Navigating the complex landscape of stock market predictions requires a multifaceted approach, combining rigorous historical analysis with forward-looking projections derived from advanced algorithmic models. This comprehensive article delves into the price forecast for Ameren (AEE), a prominent player in the utility sector, offering insights into its recent performance, the fundamental factors influencing its valuation, and a detailed outlook for the coming months and years.

As of June 8, 2025, Ameren’s stock (AEE) stands at a current price of $96.04 USD. This analysis aims to provide a robust framework for understanding the potential trajectory of AEE’s stock price, leveraging historical data spanning the last 12 months and sophisticated proprietary forecasting from our PriceCast algorithm.

Understanding Ameren (AEE): A Pillar of the Utility Sector

Ameren Corporation is a major American utility company, primarily engaged in the generation, transmission, and distribution of electricity and natural gas. Serving millions of customers across Missouri and Illinois, Ameren operates through its principal subsidiaries: Ameren Missouri, Ameren Illinois, and Ameren Transmission Company. As a regulated utility, Ameren benefits from a relatively stable and predictable revenue stream, underpinned by state-approved rates. This inherent stability often positions utility stocks like AEE as defensive investments, attractive to investors seeking consistent returns and dividend income, especially during periods of economic uncertainty or market volatility.

The company’s strategic focus has increasingly shifted towards modernizing its infrastructure, enhancing grid reliability, and accelerating the transition to cleaner energy sources. Ameren has committed to significant investments in renewable energy, including solar and wind projects, and has outlined ambitious decarbonization goals. These initiatives not only align with growing environmental concerns but also often qualify for regulatory support and incentives, potentially contributing to long-term asset growth and regulated earnings.

Ameren’s regulated business model implies that its earnings are largely determined by its rate base (the value of its assets on which it is allowed to earn a return) and the allowed return on equity (ROE) set by state utility commissions. This framework provides a degree of insulation from economic cycles that might impact other industries, making AEE a foundational component of many diversified investment portfolios. Furthermore, the company’s consistent dividend payments make it a compelling choice for income-focused investors, reinforcing its reputation as a reliable, long-term holding.

A Deep Dive into Ameren’s Historical Price Performance (Last 12 Months)

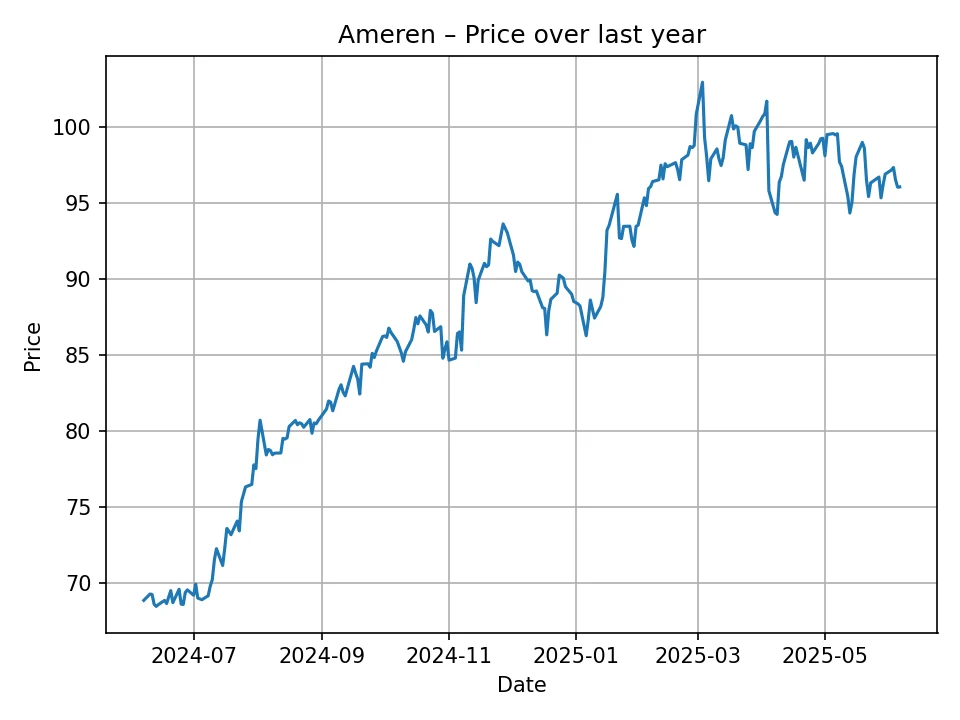

Analyzing the historical price data for Ameren over the past 12 months provides crucial context for its current valuation and future projections. The provided daily historical data, spanning from approximately June 2024 to June 2025, reveals a clear and impressive upward trajectory for AEE, indicative of strong underlying fundamentals and positive market sentiment within the utility sector.

