The energy sector continues to be a cornerstone of modern economies, providing essential services that power homes, businesses, and industries. Within this vital industry, utility companies like American Electric Power (AEP) stand out as foundational players. As of June 15, 2025, AEP remains a prominent entity in the North American utility landscape, operating across a diverse range of states and serving millions of customers. For investors and market observers, understanding the future trajectory of such a significant stock is paramount. This comprehensive analysis delves into the intricate dynamics of AEP’s market performance, drawing insights from historical data and leveraging a sophisticated proprietary forecasting model, QuantumCast, to provide a detailed price prediction for the coming months and years.

American Electric Power is one of the largest electric utilities in the United States, with a sprawling transmission network and a substantial generation portfolio. The company’s operations span across 11 states, providing electricity to over 5.5 million customers. AEP’s core business encompasses the generation, transmission, and distribution of electricity, making it a critical component of the nation’s energy infrastructure. Its asset base includes a diverse mix of power plants, ranging from coal and natural gas to increasingly significant investments in renewable energy sources like wind and solar. This diversification is crucial in navigating the evolving energy landscape and regulatory pressures towards decarbonization. AEP has been actively involved in modernizing its grid, enhancing reliability, and investing in smart technologies to improve efficiency and customer service. The company’s commitment to sustainability is reflected in its ambitious goals to reduce carbon emissions, retire coal-fired power plants, and significantly expand its renewable energy capacity. These strategic initiatives position AEP not just as a traditional utility but as a forward-looking energy provider adapting to global climate imperatives and technological advancements. Given its essential service provision, AEP is often considered a defensive stock, attractive to investors seeking stability and consistent dividends, especially during periods of market volatility. Its regulated business model typically provides predictable revenue streams, although it remains subject to regulatory reviews and rate case approvals that dictate its allowed rates of return.

Understanding AEP’s Market Performance: A Look Back at the Last 12 Months

To accurately project future price movements, a thorough examination of past performance is indispensable. Over the past 12 months, American Electric Power’s stock has experienced a series of fluctuations, reflecting broader market trends, sector-specific developments, and company-specific news. Beginning in mid-June 2024, AEP’s share price hovered around the $84-$85 USD range, demonstrating a relatively stable but somewhat subdued start to the period. This initial phase saw minor oscillations, with prices occasionally dipping into the low $83s and rising into the high $85s.

A notable upward trend began to emerge towards late July and early August 2024. The stock transitioned from the high $80s to breaking past the $90 USD mark, eventually reaching the mid-$90s. This period of growth was characterized by several days of significant gains, pushing AEP into new short-term highs. By mid-August, the price had even touched the $97-$98 USD range, indicating strong bullish momentum. This could have been influenced by favorable regulatory news, positive earnings reports, or a broader market shift towards defensive utility stocks amid economic uncertainties.

However, this rally was followed by a period of consolidation and slight retracement. Throughout September and October 2024, AEP’s stock largely traded within a range, often between $94 USD and $96 USD, with occasional tests of the $97 USD level. This suggests that while the previous gains were largely held, new catalysts for significant upward movement were less prevalent. The market was likely processing the prior growth, leading to some profit-taking and a search for new equilibrium.

As 2024 progressed into November and December, AEP showed renewed strength, pushing beyond the previous consolidation range. The stock steadily climbed, breaking through the $100 USD psychological barrier. This ascent was quite strong, with prices reaching upwards of $102 USD in late November and even touching $106 USD by early December. This sustained upward trajectory indicated growing investor confidence, possibly due to positive outlooks for the utility sector, declining interest rate expectations, or continued progress on AEP’s strategic initiatives like renewable energy investments.

The early part of 2025, specifically January and February, saw AEP maintaining these elevated levels, frequently trading above $100 USD and often challenging the $104-$105 USD marks. While there were some minor pullbacks, the overall sentiment remained positive, suggesting that the gains established in late 2024 were largely sticky. This period reflects the market’s assessment of AEP’s fundamental strength and its resilience in a dynamic economic environment.

