BlackRock, a global investment management powerhouse, stands as a titan in the financial industry. As of June 3, 2025, its stock trades at a price of 978.07 USD, reflecting its significant influence and consistent performance in an ever-evolving market landscape. This comprehensive analysis delves into BlackRock’s recent stock performance, examines the critical factors that shape its valuation, and presents a detailed price forecast extending over the next decade, offering insights for investors and market enthusiasts alike.

Understanding BlackRock: A Financial Behemoth

BlackRock, Inc. (BLK) is the world’s largest asset manager, overseeing trillions of dollars in assets on behalf of institutions, governments, and individual investors. Its unparalleled reach and diversified offerings, which include active and passive investment strategies across equities, fixed income, cash management, and alternatives, underpin its robust market position. The company’s iShares exchange-traded funds (ETFs) dominate the passive investing space, while its proprietary Aladdin risk management technology platform is an industry standard, utilized by many of the world’s leading financial institutions. BlackRock’s commitment to sustainable investing and its proactive stance on environmental, social, and governance (ESG) factors further solidify its leadership, appealing to a growing segment of investors prioritizing responsible capital allocation. This broad and deep operational footprint positions BlackRock as a core holding for many institutional portfolios and a bellwether for the broader financial sector.

BlackRock’s Historical Stock Performance: A Year in Review

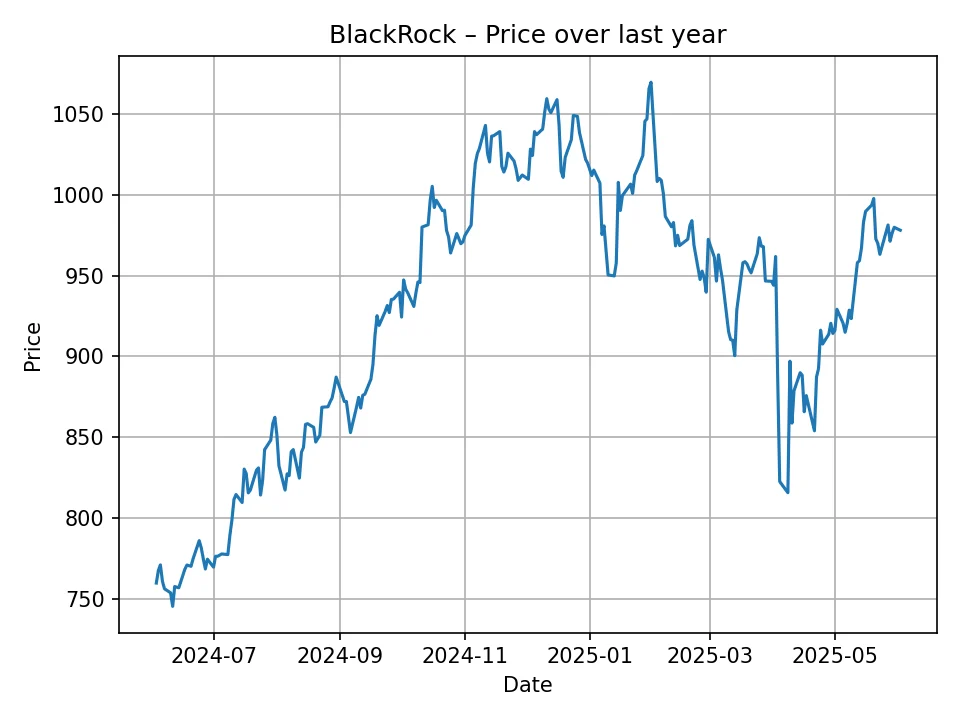

Examining BlackRock’s stock performance over the past 12 months provides crucial context for its current valuation and future trajectory. Starting from a price of approximately 759.80 USD, the stock has demonstrated a notable upward trend, albeit with periods of volatility.

Throughout the second half of 2024, BlackRock experienced steady appreciation, moving from the mid-700s to the low 800s. This period was likely supported by broader market stability and continued inflows into investment products. As 2024 progressed into the early months of 2025, the stock witnessed significant momentum, peaking at around 1069.66 USD. This impressive rally can be attributed to strong equity market performance globally, robust asset inflows, and perhaps positive sentiment surrounding BlackRock’s earnings reports and strategic initiatives.