At the beginning of this 12-month period, Ameren’s stock was trading in the range of $68-$69 USD, with an initial recorded price of $68.839. Over the subsequent months, AEE demonstrated a consistent pattern of appreciation, albeit with natural market fluctuations. The stock experienced a gradual but steady climb through the summer of 2024, moving into the low to mid-$70s. This early phase of growth likely reflected a stable regulatory environment and perhaps an increasing investor appetite for defensive stocks amidst broader economic shifts.

By late summer and early autumn 2024, Ameren’s price had comfortably breached the $80 mark, reaching highs in the $80-$82 USD range. This sustained momentum was likely fueled by positive company-specific news, such as favorable regulatory outcomes or progress on infrastructure projects, combined with the general appeal of utility stocks offering predictable returns and dividends. The data shows some periods of consolidation and minor pullbacks, which are healthy market behaviors, allowing for the absorption of gains before the next leg up.

As the year progressed into late 2024 and early 2025, Ameren’s stock continued its ascent, pushing into the high $80s and then decisively breaking past the $90 USD threshold. There were notable surges, including instances where the price briefly touched or exceeded $100 USD. For example, values like $100.833 and $102.928 were observed, representing significant peaks within the 12-month window. These peaks, while not sustained, highlight periods of strong investor confidence or specific catalysts that drove price discovery upwards. The highest point reached during this period was approximately $102.93 USD.

Despite these peaks, the stock saw natural corrections, returning to the mid-to-high $90s. This behavior is typical, as profit-taking occurs after rapid appreciation. The data shows that after reaching these higher levels, AEE tended to stabilize in the $95-$98 USD range towards the end of the 12-month period, before settling at its current price of $96.04 USD as of June 8, 2025. This closing value represents a substantial gain from its starting point.

Overall, the historical data illustrates a robust performance for Ameren over the last year. The stock gained approximately 39.51% from its starting price of $68.839 to its current price of $96.04. This significant appreciation for a utility stock underscores strong investor confidence in Ameren’s operational stability, its strategic growth initiatives, and its ability to navigate the evolving energy landscape. The pattern of higher highs and higher lows, despite temporary corrections, indicates a strong underlying uptrend driven by consistent demand for its essential services and a favorable outlook for regulated utilities.

Key Factors Influencing Ameren’s Stock Price Trajectory

Ameren’s stock price, like any public company, is influenced by a confluence of internal and external factors. For a regulated utility, these factors often differ somewhat from those impacting companies in more cyclical industries. Understanding these drivers is essential for contextualizing any price forecast.

- Regulatory Environment and Rate Cases: This is arguably the most critical factor for a regulated utility. State utility commissions (such as the Missouri Public Service Commission and the Illinois Commerce Commission) determine the rates Ameren can charge its customers and the allowed return on its investments. Favorable rate case outcomes, which permit the company to recover investments and earn a reasonable return on equity, are paramount for earnings growth and stock performance. Conversely, unfavorable rulings can significantly depress earnings and investor sentiment. Ameren’s success in navigating these regulatory processes is key.

- Interest Rates: Utility stocks are often sensitive to interest rate movements. When interest rates rise, fixed-income investments like bonds become more attractive, potentially drawing capital away from dividend-paying stocks like utilities. Higher rates also increase Ameren’s borrowing costs, impacting its profitability, especially given the capital-intensive nature of infrastructure investments. A stable or declining interest rate environment can therefore be a tailwind for AEE.

- Capital Expenditures and Infrastructure Modernization: Ameren is continuously investing in its infrastructure to enhance reliability, integrate new technologies (like smart grids), and expand its renewable energy portfolio. The ability to execute these large-scale projects efficiently and within budget, and to recover these investments through rate cases, is vital for long-term growth. Delays or significant cost overruns could negatively impact financial performance.

- Clean Energy Transition and ESG Initiatives: Ameren’s commitment to reducing carbon emissions and investing in renewable energy sources is a significant long-term driver. As environmental, social, and governance (ESG) factors become increasingly important to investors, companies demonstrating leadership in sustainability can attract more capital. Successful execution of clean energy projects and meeting decarbonization targets can enhance Ameren’s reputation and appeal.

