Accenture (NYSE: ACN) stands as a global professional services behemoth, offering an unparalleled suite of capabilities in strategy, consulting, digital, technology, and operations. As one of the world’s leading companies in its sector, Accenture plays a pivotal role in assisting businesses and governments worldwide navigate the complexities of digital transformation, operational efficiency, and sustainable growth. The company’s stock performance is often viewed as a bellwether for the broader IT services and consulting industry, reflecting trends in corporate spending on technology and strategic initiatives. With a current price of 311.71 USD as of June 15, 2025, investors are keenly interested in understanding the potential trajectory of Accenture’s shares in the evolving global economic landscape.

This comprehensive analysis delves into Accenture’s market position, historical stock performance, the fundamental and external factors driving its valuation, and provides detailed price forecasts for both the short and long term. Leveraging a sophisticated proprietary algorithm, FutureLens, we aim to offer a data-driven perspective on what the future might hold for Accenture stock, helping investors make informed decisions.

Accenture: A Pillar of the Digital Economy

Accenture’s business model is inherently tied to the pace of innovation and the strategic priorities of its global client base. The company’s core strength lies in its ability to deliver end-to-end solutions, from high-level strategic advisory to complex technology implementation and ongoing operational management. Its services are broadly categorized into five main areas:

- Strategy & Consulting: Helping clients define their future, improve performance, and manage change. This includes areas like enterprise transformation, talent and organization, and customer experience.

- Interactive: Focused on digital marketing, commerce, and design, helping brands connect with customers in innovative ways.

- Technology: Designing, building, and implementing technology solutions, including cloud services, enterprise platforms, and custom development. Accenture is a leading partner for major cloud providers like AWS, Microsoft Azure, and Google Cloud, and enterprise software giants like SAP and Oracle.

- Operations: Managing business processes for clients, often through outsourcing and managed services, covering areas like finance, procurement, and supply chain. This segment increasingly leverages automation and AI.

- Song: A creative agency combining design, marketing, and technology to help clients accelerate growth and create new value.

Accenture’s robust global delivery network, deep industry expertise across more than 40 industries, and significant investment in research and development (R&D) and acquisitions position it as a critical partner for enterprises striving to achieve digital maturity and competitive advantage. The company’s continued focus on emerging technologies such as Artificial Intelligence (AI), Generative AI, blockchain, quantum computing, and metaverse applications ensures its relevance in a rapidly changing technological landscape. This forward-looking approach is crucial for maintaining its market leadership and attracting a diverse range of clients, from Fortune 500 companies to government agencies.

Understanding the Market Landscape and Key Influencers

Accenture’s financial performance and stock valuation are significantly influenced by a confluence of macroeconomic trends, industry-specific developments, and company-specific initiatives. The global IT services market is dynamic, characterized by rapid technological advancements and evolving client needs. Several key factors are currently shaping this environment:

Digital Transformation Imperative

The imperative for digital transformation remains strong across all sectors. Businesses are continually investing in cloud migration, data analytics, cybersecurity, and advanced automation to enhance efficiency, innovate product offerings, and improve customer engagement. Accenture, with its comprehensive suite of services, is a primary beneficiary of this sustained investment trend.

The AI Revolution

The burgeoning field of Artificial Intelligence, particularly Generative AI, represents a monumental opportunity. Companies are seeking expert guidance on how to integrate AI into their operations, create AI-driven products, and manage the associated ethical and data governance challenges. Accenture has been aggressively building its AI capabilities, talent pool, and partnerships to capitalize on this demand, recently announcing substantial investments in AI and expanding its AI-focused workforce. The ability to effectively implement AI solutions for clients will be a significant growth driver.

Cloud Computing Dominance

Cloud adoption continues to be a foundational element of digital strategies. Enterprises are not just migrating to the cloud but are optimizing their cloud environments, adopting multi-cloud strategies, and leveraging cloud-native architectures. Accenture’s deep expertise in cloud implementation and management ensures it remains at the forefront of this critical technological shift.