Following this peak, the stock experienced a natural correction or consolidation phase, pulling back somewhat before stabilizing closer to its current price of 978.07 USD. Despite this pullback from its absolute highs, the overall trajectory over the last year remains definitively positive, indicating healthy growth and investor confidence. The journey from the 750s to nearly 980 USD represents a significant gain, reinforcing BlackRock’s resilience and its ability to capture value in varying market conditions. This historical data highlights a company capable of delivering substantial returns, underpinned by its fundamental strengths and market leadership.

Key Factors Influencing BlackRock’s Stock Price

Several critical factors drive BlackRock’s valuation and will continue to shape its stock price performance in the coming years. Understanding these elements is essential for a comprehensive price forecast.

Assets Under Management (AUM) Growth

BlackRock’s primary revenue driver is its Assets Under Management. Fees generated from AUM directly impact the company’s profitability. Factors influencing AUM include:

* Market Appreciation: A rising stock market directly increases the value of assets BlackRock manages.

* Net Inflows: The continuous influx of new client money into BlackRock’s funds and ETFs.

* Product Innovation: The ability to launch new, attractive investment products, particularly in high-growth areas like alternatives and sustainable investing.

Global Economic Conditions

The health of the global economy significantly impacts investor confidence and asset allocation. A strong global economy, characterized by stable growth and low inflation, tends to encourage investment, leading to higher AUM and better financial performance for BlackRock. Conversely, economic downturns or recessions can lead to asset depreciation and client redemptions, negatively affecting the stock price.

Interest Rate Environment

Changes in interest rates, particularly by major central banks, can influence BlackRock’s fixed income businesses and the overall appeal of different asset classes. Higher rates can make cash and bonds more attractive, potentially diverting some capital from equities, but also offering opportunities for higher yields in certain fixed-income strategies. BlackRock’s diverse portfolio allows it to adapt to varying rate environments.

Regulatory Landscape

The financial industry is heavily regulated. Changes in regulations related to asset management fees, investment products, or capital requirements could impact BlackRock’s operational costs and profitability. However, BlackRock’s size and expertise often position it well to navigate complex regulatory frameworks.

Technological Advancement and Digitalization

BlackRock’s significant investment in technology, particularly its Aladdin platform, provides a competitive edge. Continued innovation in areas like AI, data analytics, and digital client interfaces can enhance efficiency, improve risk management, and attract new clients, contributing positively to the stock’s long-term outlook.

Competitive Landscape

While BlackRock is the largest player, it operates in a highly competitive industry with numerous asset managers, boutique firms, and rising fintech competitors. The ability to maintain competitive fees, offer superior performance, and adapt to evolving client demands is crucial for sustaining its market share and growth.

Sustainable Investing (ESG) Momentum

BlackRock has positioned itself as a leader in ESG investing. As demand for sustainable solutions grows, BlackRock’s expertise and comprehensive product offerings in this area are expected to drive significant AUM inflows, bolstering its long-term growth prospects.

EdgePredict Algorithm: A Data-Driven Approach to Forecasting

The price forecasts presented in this article are generated by EdgePredict, a proprietary algorithm designed to analyze complex financial data and identify future trends. This advanced algorithm leverages historical price movements, trading volumes, broader market indicators, and macroeconomic factors to construct robust predictive models. By identifying intricate patterns and correlations that might escape conventional analysis, EdgePredict aims to provide data-driven insights into potential price trajectories. It is a sophisticated tool built on extensive data processing capabilities, offering a quantitative perspective on future market behavior.

BlackRock (BLK) Price Prediction: The Next 12 Months (2025-2026)