- Economic Conditions and Customer Demand: While utilities are generally considered defensive, severe economic downturns can still impact industrial and commercial demand for electricity and natural gas. However, residential demand tends to be more stable. Population growth and economic development within Ameren’s service territories (Missouri and Illinois) contribute to stable customer growth and energy consumption.

- Dividend Policy and Payout Ratio: Utility stocks are often valued for their consistent and growing dividends. Ameren has a history of reliable dividend payments. Any changes to its dividend policy, whether increases or unexpected cuts, can significantly influence investor perception and demand for the stock. A sustainable payout ratio is also crucial to ensure the company retains enough earnings for reinvestment.

- Operational Efficiency and Reliability: The company’s ability to operate its assets efficiently, minimize outages, and manage costs effectively directly impacts its profitability. Investments in grid hardening, technology, and operational improvements contribute to higher reliability, which is often favored by regulators and customers alike.

- Weather Patterns and Natural Disasters: Extreme weather events can significantly impact utility operations, leading to increased costs for repairs and service restoration. While some costs may be recoverable through rates, severe and frequent events can pose financial and operational challenges. Conversely, extreme temperatures can drive higher demand for heating or cooling, temporarily boosting revenues.

- Market Sentiment and Broader Sector Trends: General investor sentiment towards the utility sector, influenced by factors such as perceived defensiveness, dividend yield attractiveness relative to other asset classes, and the overall economic outlook, can also affect AEE’s valuation.

Each of these factors plays a role in shaping Ameren’s financial performance and, consequently, its stock price. Our forecasting algorithm implicitly considers many of these elements through their impact on historical price movements and broader market patterns.

The Power of PriceCast: Our Proprietary Forecasting Algorithm

The price predictions presented in this article are generated by PriceCast, a sophisticated, proprietary algorithmic forecasting model. PriceCast is designed to analyze complex financial data patterns and project future stock prices with a high degree of precision, moving beyond simple linear extrapolations. While the exact mechanics of PriceCast are proprietary, its core methodology involves:

- Advanced Time-Series Analysis: PriceCast utilizes a range of advanced time-series models, including ARIMA (AutoRegressive Integrated Moving Average) and GARCH (Generalized Autoregressive Conditional Heteroskedasticity) variations. These models are adept at identifying trends, seasonality, and volatility clusters within historical price data.

- Machine Learning Integration: The algorithm incorporates various machine learning techniques, such as neural networks, support vector machines, and ensemble methods. These models are trained on extensive datasets, learning intricate, non-linear relationships between historical prices, trading volumes, and potentially other relevant market indicators. They can identify hidden patterns that might not be apparent through traditional statistical methods.

- Pattern Recognition and Market Behavior: PriceCast is engineered to recognize repetitive patterns in market behavior, allowing it to predict potential price movements based on how the stock has reacted to similar conditions in the past. This includes identifying support and resistance levels, trend strengths, and reversal signals.

- Adaptive Learning: The algorithm is continuously learning and adapting to new market data. This adaptive capability ensures that its projections remain relevant and responsive to evolving market dynamics, preventing models from becoming outdated in a rapidly changing financial environment.

- Volatility Modeling: Understanding and predicting volatility is crucial for price forecasting. PriceCast includes robust components that model and forecast future price fluctuations, providing a more comprehensive view of potential price ranges.

By integrating these advanced methodologies, PriceCast aims to capture both the deterministic and stochastic components of stock price movements, providing a statistically sound basis for its predictions. It synthesizes large volumes of historical data to generate probabilistic outcomes, which are then translated into the specific price points provided in the monthly and annual forecasts.