Macroeconomic Headwinds and Tailwinds

While the long-term outlook for IT services is positive, short-term macroeconomic conditions can introduce volatility. Factors such as global GDP growth rates, inflation, interest rate policies by central banks, and geopolitical stability can influence corporate spending on discretionary IT projects. A cautious economic outlook might lead to deferred projects or tighter budget controls, temporarily impacting consulting demand. Conversely, economic recovery or increased clarity on monetary policy can stimulate investment. Accenture’s diversified client base and global reach help mitigate some region-specific or industry-specific economic slowdowns, providing a degree of resilience.

Competitive Landscape

Accenture operates in a highly competitive market, facing rivals such as Deloitte, EY, PwC, KPMG (the “Big Four”), IBM, Cognizant, Capgemini, and various specialized niche players. Maintaining a competitive edge requires continuous innovation, attracting and retaining top talent, and demonstrating superior value to clients. Accenture’s consistent ranking as a leader in various industry reports underscores its ability to navigate this competitive environment effectively.

Historical Performance: A Look Back at Accenture’s Journey

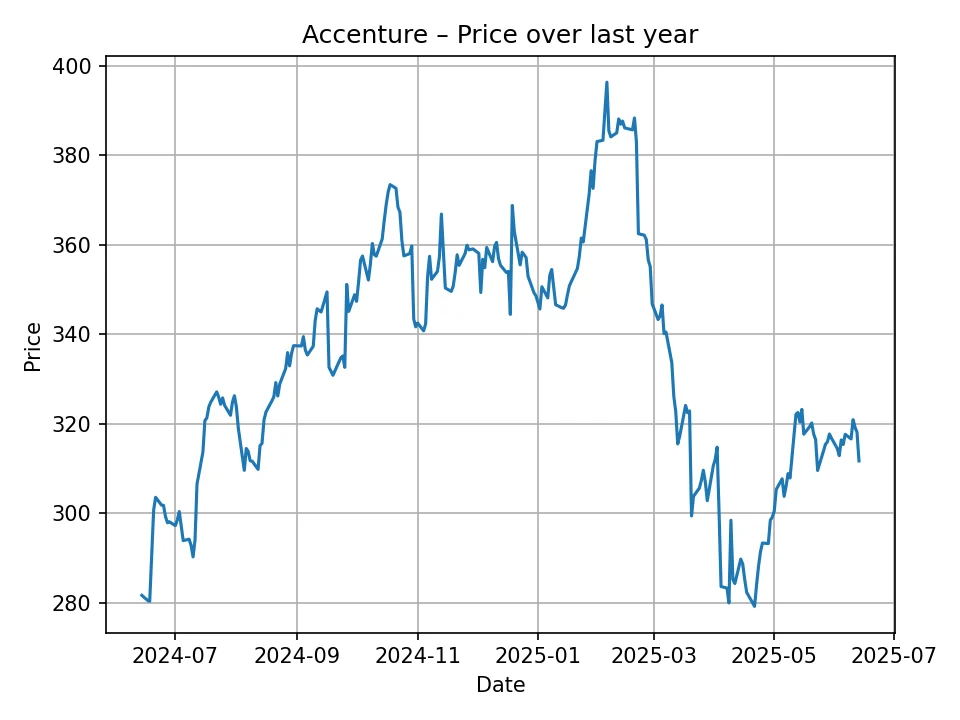

Understanding Accenture’s past stock performance provides crucial context for its future trajectory. Over the last 12 months, the stock has experienced periods of significant appreciation and consolidation, reflecting the broader market dynamics and specific company-related news. The provided historical data, representing daily closing prices from June 2024 to June 2025, offers a granular view of these movements.

The price began the period around 281.70 USD, showing an initial upward trend. Notably, Accenture’s stock experienced a significant surge, reaching a high point of 396.28 USD during this 12-month span. This peak likely coincided with positive market sentiment, strong earnings reports, or major strategic announcements that reinforced investor confidence in the company’s growth prospects and leadership in key technology areas like AI and cloud. Such rapid ascent often reflects robust demand for Accenture’s services and optimistic analyst ratings.

Following this peak, the stock demonstrated a degree of volatility and correction. There were periods of notable pullbacks, for instance, from the high 380s to the 360s, and then further dips, even touching around 299 USD at one point towards the latter end of the historical data provided. This kind of price correction is common after a significant rally and can be attributed to various factors, including broader market corrections, profit-taking by investors, or a reassessment of growth expectations. Investor sentiment can also shift due to macroeconomic concerns, such as rising interest rates impacting valuation multiples for growth stocks, or concerns about a potential slowdown in IT spending. The current price of 311.71 USD sits in a mid-to-lower range relative to its 12-month high, suggesting a recent period of consolidation or slight decline after previous highs, but still significantly above the initial value observed a year prior.