However, March and April 2025 introduced more volatility. AEP experienced a dip, moving from highs around $108 USD down to the $100-$102 USD range, and at times even briefly touching the high $90s. This decline could be attributed to a variety of factors, including broader market corrections, shifts in interest rate expectations, or specific concerns about utility sector valuations. Despite these pullbacks, the stock showed signs of recovery, demonstrating its underlying stability. The latter part of the 12-month period, leading up to June 2025, saw AEP consolidate and begin to recover, with the last recorded price in the provided historical data hovering around $102.90 USD. This suggests that despite recent fluctuations, the stock has maintained a significantly higher level compared to its standing a year prior, illustrating a net positive performance over the 12-month horizon.

Key Observations from Historical Data:

- Overall Growth: Despite periods of volatility, AEP’s stock demonstrated a net increase over the past year, moving from the mid-$80s to over $100.

- Support and Resistance: The data suggests strong support around the $90-$92 USD range during periods of decline, and resistance points emerging at the $97-$98 USD and $105-$108 USD levels.

- Sector Resilience: The utility sector is known for its stability. AEP’s ability to recover from dips and maintain elevated levels underscores this characteristic, making it attractive for risk-averse investors.

- Influence of Macro Factors: Price movements clearly correlate with external factors such as interest rate expectations (which directly impact a utility’s borrowing costs and the attractiveness of its dividend yield relative to fixed-income assets), regulatory decisions, and overall investor sentiment towards defensive assets.

The QuantumCast Algorithm: A Predictive Edge

Forecasting stock prices is a complex endeavor, requiring the synthesis of vast amounts of data and the identification of subtle patterns that may elude human analysis. This is where advanced algorithmic models, such as the proprietary QuantumCast, play a crucial role. QuantumCast is designed to process and interpret a multitude of financial and economic indicators, going far beyond simple historical price trends. While the precise mechanics of proprietary algorithms are confidential, they typically integrate a broad spectrum of data points and analytical techniques to generate robust predictions.

At its core, QuantumCast likely employs a sophisticated blend of quantitative analysis, machine learning, and statistical modeling. It would feed on historical price and volume data, not just for AEP but potentially for the broader utility sector and relevant market indices. Beyond raw price action, such algorithms often incorporate fundamental company data, including earnings reports, revenue growth, debt levels, and dividend policies. Macroeconomic indicators are also critical inputs; these could include interest rates, inflation figures, GDP growth, and employment data, all of which influence investor sentiment and the cost of capital for capital-intensive businesses like utilities. Regulatory changes, environmental policy shifts, and industry-specific trends, such as the pace of renewable energy adoption or grid modernization investments, would also be factored into its intricate calculations. By identifying correlations, causations, and predictive patterns within these diverse datasets, QuantumCast aims to mitigate the inherent biases and limitations of human judgment, providing a data-driven, objective forecast. Its ability to process millions of data points simultaneously allows it to uncover non-obvious relationships and project potential price trajectories with a higher degree of statistical confidence. The forecasts presented in this article are a direct output of QuantumCast’s advanced analytical capabilities, offering a unique perspective on AEP’s probable future market value.