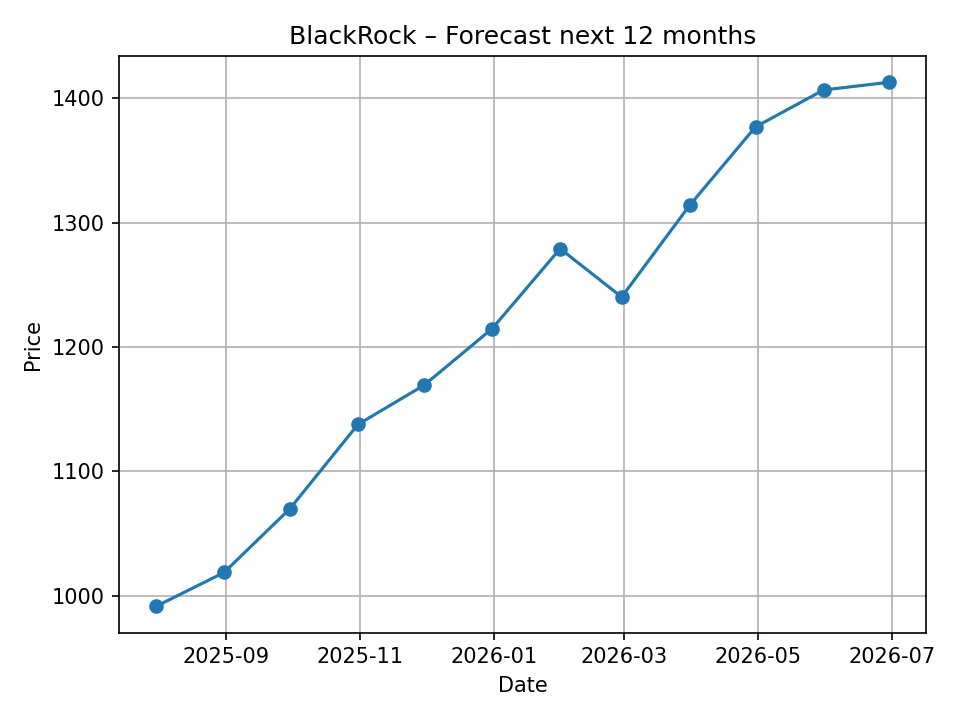

Looking ahead, the EdgePredict algorithm anticipates continued upward momentum for BlackRock’s stock over the next year. The monthly forecast projects a steady, robust appreciation, indicative of strong underlying business fundamentals and favorable market conditions.

Here is the detailed monthly price forecast for BlackRock, generated by the EdgePredict algorithm:

| Month/Year | Projected Price (USD) |

|---|---|

| July 2025 | 991.50 |

| August 2025 | 1018.75 |

| September 2025 | 1070.05 |

| October 2025 | 1137.85 |

| November 2025 | 1169.31 |

| December 2025 | 1214.79 |

| January 2026 | 1279.15 |

| February 2026 | 1240.29 |

| March 2026 | 1314.00 |

| April 2026 | 1377.10 |

| May 2026 | 1406.77 |

| June 2026 | 1413.02 |

The forecast suggests BlackRock could cross the significant 1000 USD mark by August 2025 and continue its ascent, potentially reaching over 1200 USD by the end of 2025. The projection shows a particularly strong surge in late 2025 and early 2026, with an estimated price of 1413.02 USD by June 2026. A minor dip is observed in February 2026, a common occurrence in price movements, but the overall trend remains firmly positive, highlighting the algorithm’s expectation of sustained growth for the asset manager. This short-to-medium term outlook reflects confidence in BlackRock’s ability to attract and manage assets effectively, capitalizing on market opportunities.

BlackRock (BLK) Price Prediction: The Next Decade (2026-2035)

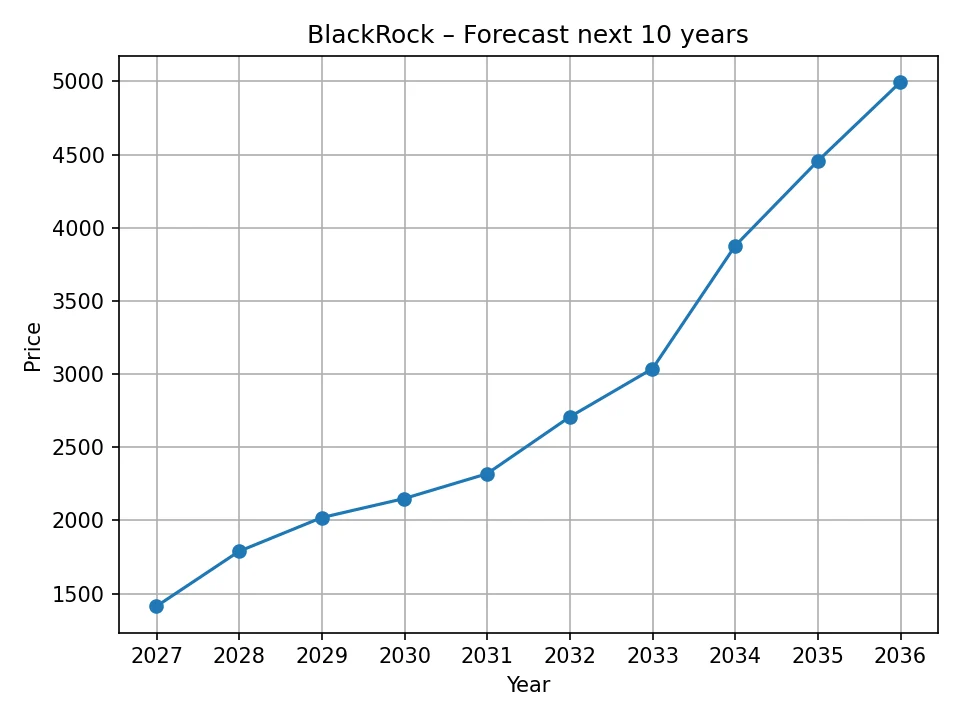

Extending the forecast further, the EdgePredict algorithm paints an even more compelling picture for BlackRock’s long-term valuation. The annual projections indicate substantial and consistent growth throughout the next decade, suggesting that BlackRock’s dominant market position and strategic initiatives will continue to yield significant returns for shareholders.