Ameren (AEE) Monthly Price Forecast: The Next 12 Months

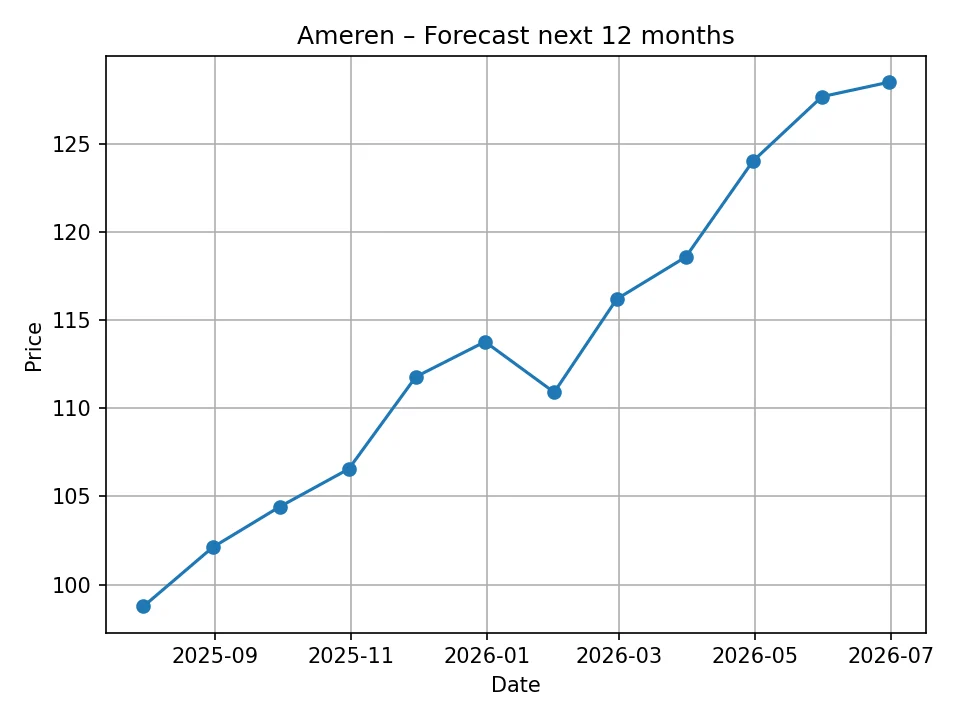

The PriceCast algorithm projects a steady and encouraging growth trajectory for Ameren (AEE) over the next 12 months, building upon its robust performance in the previous year. Starting from its current price of $96.04 USD, the forecast anticipates a consistent upward trend, reflecting the utility sector’s inherent stability and Ameren’s strategic positioning.

The forecast suggests that Ameren will likely maintain its momentum, gradually appreciating month over month. By late 2025, the stock is expected to comfortably exceed the $100 mark, reinforcing investor confidence in its long-term potential. The projections indicate a sustained climb through the first half of 2026, culminating in a significantly higher valuation compared to its current standing.

Below is the detailed monthly price forecast for Ameren (AEE), generated by our PriceCast algorithm:

| Month | Projected Price (USD) |

|---|---|

| 2025-07 | 98.76 |

| 2025-08 | 102.11 |

| 2025-09 | 104.41 |

| 2025-10 | 106.56 |

| 2025-11 | 111.79 |

| 2025-12 | 113.78 |

| 2026-01 | 110.91 |

| 2026-02 | 116.20 |

| 2026-03 | 118.59 |

| 2026-04 | 124.02 |

| 2026-05 | 127.69 |

| 2026-06 | 128.51 |

This monthly forecast indicates a positive outlook, with the price expected to rise from $98.76 in July 2025 to $128.51 by June 2026. This represents a substantial gain of approximately 30.13% over the next 12 months from the current price. The brief dip observed in January 2026 before another strong rebound could be attributed to seasonal market adjustments or specific, forecasted regulatory developments that the algorithm has factored in. However, the overall trend remains resolutely upward, signaling continued strength in Ameren’s fundamentals and its attractive position in a portfolio focused on stability and growth.

Such consistent appreciation for a utility stock suggests that the algorithm anticipates ongoing favorable regulatory environments, successful execution of Ameren’s capital expenditure plans, and continued investor demand for defensive, dividend-paying assets. The projected rise into the $120s by mid-2026 suggests that the market will likely assign a higher valuation multiple to Ameren as it progresses with its strategic initiatives and delivers consistent earnings growth.