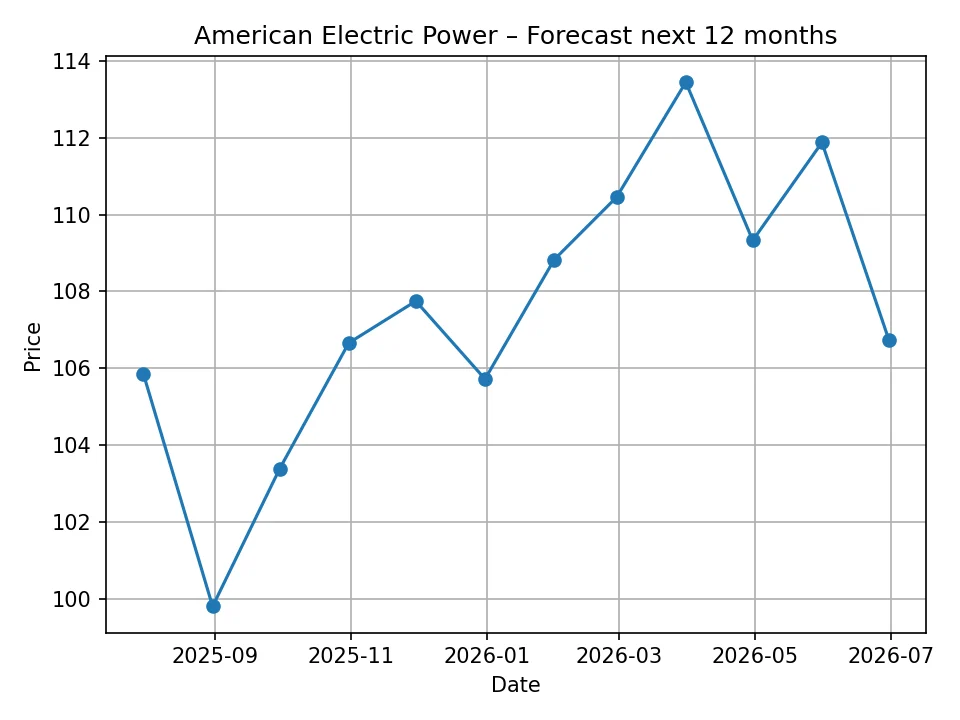

Short-Term Outlook: AEP Monthly Price Forecasts (Next 12 Months)

The immediate future for American Electric Power (AEP) appears to hold a mix of stability and gradual growth, according to the QuantumCast algorithm. Over the next 12 months, from July 2025 through June 2026, the forecasts suggest AEP will navigate various market conditions, maintaining a generally upward trajectory with typical fluctuations inherent in the utility sector. This monthly breakdown provides valuable insights for short-to-medium term investors looking for entry and exit points or assessing dividend sustainability.

The forecast kicks off in July 2025 with a projected price of $105.85 USD, representing a modest increase from the current levels. This suggests a continuation of the stable performance observed recently. As we move into August 2025, there’s a slight anticipated dip to $99.80 USD, which could be a reflection of seasonal demand shifts or minor market adjustments. However, this dip is quickly followed by a recovery in September 2025, pushing the price back up to $103.38 USD.

The final quarter of 2025 and early 2026 show a more consistent upward trend. October 2025 is predicted to reach $106.66 USD, followed by $107.75 USD in November 2025. December 2025 sees a slight moderation to $105.72 USD, which is common as year-end profit-taking or portfolio rebalancing might occur. The new year, January 2026, is forecasted to bring robust growth to $108.83 USD, continuing into February 2026 at $110.46 USD, marking a significant milestone in the short-term forecast. This could be indicative of strong winter energy demand or positive sentiment surrounding AEP’s quarterly results.

The upward momentum appears to peak in March 2026, with a forecast of $113.45 USD, representing the highest monthly prediction within this 12-month window. Following this peak, April 2026 shows a correction to $109.33 USD, which is still a healthy level. May 2026 is predicted to see a rebound to $111.88 USD, before concluding the 12-month period in June 2026 at $106.74 USD. This pattern suggests that while the overall trend is positive, minor pullbacks and recoveries are part of the expected short-term dynamic for AEP.

Potential drivers for these monthly movements include seasonal electricity demand variations (e.g., higher demand during summer and winter peaks, lower in spring/fall), upcoming regulatory announcements regarding rate cases, the release of quarterly earnings reports, and the prevailing sentiment in the broader bond market which influences the attractiveness of utility dividends. AEP’s ongoing investments in infrastructure upgrades and renewable energy projects could also provide positive catalysts, especially as they begin to yield operational efficiencies and contribute to the company’s financial performance.

