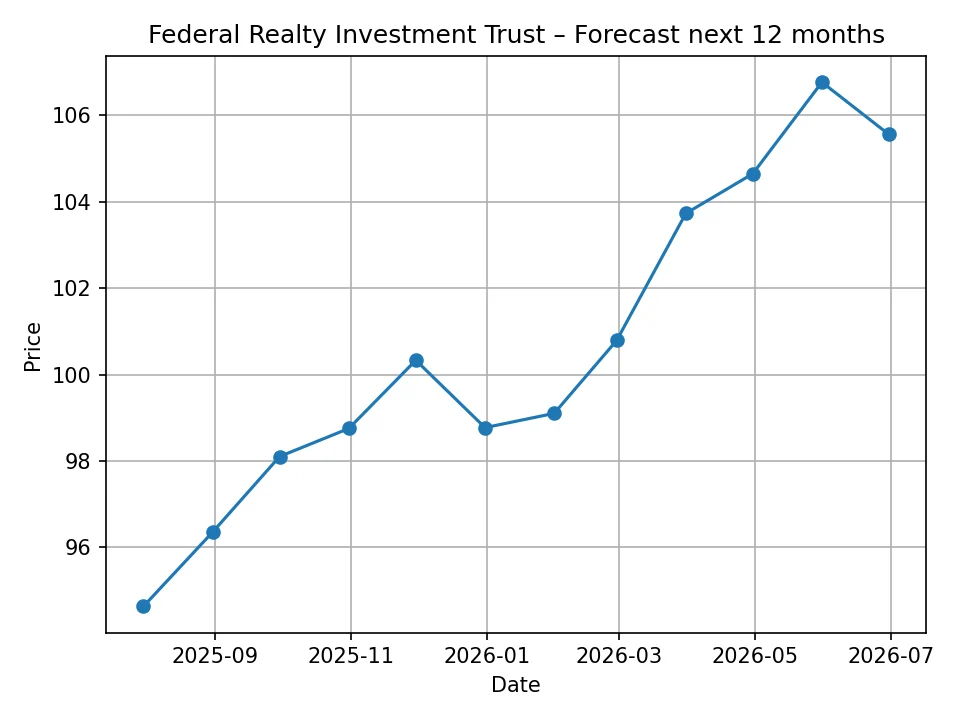

The 12-month price forecast for Federal Realty Investment Trust (FRT), generated by the CleverCast algorithm, suggests a generally upward trend for the stock over the coming year, with some fluctuations. This short-term outlook provides a granular view of potential monthly price movements, offering insights for investors with a nearer-term investment horizon.

The forecast commences from July 2025, projecting a price of $94.63 USD. This initial figure indicates a slight dip from the last known historical price point of approximately $96.42 USD, suggesting a potential near-term consolidation or minor correction before a more sustained ascent. Following this, the algorithm predicts a steady recovery and gradual growth throughout the latter half of 2025. By August 2025, the price is anticipated to reach $96.35 USD, approaching its current levels, and then continuing its climb to $98.10 USD in September and $98.75 USD in October. This consistent positive momentum points towards an improving market sentiment or a stabilization of the underlying factors influencing FRT’s performance.

As the year progresses towards its end, the forecast shows FRT crossing the $100 USD threshold, reaching $100.33 USD in November 2025. While there’s a slight anticipated pullback to $98.77 USD in December, the overall trend reasserts itself in early 2026. January 2026 is projected to see a price of $99.10 USD, followed by another push upward to $100.79 USD in February. The most significant gains within this 12-month period appear to be concentrated in the spring of 2026, with the price forecast rising to $103.73 USD in March, $104.65 USD in April, and reaching a peak for this forecast period at $106.77 USD in May 2026. The period concludes with a projected price of $105.56 USD in June 2026.

Overall, the 12-month forecast suggests that despite minor interim fluctuations, FRT is poised for moderate growth, potentially adding approximately $9 to $10 USD to its value from the current level by the end of this period. This indicates that the CleverCast algorithm foresees a relatively favorable environment for retail REITs, possibly driven by stabilizing interest rates, resilient consumer spending, or successful execution of FRT’s strategic initiatives. Investors should note the consistent upward trajectory, implying a build-up of positive momentum and investor confidence in FRT’s ability to deliver value.