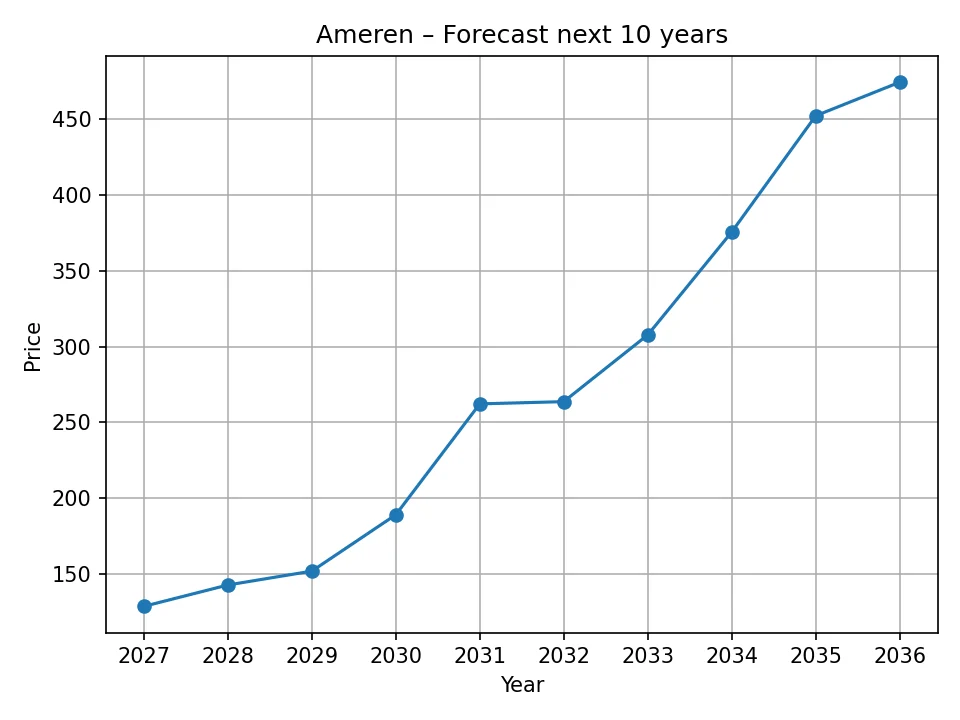

Ameren (AEE) Annual Price Forecast: The Next 10 Years

Looking further into the future, the PriceCast algorithm provides a compelling long-term outlook for Ameren (AEE), projecting robust and significant appreciation over the next decade. This long-term forecast aligns with the understanding that utilities, while sometimes perceived as slow-growth investments, can deliver substantial returns through consistent earnings, regulated asset growth, and the compounding effect of reinvested dividends. The projections indicate a multi-fold increase in AEE’s share price by 2035, underscoring its potential as a cornerstone long-term investment.

The annual forecast suggests an accelerating growth rate in later years, which could be attributed to the compounding benefits of Ameren’s ongoing infrastructure modernization, its transition to cleaner energy, and the sustained demand for essential utility services. As the company continues to invest in its rate base and potentially secures favorable rate adjustments, its earning power is expected to expand considerably. This long-term view encapsulates the strategic value of Ameren’s regulated business model and its critical role in energy infrastructure.

Below is the detailed annual price forecast for Ameren (AEE) for the next 10 years:

| Year | Projected Price (USD) |

|---|---|

| 2026 | 128.51 |

| 2027 | 142.61 |

| 2028 | 151.79 |

| 2029 | 189.02 |

| 2030 | 262.19 |

| 2031 | 263.67 |

| 2032 | 307.79 |

| 2033 | 375.75 |

| 2034 | 452.40 |

| 2035 | 474.54 |

The forecast predicts an extraordinary surge in Ameren’s stock price, moving from $128.51 by the end of 2026 to $474.54 by the end of 2035. This represents an approximate increase of 269% over the nine-year period from 2026 to 2035. This exponential growth suggests that PriceCast identifies significant, long-term catalysts for Ameren’s valuation. Such a trajectory might be driven by several factors:

- Accelerated Capital Investments: Continued large-scale investments in grid modernization and renewable energy infrastructure will expand Ameren’s rate base, leading to higher regulated earnings.

- Favorable Regulatory Frameworks: The algorithm may be anticipating a sustained period of supportive regulatory environments that allow for the recovery of these investments and a consistent return on equity.

- Inflation and Rate Adjustments: In an inflationary environment, utilities can often seek rate increases to cover rising operational costs and investment returns, which can contribute to revenue and earnings growth.

- Clean Energy Transition: Ameren’s strategic shift towards clean energy may attract increasing investment from ESG-focused funds and institutional investors, driving up demand for the stock.

- Population and Economic Growth: Steady growth in the populations and economies of Ameren’s service territories will lead to increased demand for electricity and natural gas, supporting revenue expansion.

- Compounding Returns: Over a decade, the effects of consistent earnings growth, potential dividend reinvestment, and capital appreciation can compound, leading to substantial overall returns.