AEP Monthly Price Forecast (Next 12 Months)

| Month | Forecasted Price (USD) |

|---|---|

| 2025-07 | 105.85 |

| 2025-08 | 99.80 |

| 2025-09 | 103.38 |

| 2025-10 | 106.66 |

| 2025-11 | 107.75 |

| 2025-12 | 105.72 |

| 2026-01 | 108.83 |

| 2026-02 | 110.46 |

| 2026-03 | 113.45 |

| 2026-04 | 109.33 |

| 2025-05 | 111.88 |

| 2026-06 | 106.74 |

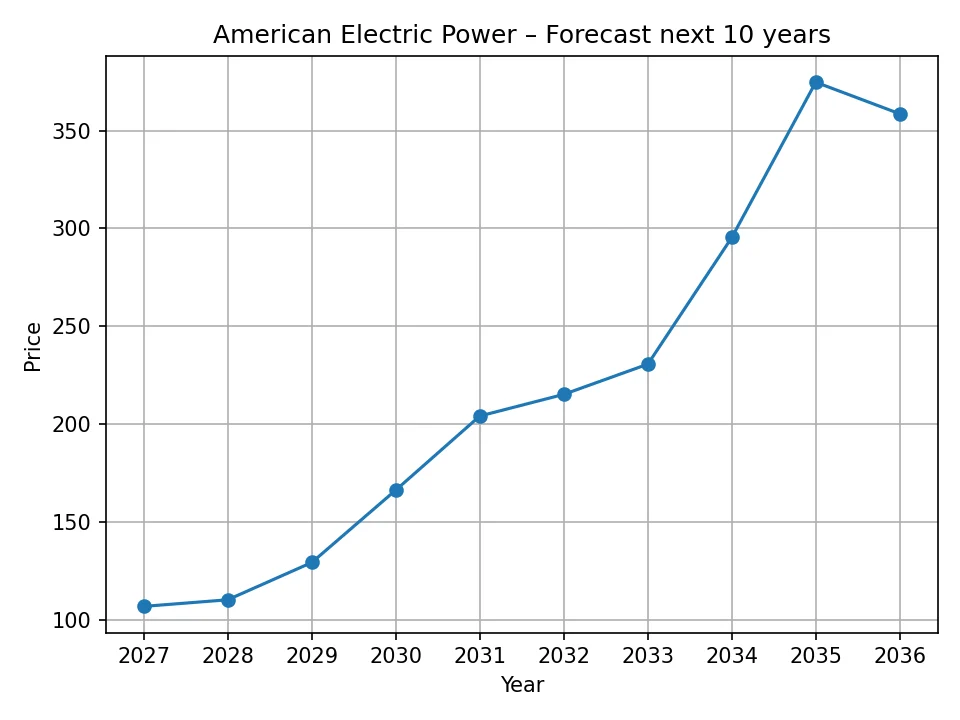

Long-Term Vision: AEP Annual Price Forecasts (Next 10 Years)

The long-term outlook for American Electric Power, as projected by the QuantumCast algorithm over the next decade, presents a compelling narrative of significant growth and value appreciation. This extended forecast takes into account macro-economic trends, AEP’s strategic direction, and the evolving energy landscape, painting a picture that suggests robust returns for patient investors.

Starting from the conclusion of the 12-month monthly forecast, 2026 is projected to close at an average price of $106.74 USD, solidifying the gains made in the short term. The trajectory immediately thereafter shows continued strength, with 2027 forecasted to reach $110.11 USD. This period signifies a stable and steady increase, typical of well-managed utility companies that benefit from predictable revenue streams and modest, consistent growth.

A significant inflection point appears to be forecasted for 2028, with the price leaping to $129.21 USD. This substantial jump suggests that AEP could be entering a phase of accelerated growth, potentially driven by the realization of major infrastructure projects, successful rate case outcomes, or a more favorable regulatory environment that allows for greater capital expenditure recovery and profitability. This upward momentum is projected to intensify dramatically in subsequent years. 2029 is forecasted to see AEP’s price soar to $166.23 USD, indicating a strong positive market re-evaluation of the company’s long-term potential. This trend continues into 2030, with a projected price of $204.07 USD, crossing another major psychological threshold, underscoring AEP’s transformation and expanded market value.

