Builders FirstSource (BLDR) stands as a pivotal entity in the American construction supply chain, playing an indispensable role in providing building materials, manufactured components, and value-added services to professional homebuilders, subcontractors, remodelers, and consumers. As of June 10, 2025, with the latest available historical data point indicating a price of approximately $112.96, investors and market observers are keen to understand the potential trajectory of this industry leader. The company’s performance is intrinsically linked to the broader health of the U.S. housing market and construction sector, making its stock a bellwether for residential and commercial building activity. This comprehensive analysis delves into Builders FirstSource’s historical performance, identifies key influencing factors, and leverages an advanced algorithmic forecast to project its price movements over the short and long term.

Understanding Builders FirstSource (BLDR)

Builders FirstSource has grown to become one of the largest suppliers of building materials in the United States, offering a comprehensive range of products and services. From lumber and trusses to doors, windows, and other millwork, the company is a one-stop shop for construction professionals. Its integrated model allows it to offer a wide array of solutions, including components like prefabricated walls and roof trusses, which can significantly reduce on-site construction time and labor costs. This strategic approach provides a competitive edge, especially in a market increasingly focused on efficiency and cost-effectiveness.

The company’s strategic acquisitions and organic growth initiatives have solidified its market position. By expanding its geographic footprint and diversifying its product offerings, Builders FirstSource aims to capture a larger share of the fragmented building materials market. Its success is heavily reliant on factors such as housing starts, repair and remodeling activity, and overall economic stability. Given the current economic climate, marked by fluctuating interest rates and evolving housing demand, understanding the intricate dynamics that influence BLDR’s stock price is crucial for any potential investor or market participant.

Historical Performance Analysis: A Look Back at the Last 12 Months

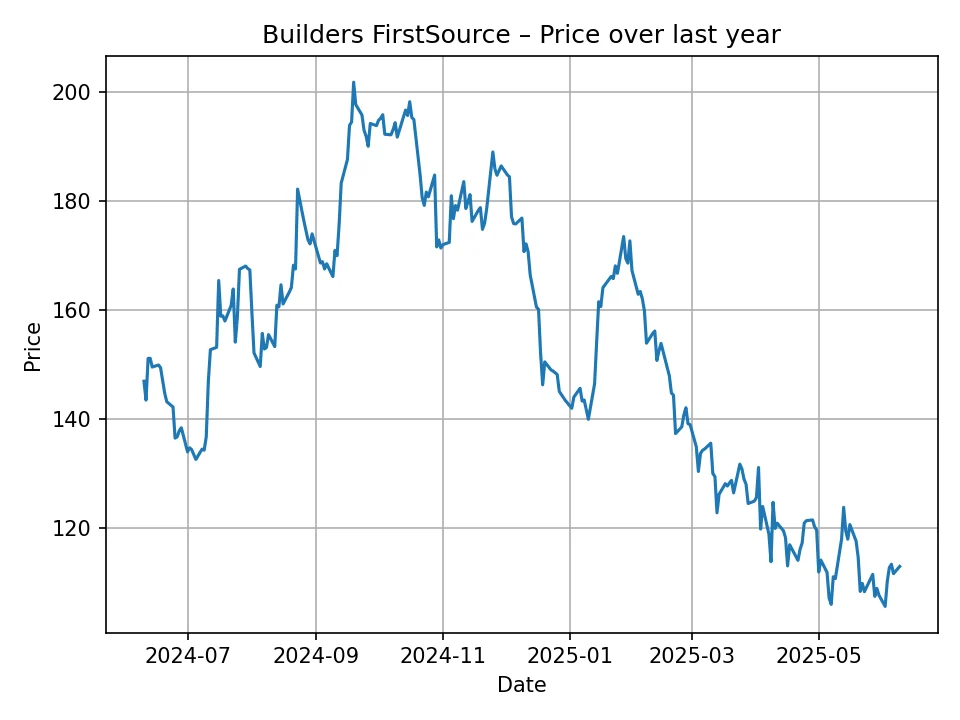

Analyzing the historical price data for Builders FirstSource over the past 12 months provides critical context for understanding its current valuation and potential future movements. The daily historical data reveals a period of considerable volatility, reflecting the dynamic nature of the construction sector and the broader economy.

Over the last year, BLDR’s stock has traded within a significant range. The lowest recorded price during this period was approximately $105.63 USD, while the peak reached an impressive $201.83 USD. This wide range indicates that investors have responded to various market signals, including economic data, housing market trends, and company-specific news. On average, the stock traded around $154.64 USD over the past year.

The journey from its lowest point to its peak, and subsequently to its latest closing price of approximately $112.96 USD, illustrates the challenges and opportunities faced by the company. Early in the period, the stock showed strong upward momentum, driven perhaps by robust housing demand, stable interest rates, or effective operational strategies. However, the latter part of the 12-month period appears to show a retracement from those highs, bringing the price closer to the lower end of its annual range. This could be attributed to a confluence of factors, such as rising interest rates dampening housing affordability, concerns about a potential economic slowdown, or shifts in material costs impacting profitability.