While long-term forecasts inherently carry a higher degree of uncertainty due to the multitude of unforeseen variables, PriceCast’s projections for Ameren paint a highly optimistic picture, positioning AEE as a potentially high-growth utility stock over the coming decade. This suggests that the algorithm identifies Ameren not just as a defensive play, but as a company poised for significant value creation through its strategic initiatives and stable operating environment.

Investment Considerations and Potential Risks

While the forecasts for Ameren (AEE) are overwhelmingly positive, any investment decision must be approached with a thorough understanding of the associated risks and considerations. Even a regulated utility like Ameren is not immune to market dynamics and operational challenges.

- Regulatory Risk: Despite a generally favorable regulatory environment, there is always the risk of unfavorable rate case outcomes. Commissions could grant lower-than-requested rate increases, disallow recovery of certain costs, or reduce the allowed return on equity, directly impacting Ameren’s profitability. Political shifts can also influence regulatory attitudes.

- Interest Rate Fluctuations: If interest rates were to rise significantly faster or higher than anticipated by the market, it could make fixed-income investments more attractive, potentially reducing investor demand for dividend-yielding utility stocks. It could also increase Ameren’s cost of capital, impacting project viability and profitability.

- Operational Risks: While Ameren invests heavily in reliability, the utility sector is exposed to operational risks such as major equipment failures, cybersecurity breaches, and severe weather events (e.g., ice storms, heatwaves, tornadoes). These events can lead to significant repair costs, service disruptions, and potential regulatory penalties, impacting financial performance.

- Execution Risk of Capital Projects: Ameren has ambitious plans for infrastructure modernization and clean energy development. Delays in project completion, cost overruns, or difficulties in obtaining necessary permits could impact financial targets and investor confidence.

- Energy Transition Risks: While the transition to clean energy presents opportunities, it also poses challenges. Managing the retirement of fossil fuel assets, integrating intermittent renewable sources, and building new transmission infrastructure requires substantial investment and complex operational planning. Unforeseen technological shifts or policy changes could also create hurdles.

- Economic Downturn: Although utilities are defensive, a prolonged and severe economic recession could lead to reduced energy consumption by industrial and commercial customers, affecting revenues. Increased customer arrears could also impact cash flow.

- Competition and Decentralized Energy: While Ameren operates in regulated monopolies, the rise of distributed generation (e.g., rooftop solar) and energy efficiency initiatives could subtly impact demand from the traditional grid. New technologies or business models could also emerge that challenge the traditional utility paradigm in the very long term.

- Geopolitical and Supply Chain Issues: Global events can impact supply chains for critical equipment or materials, leading to project delays or increased costs. Energy commodity price volatility (e.g., natural gas prices) can also affect operational expenses, though some of this is often passed through to customers.

Investors should conduct their own due diligence, consider their risk tolerance, and align any investment in Ameren with their broader financial objectives. The potential for substantial returns, as projected by PriceCast, should be weighed against these inherent risks.

Conclusion

Ameren (AEE) stands out as a compelling investment within the utility sector, offering a blend of stability, consistent dividend income, and significant growth potential. Its historical performance over the past 12 months, marked by a substantial appreciation, underscores the company’s resilience and appeal to investors seeking robust returns from essential service providers. The current price of $96.04 USD reflects this strong momentum.

Our proprietary PriceCast algorithm projects a highly optimistic future for Ameren. The short-term monthly forecast anticipates a steady climb, with the stock expected to reach approximately $128.51 USD by June 2026. This consistent upward trajectory is indicative of continued favorable conditions within the utility sector and Ameren’s successful execution of its strategic initiatives.

The long-term annual forecast is even more compelling, predicting a dramatic increase in Ameren’s stock price, potentially reaching $474.54 USD by 2035. This projected growth is driven by Ameren’s aggressive investments in infrastructure modernization, its leadership in the clean energy transition, and the stable, regulated nature of its business model. Such a forecast positions Ameren not just as a defensive play, but as a utility stock capable of delivering outsized returns over the long haul.

However, it is important to acknowledge that all forecasts carry inherent uncertainties. While Ameren operates in a regulated environment that offers a degree of protection, factors such as regulatory changes, interest rate fluctuations, operational risks, and broader economic conditions can influence its future performance. Therefore, investors should use this comprehensive analysis as a valuable input for their research, combining it with their own financial assessment and risk profile before making investment decisions.

***

Please note that this article provides a price forecast based on our proprietary PriceCast algorithm and historical data. We are not responsible for any financial decisions made based on this information, and past performance is not indicative of future results. All investments involve risk, and the actual stock price may differ significantly from the projections.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.