Analyzing the daily fluctuations reveals both resilience and responsiveness to market signals. Accenture’s stock generally trends with the broader technology sector but also exhibits unique movements based on its quarterly earnings, strategic acquisitions, and major client wins. Despite the recent pullbacks from its peak, the overall trend over the past year, starting from the low 280s and currently at 311.71 USD, indicates a net positive growth. This historical performance underscores Accenture’s ability to create long-term value for shareholders, even amidst short-term market pressures. The company’s diversified revenue streams and persistent demand for its core services often provide a cushion against severe downturns, allowing for relatively quick recovery once market sentiment improves.

Proprietary Forecast Methodology: FutureLens

The price forecasts presented in this article are generated using FutureLens, a sophisticated proprietary algorithm designed for financial market prediction. FutureLens employs a multi-faceted approach, integrating advanced statistical models, machine learning techniques, and comprehensive historical data analysis. It processes large datasets, including past price movements, trading volumes, and relevant economic indicators, to identify complex patterns and project potential future price trajectories. While specific details of the algorithm are proprietary, its design prioritizes robustness and adaptability, aiming to provide a nuanced understanding of market dynamics and potential future valuations for assets like Accenture stock. It should be noted that all forecasts are based on probabilistic models and are subject to inherent market uncertainties.

Short-Term Price Forecast: The Next 12 Months

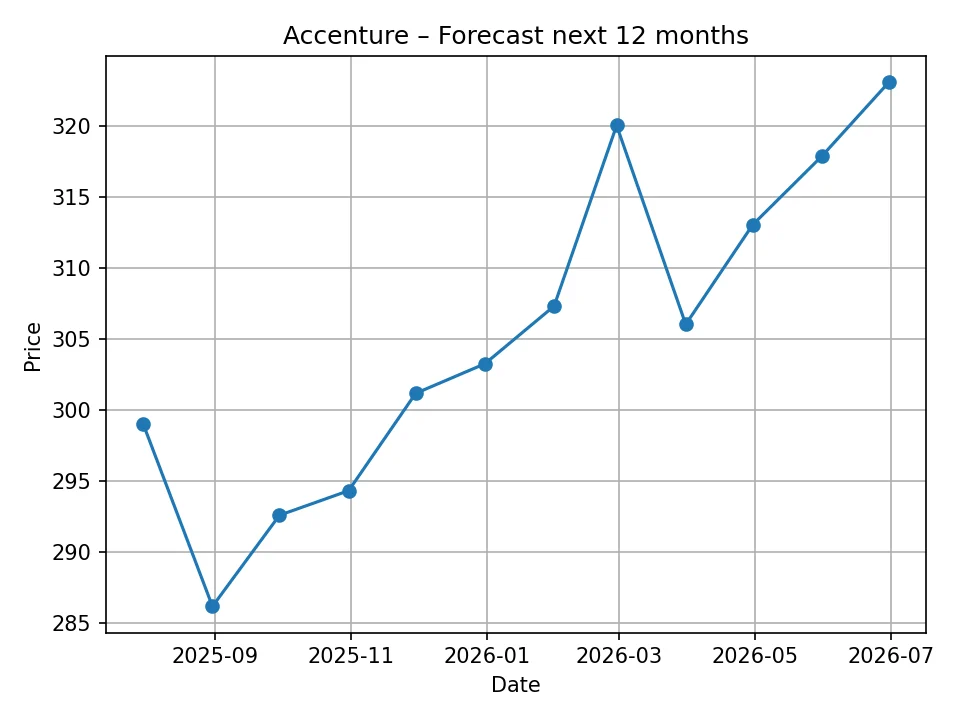

The short-term outlook for Accenture’s stock, as projected by the FutureLens algorithm, indicates a period of initial slight adjustment followed by a gradual upward trajectory. This forecast suggests that while there might be some near-term consolidation or minor dips, the underlying strength of Accenture’s business model and the persistent demand for its services are expected to drive recovery and modest growth.