The decline from its 52-week high suggests that market sentiment has turned more cautious regarding the construction sector. Investors might be factoring in potential headwinds like sustained high mortgage rates, which could cool down new home construction, or a slowdown in repair and remodel projects as consumer discretionary spending tightens. Despite these challenges, the company’s fundamental strength, including its extensive distribution network and diversified product portfolio, provides a foundation for resilience. The current price level, while lower than its peak, might represent a more normalized valuation given prevailing market conditions.

Key Factors Influencing BLDR Stock Price

The valuation and future trajectory of Builders FirstSource stock are subject to a multitude of interconnected factors. Understanding these drivers is essential for a holistic price prediction.

Housing Market Dynamics

The health of the U.S. housing market is paramount to BLDR’s performance.

* Interest Rates and Mortgage Rates: Higher interest rates directly translate to higher mortgage rates, increasing the cost of homeownership and potentially dampening demand for new homes. This can lead to a slowdown in housing starts and completions, directly impacting BLDR’s sales volumes. Conversely, falling rates can stimulate demand.

* Housing Starts and Permits: The number of new residential construction projects initiated (housing starts) and approved (building permits) are direct indicators of future demand for BLDR’s products. A robust pipeline of new construction is critical.

* Existing Home Sales: While BLDR primarily serves new construction, a healthy existing home market can indirectly support demand for renovation materials as new homeowners customize their properties.

* Affordability: Rising home prices coupled with high mortgage rates can make homeownership unattainable for many, reducing the pool of potential buyers and slowing housing market activity.

* Demographic Shifts: The aging of the millennial generation into prime homebuying years, combined with shifting preferences for suburban living and the need for more space, could drive long-term housing demand. The Baby Boomer generation’s desire to age in place also fuels repair and remodeling demand.

Overall Construction Spending

Beyond residential, non-residential construction and public infrastructure spending also play a role.

* Commercial Construction: While a smaller segment for BLDR, growth in commercial projects (e.g., offices, retail, industrial facilities) can contribute to overall demand for building materials.

* Infrastructure Projects: Government initiatives related to infrastructure development (roads, bridges, utilities) can drive demand for certain materials, although BLDR’s direct exposure might be limited compared to pure infrastructure companies.

* Repair and Remodeling: A significant portion of BLDR’s business comes from the repair and remodeling sector. Consumer confidence, disposable income, and home equity levels influence this segment.

Building Material Costs and Supply Chain

BLDR operates within a dynamic supply chain, making material costs a crucial factor.

* Lumber Prices: As a major distributor of lumber, fluctuations in timber prices directly impact BLDR’s cost of goods sold and, consequently, its profit margins. Volatility can stem from supply disruptions, natural disasters, or changes in demand.

* Other Raw Materials: Prices of steel, gypsum, insulation, and other commodities used in construction also affect BLDR’s profitability.

* Supply Chain Stability: Disruptions in the global supply chain, such as those experienced during the pandemic, can lead to material shortages, increased lead times, and higher transportation costs, all of which can impede BLDR’s operations and financial performance.

Broader Economic Outlook

The macroeconomic environment sets the stage for the construction industry.

* GDP Growth: A strong economy generally correlates with higher consumer confidence and business investment, supporting both residential and commercial construction.

* Inflation: Persistent inflation can erode purchasing power for consumers and increase operational costs for businesses, potentially slowing down construction activity.

* Employment Levels: A healthy job market provides individuals with the financial stability to purchase homes and undertake renovation projects. Conversely, rising unemployment can stifle demand.

* Consumer Confidence: When consumers feel secure about their financial future, they are more likely to make significant investments like home purchases or renovations.

Company-Specific Factors

Internal strengths and strategic decisions are vital for BLDR’s long-term success.

* Acquisitions and Integration: BLDR has a history of strategic acquisitions. The successful integration of newly acquired businesses, realizing synergies, and expanding market reach can significantly boost revenue and profitability. Poor integration, however, can be a drag.

* Operational Efficiency: The ability to optimize logistics, manage inventory effectively, and control operating expenses can enhance profit margins, even in a challenging market.

* Financial Health: A strong balance sheet, manageable debt levels, and robust cash flow provide the company with the flexibility to invest in growth, withstand downturns, and potentially return capital to shareholders.

* Innovation and Technology Adoption: Investing in digital tools, prefabrication technologies, and other innovations can improve efficiency, reduce waste, and offer new value propositions to customers, setting BLDR apart from competitors.

* Management Quality: The experience and strategic vision of the leadership team are critical in navigating market complexities and driving long-term growth.