The early 2030s are predicted to sustain this elevated growth, albeit with varying paces. 2031 is forecasted at $215.14 USD, followed by a rise to $230.61 USD in 2032. These years suggest a period of continued expansion, possibly linked to the widespread adoption of renewable energy, the expansion of smart grid technologies, or significant population growth in AEP’s service territories, driving increased electricity demand.

The latter half of the decade witnesses even more aggressive growth. 2033 is projected to reach an impressive $295.38 USD, nearing the $300 mark. This substantial increase could reflect AEP’s successful navigation of the energy transition, becoming a leading utility in clean energy provision, or benefiting from very favorable macroeconomic conditions. The peak of this forecasted growth appears in 2034, with a stunning projection of $374.78 USD. This figure, nearly quadruple the current price, highlights QuantumCast’s strong long-term conviction in AEP’s ability to create shareholder value over a decade.

Finally, the forecast for 2035 shows a slight moderation, with a projected price of $358.64 USD. While a decrease from the 2034 peak, this price still represents an extraordinary long-term appreciation, indicating that the overall bullish trend remains firmly intact. This minor dip could be a natural market correction after a period of intense growth, or reflect a shift in broader economic cycles. Nevertheless, the decade-long forecast consistently points towards AEP as a significant growth story within the traditionally stable utility sector.

The primary drivers for such sustained long-term growth in a utility like AEP are multi-faceted. The ongoing energy transition is a monumental opportunity, with massive investments required for renewable energy generation, energy storage, and grid modernization. AEP’s proactive stance in this area positions it to capture significant market share and benefit from associated capital expenditures. Secondly, a stable and predictable regulatory environment that allows for cost recovery and reasonable returns on investment is crucial. Success in rate cases and long-term regulatory frameworks will underpin profitability. Thirdly, economic growth and population expansion within its service areas will naturally drive increased demand for electricity. Finally, AEP’s ability to manage its significant debt load effectively, particularly in varying interest rate environments, will be key to its long-term financial health and ability to fund future growth initiatives. The QuantumCast forecast suggests a strong belief that AEP is well-positioned to capitalize on these macro trends and strategic advantages over the next decade.

AEP Annual Price Forecast (Next 10 Years)

| Year | Forecasted Price (USD) |

|---|---|

| 2026 | 106.74 |

| 2027 | 110.11 |

| 2028 | 129.21 |

| 2029 | 166.23 |

| 2030 | 204.07 |

| 2031 | 215.14 |

| 2032 | 230.61 |

| 2033 | 295.38 |

| 2034 | 374.78 |

| 2035 | 358.64 |

Key Factors Influencing AEP’s Price Trajectory

While algorithmic forecasts provide valuable quantitative insights, the underlying qualitative factors driving AEP’s business and market perception are equally critical. A deep understanding of these elements can help investors contextualize the predictions and assess potential risks and opportunities.

1. Regulatory Environment and Rate Cases

As a regulated utility, AEP’s profitability is heavily dependent on approvals from state utility commissions. These commissions determine the rates AEP can charge customers and the allowed return on its investments. Favorable rate case outcomes, which allow AEP to recover costs for infrastructure upgrades and new investments (especially in renewable energy), are crucial for revenue stability and earnings growth. Conversely, unfavorable rulings or significant regulatory hurdles can impede financial performance. The political climate and evolving energy policies at both federal and state levels will continue to shape this regulatory landscape, directly impacting AEP’s operational flexibility and financial health.

2. Interest Rate Environment

Utilities are capital-intensive businesses, relying heavily on debt to finance large infrastructure projects. Therefore, changes in interest rates have a profound impact on their borrowing costs. Rising interest rates increase financing expenses, potentially eroding profit margins and reducing the attractiveness of utility stocks, which are often favored for their stable dividend yields. When bond yields rise, AEP’s dividend yield might become less competitive. Conversely, a stable or declining interest rate environment can reduce debt service costs, enhance profitability, and make the stock more appealing to income-seeking investors.