Monthly Price Forecast for Federal Realty Investment Trust (FRT)

Below is the detailed monthly price forecast for Federal Realty Investment Trust (FRT) for the next 12 months, generated by the CleverCast algorithm.

| Month | Forecast Price (USD) |

|---|---|

| 2025-07 | $94.63 |

| 2025-08 | $96.35 |

| 2025-09 | $98.10 |

| 2025-10 | $98.75 |

| 2025-11 | $100.33 |

| 2025-12 | $98.77 |

| 2026-01 | $99.10 |

| 2026-02 | $100.79 |

| 2026-03 | $103.73 |

| 2026-04 | $104.65 |

| 2026-05 | $106.77 |

| 2026-06 | $105.56 |

10-Year Price Forecast for Federal Realty Investment Trust (FRT)

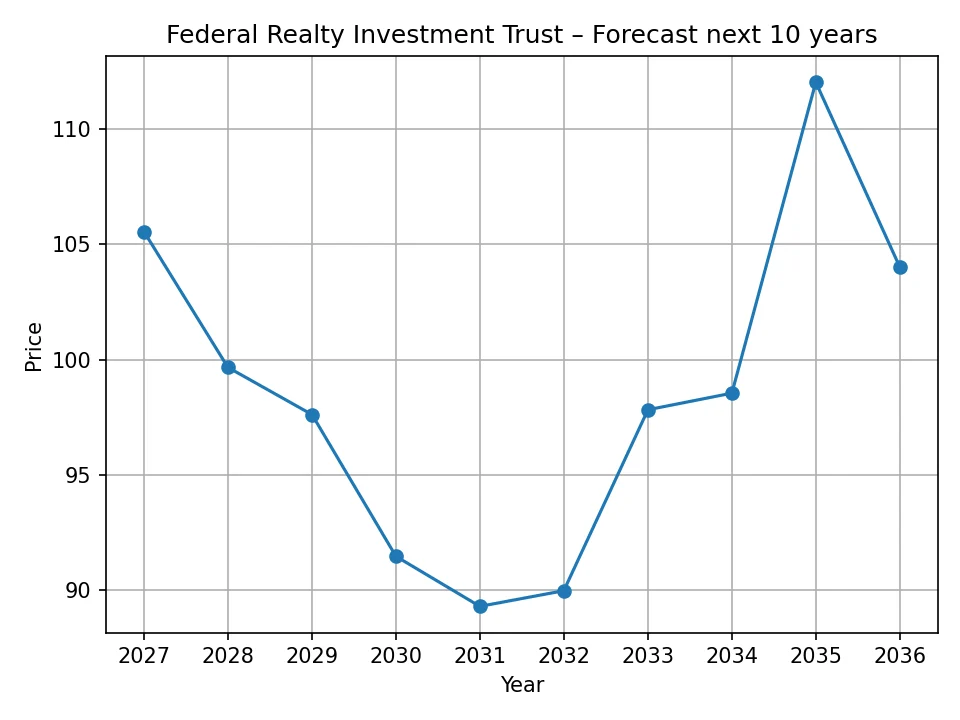

The 10-year price forecast for Federal Realty Investment Trust (FRT), also powered by the CleverCast algorithm, offers a longer-term perspective on the stock’s potential trajectory. This extensive outlook reveals a more complex pattern of growth and contraction, indicative of the inherent volatility and cyclical nature of real estate investments over extended periods.

The forecast begins with a projected price of $105.56 USD for 2026, building upon the positive momentum observed in the latter part of the 12-month monthly forecast. This strong start suggests a continuation of favorable conditions for FRT in the immediate years ahead. However, the algorithm anticipates a significant downturn in the subsequent years. For 2027, the price is projected to recede to $99.67 USD, followed by a further decline to $97.62 USD in 2028. This potential multi-year retreat could be indicative of anticipated economic slowdowns, persistent challenges in the retail sector, or a shift in investor preference away from REITs. The lowest point in this long-term forecast appears in 2029 and 2030, with projected prices of $91.47 USD and $89.30 USD, respectively. This period might reflect the algorithm’s expectation of a challenging economic environment or specific headwinds for the retail real estate market, potentially bringing the stock back to levels similar to or even below its recent historical lows.

Following this period of contraction, the CleverCast algorithm forecasts a gradual recovery and eventual strong growth in the mid-to-late 2030s. The price is projected to rebound slightly to $89.98 USD in 2031, signaling the bottoming out of the downturn. A more substantial recovery is anticipated from 2032, with the price reaching $97.83 USD, and then $98.55 USD in 2033. The most striking element of the long-term forecast is the dramatic surge predicted for 2034, where FRT’s price is projected to soar to $112.04 USD. This substantial increase suggests a period of significant growth, potentially driven by a robust economic recovery, successful portfolio redevelopments, or a resurgence in the attractiveness of high-quality retail real estate. The forecast concludes with a slight moderation to $104.03 USD in 2035, indicating a consolidation after the strong gains of the previous year.

In essence, the 10-year forecast for FRT paints a picture of a stock that may experience considerable cyclicality. While there’s a promising short-term outlook and a powerful long-term recovery projected for the latter half of the next decade, the intervening years could test investor patience. This long-range perspective highlights the importance of a patient, long-term investment approach when considering FRT, understanding that significant value appreciation might not be linear but rather characterized by pronounced periods of ups and downs, ultimately aiming for strong returns towards the end of the forecast horizon.