Here is the detailed annual price forecast for BlackRock, generated by the EdgePredict algorithm:

| Year | Projected Price (USD) |

|---|---|

| 2026 | 1413.02 |

| 2027 | 1788.93 |

| 2028 | 2019.78 |

| 2029 | 2150.17 |

| 2030 | 2319.27 |

| 2031 | 2707.16 |

| 2032 | 3037.03 |

| 2033 | 3876.18 |

| 2034 | 4455.73 |

| 2035 | 4994.98 |

The long-term forecast suggests that BlackRock could more than double its current value by 2030, potentially reaching over 2300 USD, and approach the remarkable milestone of 5000 USD by 2035. This signifies an annualized growth rate that underscores the algorithm’s profound confidence in BlackRock’s future. Such an optimistic outlook is likely predicated on continued global wealth creation, the increasing prevalence of passive investing through ETFs, the further penetration of Aladdin across the financial ecosystem, and BlackRock’s continued leadership in high-growth areas like sustainable investing. The projections imply that BlackRock is poised for sustained growth, leveraging its scale, innovation, and strategic vision to consolidate its leadership in the global asset management industry.

Catalysts for Future Growth

Several factors are expected to act as key catalysts for BlackRock’s continued growth in the coming years. The ongoing shift towards passive investing, where BlackRock’s iShares ETFs hold a dominant market share, is a powerful tailwind. The global expansion of financial markets, particularly in emerging economies, will also contribute to increased Assets Under Management. Furthermore, BlackRock’s deep commitment to technological innovation, exemplified by its Aladdin platform, not only streamlines its operations but also acts as a valuable service for other financial institutions, creating a strong ecosystem effect. The increasing demand for sustainable and ESG-focused investments, where BlackRock has consistently been a proactive leader, presents another significant growth avenue. Lastly, its ability to diversify revenue streams beyond traditional asset management, exploring areas like technology licensing and alternative investments, will further bolster its financial performance.

Potential Risks and Challenges

While the outlook for BlackRock appears robust, it is important to acknowledge potential risks and challenges. A significant global economic downturn or a prolonged bear market could lead to a decrease in AUM due to asset depreciation and client withdrawals, directly impacting revenues. Increased regulatory scrutiny on fees, investment products, or market concentration could also impose new compliance burdens or limit profitability. The highly competitive landscape means BlackRock must continuously innovate and maintain competitive pricing to retain and attract clients. Furthermore, the rapid pace of technological change and the emergence of disruptive fintech companies could pose challenges if BlackRock fails to adapt quickly. Geopolitical instability and unforeseen market shocks also represent inherent risks to any global financial institution. Investors should consider these factors carefully alongside the optimistic projections.

Conclusion

BlackRock stands as an undisputed leader in the global asset management industry, characterized by its immense scale, diverse product offerings, and technological prowess. As of June 3, 2025, with its stock price at 978.07 USD, the company has demonstrated impressive resilience and growth over the past year. The EdgePredict algorithm’s forecasts suggest a continuation of this upward trajectory, projecting significant appreciation over the next 12 months and a substantial climb over the next decade, potentially reaching nearly 5000 USD by 2035. This optimistic outlook is underpinned by BlackRock’s strong fundamentals, its leadership in key growth areas like ETFs and ESG investing, and its strategic technological investments. While potential risks such as market downturns or regulatory changes exist, BlackRock’s robust market position and adaptability suggest a strong long-term future.

Disclaimer: This article and the price predictions contained within are based on an analysis utilizing a proprietary algorithm, EdgePredict, and are provided for informational purposes only. We are not financial advisors, and this content should not be construed as investment advice. The financial markets are inherently volatile, and actual results may differ significantly from any forecasts or predictions. Investing in stocks involves risks, including the potential loss of principal. We are not responsible for any investment decisions made based on the information presented herein. Always conduct your own thorough research and consult with a qualified financial professional before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.