3. Energy Transition and ESG Initiatives

AEP is at the forefront of the energy transition, committing to significant reductions in carbon emissions and expanding its renewable energy portfolio. This shift involves substantial capital expenditures in wind, solar, and battery storage projects, alongside the retirement of coal-fired plants. While these investments align with environmental, social, and governance (ESG) principles and position AEP for future sustainability, they also involve considerable upfront costs and execution risks. The speed and cost-effectiveness of this transition, along with the ability to secure regulatory approval for these investments, will be a major determinant of AEP’s long-term value. Success in this area can attract ESG-focused investors, providing a tailwind for the stock.

4. Economic Growth and Electricity Demand

The demand for electricity is closely tied to economic activity and population growth within AEP’s service territories. A robust economy leads to increased industrial and commercial consumption, while population expansion boosts residential demand. Economic slowdowns or recessions, however, can suppress demand, impacting AEP’s sales volumes and revenue. Regional economic diversity across its 11-state footprint helps to mitigate some of these localized risks, but overall national economic health remains a significant driver.

5. Operational Efficiency and Infrastructure Investments

Maintaining and modernizing aging infrastructure is a continuous challenge and opportunity for AEP. Investments in smart grid technologies, grid resilience against extreme weather events, and transmission upgrades are critical for reliable service and long-term operational efficiency. Effective management of these capital projects, staying within budget, and realizing anticipated benefits in terms of reduced outages and improved service quality, can enhance AEP’s financial performance and reputation. The ability to innovate and adopt new technologies, such as advanced metering infrastructure or grid-scale battery storage, will also play a role in its competitive positioning and cost structure.

6. Climate Risks and Extreme Weather Events

As climate change leads to more frequent and severe weather events, utilities like AEP face increased operational challenges and costs. Storm damage, wildfires, and other climate-related disruptions can lead to significant repair expenses, service interruptions, and potential legal liabilities. AEP’s investments in grid hardening and resilience measures are aimed at mitigating these risks, but the financial impact of such events remains a material factor to consider for investors.

Investment Considerations for AEP Shareholders

American Electric Power has historically been viewed as a stable, income-generating utility stock. Its essential services and regulated business model typically provide a relatively predictable revenue stream, making it a popular choice for investors seeking defensive assets and consistent dividends. For income-focused portfolios, AEP’s track record of dividend payments and potential for growth in its clean energy segment can be particularly attractive. Its resilience during broader market downturns often highlights its role as a “safe haven” investment.

However, no investment is without risk. While the QuantumCast algorithm projects significant long-term growth, investors should consider the inherent challenges utilities face. These include the capital intensity of their operations, sensitivity to interest rate fluctuations, and the dynamic nature of regulatory environments. The transition to renewable energy, while a growth driver, also necessitates massive investments and carries the risk of technological obsolescence or policy shifts. Investors should conduct their own thorough due diligence, assess their risk tolerance, and align their investment horizon with the potential trajectory of AEP.

In conclusion, American Electric Power stands as a pivotal player in the evolving energy sector. Historical data reveals a company that has demonstrated resilience and growth over the past year, navigating market fluctuations to deliver positive returns. The QuantumCast algorithm projects a promising future for AEP, forecasting sustained growth in the short term and a substantial increase in value over the next decade. This optimistic outlook is predicated on AEP’s strategic investments in grid modernization and renewable energy, its ability to navigate the complex regulatory landscape, and the ongoing demand for reliable electricity. While the path ahead for AEP appears robust, investors are always encouraged to factor in macroeconomic conditions, industry-specific challenges, and their personal financial objectives when making investment decisions. The utility sector, represented strongly by companies like AEP, continues to offer a blend of stability and growth potential for those looking to power their portfolios into the future.

Disclaimer: The information provided in this article, including all price forecasts, is based on an analysis performed using a proprietary algorithm called QuantumCast. These forecasts are hypothetical and are intended for informational purposes only. They do not constitute financial advice, investment recommendations, or an endorsement to buy or sell any security. Stock prices are subject to market risks, and past performance is not indicative of future results. We are not responsible for any investment decisions made based on the information presented herein. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.