Annual Price Forecast for Federal Realty Investment Trust (FRT)

Below is the detailed annual price forecast for Federal Realty Investment Trust (FRT) for the next 10 years, generated by the CleverCast algorithm.

| Year | Forecast Price (USD) |

|---|---|

| 2026 | $105.56 |

| 2027 | $99.67 |

| 2028 | $97.62 |

| 2029 | $91.47 |

| 2030 | $89.30 |

| 2031 | $89.98 |

| 2032 | $97.83 |

| 2033 | $98.55 |

| 2034 | $112.04 |

| 2035 | $104.03 |

Risks and Opportunities for Federal Realty Investment Trust (FRT)

Investing in Federal Realty Investment Trust (FRT), like any equity, comes with a distinct set of risks and opportunities that can significantly influence its price trajectory. Understanding these factors is paramount for informed decision-making.

Risks

- Interest Rate Risk: FRT’s operations and valuation are highly sensitive to interest rate movements. Persistent high interest rates increase the cost of debt for acquisitions and developments, compress profit margins, and can make fixed-income investments more attractive, diverting capital away from REITs.

- Economic Downturn: A significant economic recession or prolonged slowdown would directly impact consumer spending and business activity, leading to potential tenant bankruptcies, store closures, higher vacancy rates, and difficulty in achieving rental growth. This could severely stress FRT’s revenue streams.

- E-commerce Competition: Despite FRT’s focus on essential and experiential retail, the continued rise of e-commerce poses a structural challenge. While physical retail has shown resilience, a rapid acceleration in online shopping could put renewed pressure on brick-and-mortar occupancy and rental rates.

- Tenant Defaults and Lease Renewals: Even high-quality tenants can face financial difficulties. Defaults or non-renewals can lead to lost income and significant costs associated with finding new tenants and re-leasing space. The ability to maintain high occupancy and favorable lease terms is crucial.

- Oversupply of Retail Space: In certain markets, an oversupply of retail properties could lead to increased competition for tenants, putting downward pressure on rents and property values. While FRT operates in high-barrier-to-entry markets, it is not entirely immune to this risk.

- Development and Redevelopment Execution Risk: FRT’s growth strategy heavily relies on successful redevelopment projects. These projects are capital-intensive and carry risks related to construction delays, cost overruns, permitting issues, and ultimately, whether the redeveloped properties attract the desired tenants at anticipated rental rates.

Opportunities

- Resilient Consumer Spending and Mixed-Use Trend: FRT’s focus on necessity-based retail (grocery-anchored centers) and the growing trend towards mixed-use developments that blend retail, dining, entertainment, and residential components can provide a stable and growing income stream. These properties create vibrant community hubs that attract foot traffic beyond pure shopping.

- Strategic Redevelopment and Value Creation: FRT’s extensive experience in redeveloping its existing portfolio allows it to unlock significant value from well-located, mature assets. By transforming outdated properties into modern, attractive mixed-use centers, FRT can command higher rents and increase property values, driving long-term growth.

- High-Quality Asset Base: The company’s portfolio consists of prime properties in densely populated, affluent coastal markets with high barriers to entry. This strategic positioning provides a competitive advantage, as these locations tend to maintain strong tenant demand and command premium rental rates, even during economic fluctuations.

- Dividend Appeal and Aristocrat Status: FRT’s long history of consistent dividend increases (over 50 consecutive years) makes it a ‘Dividend Aristocrat’ and an attractive option for income-focused investors, especially in times of market volatility. This stable income stream can provide a buffer during periods of slower capital appreciation.

- Inflation Hedge (Long-Term): While inflation poses short-term risks, over the long term, real estate can act as an inflation hedge. As construction costs and property values rise with inflation, so too can rental income, preserving the purchasing power of investments.

- Diversified Tenant Base: FRT’s efforts to diversify its tenant base across various retail categories and services, including non-discretionary businesses, helps to mitigate the risk associated with any single tenant or industry. This diversification enhances the stability of its income streams.

In conclusion, while FRT faces challenges inherent to the retail real estate sector and the broader economic climate, its strategic positioning, high-quality asset base, and proven redevelopment capabilities present compelling opportunities for long-term value creation. Investors should weigh these risks and opportunities carefully against their personal investment goals and risk tolerance.

The price forecasts and market analysis presented in this article are based on data processed by a proprietary algorithm, CleverCast. These forecasts are speculative in nature and do not constitute financial advice. Investing in financial markets involves risks, and past performance is not indicative of future results. We are not responsible for any investment decisions made based on the information provided herein.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.