For July 2025, the forecast price is 298.99 USD, indicating a slight dip from the current price of 311.71 USD. This immediate decrease could reflect a short-term market correction or a temporary cautious sentiment among investors, perhaps in anticipation of broader economic data or a post-earnings adjustment period. This trend continues into August 2025, with a projected price of 286.17 USD, suggesting that the initial consolidation might extend for a couple of months. Such short-term volatility is not uncommon for stocks that have seen significant movement and could be a healthy recalibration.

However, from September 2025 onwards, the forecast shows a clear pattern of recovery and sustained growth. The price is predicted to rebound to 292.58 USD in September, followed by 294.31 USD in October 2025. This upward momentum is expected to continue through the end of 2025, reaching 301.16 USD in November and 303.24 USD in December. This recovery suggests that any initial headwinds are likely to be temporary, with fundamental demand for Accenture’s services reasserting its influence on the stock price.

Entering 2026, the positive trend is projected to accelerate. January 2026 sees a forecast of 307.30 USD, followed by a more significant jump to 320.01 USD in February 2026. This could be attributed to renewed corporate spending, positive industry outlooks, or perhaps strong performance in Accenture’s quarterly results. While there’s a slight forecasted dip in March 2026 to 306.01 USD, possibly reflecting seasonal variations or specific market adjustments, the overall trend quickly resumes its upward path. April is projected at 313.02 USD, May at 317.85 USD, and by June 2026, the price is expected to reach 323.05 USD. This indicates that despite initial short-term adjustments, Accenture’s stock is anticipated to deliver a modest but consistent increase over the next 12 months, ending the period higher than its current value.

Here is the detailed monthly forecast for Accenture:

| Month | Forecasted Price (USD) |

|---|---|

| 2025-07 | 298.99 |

| 2025-08 | 286.17 |

| 2025-09 | 292.58 |

| 2025-10 | 294.31 |

| 2025-11 | 301.16 |

| 2025-12 | 303.24 |

| 2026-01 | 307.30 |

| 2026-02 | 320.01 |

| 2026-03 | 306.01 |

| 2026-04 | 313.02 |

| 2026-05 | 317.85 |

| 2026-06 | 323.05 |

Long-Term Price Forecast: The Next Decade

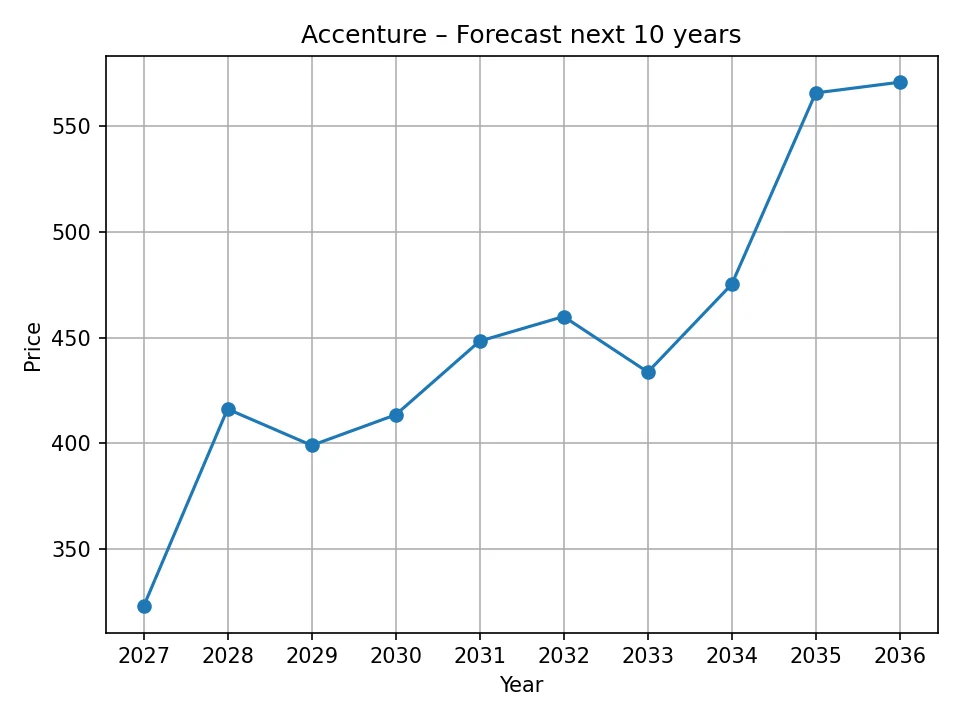

The long-term forecast for Accenture’s stock, spanning the next ten years, paints a highly optimistic picture, projecting significant and sustained growth. This long-term bullish outlook is grounded in the expectation that Accenture will continue to benefit from overarching global trends in digitalization, technological innovation, and the increasing complexity of business operations that necessitate expert external consultation. The FutureLens algorithm predicts that Accenture’s strategic positioning, continuous adaptation, and market leadership in crucial areas like AI, cloud, and cybersecurity will drive substantial value creation for shareholders over the coming decade.

The annual forecast begins with 2026, where the price is expected to settle at 323.05 USD, consistent with the end of the monthly forecast period. This serves as a solid base for the projected multi-year expansion. A significant jump is anticipated in 2027, with the price soaring to 416.25 USD. This robust increase suggests that Accenture will likely capitalize on maturing digital transformation cycles and potentially widespread adoption of advanced AI technologies across various industries, translating into increased demand for its implementation and advisory services.

Following this strong surge, the forecast shows a slight adjustment in 2028 to 399.06 USD. This minor dip is common in long-term projections and could represent a period of market consolidation or a temporary slowdown in growth rates as certain technologies mature or new market dynamics emerge. However, this is quickly followed by a renewed upward trend, with 2029 projected at 413.53 USD, indicating that the long-term growth narrative remains firmly intact.

The growth trajectory becomes even more pronounced in the subsequent years. For 2030, the forecast is 448.31 USD, reflecting continued strong performance driven by Accenture’s ability to capture market share and expand its service offerings. This trend extends to 2031, reaching 459.93 USD. A slight moderation is forecasted for 2032, at 433.70 USD, which could signify another period of market recalibration or perhaps increased competition in specific segments, but it does not derail the overall long-term positive outlook.

The latter half of the decade sees accelerated growth. By 2033, Accenture’s stock is predicted to reach 475.19 USD, showcasing the company’s sustained relevance and capacity for innovation. The most significant jump in the long-term forecast occurs between 2033 and 2034, with the price surging to 565.53 USD in 2034. This substantial increase suggests that by this point, Accenture might be reaping significant benefits from large-scale adoption of next-generation technologies like quantum computing, hyper-automation, or advanced data monetization strategies, firmly cementing its position as a dominant force in the global professional services market. Finally, by 2035, the forecast projects the price to reach 570.59 USD, culminating a decade of remarkable growth.

This optimistic long-term forecast is underpinned by several key assumptions: Accenture’s continued ability to innovate and adapt to technological shifts, its strong client relationships, its global diversified revenue base, and the ongoing fundamental need for businesses worldwide to navigate complex digital transformations and leverage advanced technologies for competitive advantage. The projections suggest that Accenture’s robust business model, combined with its strategic investments in future-proof capabilities, positions it well for sustained profitability and substantial shareholder returns over the next ten years.

Here is the detailed annual forecast for Accenture:

| Year | Forecasted Price (USD) |

|---|---|

| 2026 | 323.05 |

| 2027 | 416.25 |

| 2028 | 399.06 |

| 2029 | 413.53 |

| 2030 | 448.31 |

| 2031 | 459.93 |

| 2032 | 433.70 |

| 2033 | 475.19 |

| 2034 | 565.53 |

| 2035 | 570.59 |

Risk Factors and Considerations

While the outlook for Accenture appears robust, particularly in the long term, it is crucial for investors to be aware of potential risk factors that could impact these forecasts. No financial projection is without uncertainty, and various internal and external elements can influence actual stock performance:

Economic Downturns

A significant global economic recession or prolonged period of low growth could lead to reduced corporate spending on IT services and consulting. Companies might defer or cancel discretionary projects, directly impacting Accenture’s revenue and profitability. While Accenture’s diversified client base offers some resilience, a severe downturn could still pose a considerable challenge.

Intensified Competition

The professional services market is highly competitive. Accenture faces intense rivalry from other global consulting firms, technology giants, and specialized niche players. Aggressive pricing strategies, loss of key talent, or the emergence of disruptive business models by competitors could erode Accenture’s market share and profitability. Maintaining its competitive edge requires continuous innovation and strong value proposition.

Failure to Adapt to New Technologies

The pace of technological change is relentless. While Accenture has a strong track record of adapting to and leading new technology waves (e.g., cloud, AI), a failure to quickly identify, invest in, and develop expertise in the next wave of disruptive technologies could diminish its relevance and competitive advantage. Staying ahead of the curve requires substantial R&D investment and agile strategic pivots.

Talent Acquisition and Retention

Accenture’s business is fundamentally dependent on its human capital—its highly skilled consultants and technology experts. The global talent war, particularly for professionals with expertise in advanced technologies like AI and cybersecurity, poses a significant challenge. Difficulty in attracting, retaining, and upskilling top talent could impact service delivery quality, project execution, and ultimately, client satisfaction and financial performance.

Cybersecurity Risks

As a leading provider of digital and technology services, Accenture itself, and its clients, are constantly exposed to cybersecurity threats. A major cyberattack impacting Accenture’s systems or a significant data breach involving client information could result in severe reputational damage, legal liabilities, and financial losses, directly affecting investor confidence.

Geopolitical and Regulatory Risks

Accenture operates globally, making it susceptible to geopolitical instability, trade tensions, and changes in regulatory environments across different countries. New data privacy laws, changes in tax policies, or increased protectionism could impact its operational costs, market access, and overall business strategy.

Client Concentration and Project Complexity

While diversified, reliance on a few large clients or highly complex, long-term projects can introduce risk. Delays, scope changes, or disputes in such projects can significantly impact revenue recognition and profitability. Moreover, the inherent complexity of large-scale digital transformations means that project success is not always guaranteed, and outcomes can be difficult to predict, leading to potential client dissatisfaction or reduced future engagements.

Conclusion

Accenture stands as a formidable player in the global professional services industry, expertly navigating the evolving landscape of digital transformation and technological innovation. Its comprehensive service offerings, strategic investments in cutting-edge technologies like AI, and expansive global reach position it as a critical partner for businesses worldwide. The historical data for Accenture’s stock over the past 12 months reflects periods of significant growth and subsequent consolidation, mirroring broader market dynamics but ultimately demonstrating net positive appreciation.

The forecasts generated by the FutureLens algorithm provide an insightful perspective on Accenture’s potential price trajectory. The short-term monthly forecast suggests a period of initial slight adjustment and consolidation in the coming months, followed by a gradual and steady recovery. This near-term volatility is often a natural part of market cycles, especially after periods of strong performance, indicating a recalibration before renewed ascent. By June 2026, the stock is anticipated to be trading higher than its current price, showcasing resilient growth even in the near term.

The long-term annual forecast for the next decade, extending to 2035, paints a compellingly optimistic picture. Accenture’s stock is projected to achieve substantial and sustained growth, potentially reaching well over 500 USD per share. This strong long-term outlook is predicated on the continued, indispensable role Accenture plays in assisting organizations with their digital journeys, the accelerating adoption of AI across industries, and the company’s proven ability to adapt, innovate, and lead in a rapidly changing technological environment. Its robust business model, diversified revenue streams, and strategic foresight are expected to drive significant shareholder value over the coming years.

However, it is vital for investors to consider the inherent risks associated with any investment. Factors such as macroeconomic headwinds, intense competition, the challenge of talent retention, and the need for continuous technological adaptation can all influence actual performance. While Accenture’s strong fundamentals and strategic position offer a degree of insulation against some of these risks, diligent research and a clear understanding of market dynamics are paramount. In conclusion, while past performance is not indicative of future results, and all forecasts come with inherent uncertainties, Accenture’s trajectory appears promising for those looking at long-term investment in the digital economy’s backbone.

Disclaimer: Please note that this article provides a price forecast based on data analysis using the proprietary FutureLens algorithm. These projections are for informational purposes only and should not be considered as financial advice. Investing in the stock market involves significant risks, and past performance is not indicative of future results. We are not responsible for any investment decisions made based on the information presented herein. It is highly recommended to conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.