Competitive Landscape

Builders FirstSource operates in a competitive industry.

* Market Share: The company’s ability to gain or maintain market share against other national and regional distributors, as well as local lumberyards, is crucial.

* Pricing Power: Intense competition can limit BLDR’s ability to pass on higher costs to customers, impacting profitability.

Regulatory and Environmental Factors

- Building Codes: Changes in local or national building codes (e.g., requiring more energy-efficient materials) can affect demand for certain products and require adjustments in BLDR’s offerings.

- Environmental Regulations: Regulations related to sustainable forestry, waste management, or carbon emissions could impact sourcing, production, and operational costs.

Technological Advancements

- Prefabrication and Off-site Construction: The increasing adoption of prefabricated components and off-site construction methods, a core offering of BLDR, presents a significant growth opportunity by improving construction speed and reducing on-site labor needs.

- Digitalization: Leveraging digital platforms for order management, supply chain optimization, and customer engagement can enhance efficiency and customer satisfaction.

Understanding Price Prediction Methodologies: The ClearSight Approach

Forecasting stock prices is an inherently complex endeavor, influenced by countless variables. Traditional methods typically fall into two broad categories: fundamental analysis and technical analysis. Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, industry trends, and macroeconomic factors. Technical analysis, on the other hand, focuses on historical price and volume data to identify patterns and predict future movements.

However, modern financial forecasting increasingly relies on advanced quantitative models and machine learning algorithms. The price predictions for Builders FirstSource presented in this article are generated by the proprietary ClearSight algorithm. This algorithm is designed to process vast amounts of historical data, identify complex relationships and trends, and project future prices based on its learned patterns. While the specific inner workings of ClearSight are proprietary, its strength lies in its data-driven approach, seeking to identify subtle market dynamics that might not be immediately apparent through traditional analysis. It aims to provide an objective, statistically grounded outlook on potential price movements, serving as a valuable tool for market participants.

12-Month Price Forecast for Builders FirstSource (BLDR)

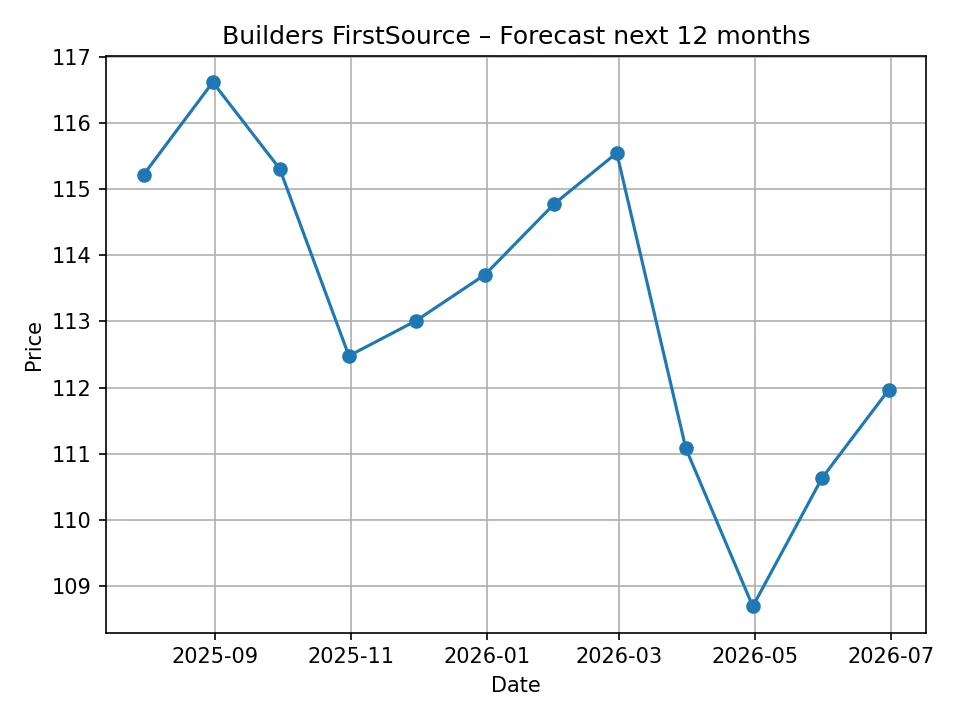

Based on the analysis performed by the ClearSight algorithm, the monthly price forecast for Builders FirstSource for the next 12 months, from July 2025 to June 2026, offers a detailed perspective on its near-term potential. The forecast suggests a period of relative stability with minor fluctuations, indicating a potential stabilization or slight recovery after the recent decline observed in the historical data.

Here is the detailed monthly forecast:

| Month-Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 115.22 |

| 2025-08 | 116.62 |

| 2025-09 | 115.31 |

| 2025-10 | 112.48 |

| 2025-11 | 113.01 |

| 2025-12 | 113.71 |

| 2026-01 | 114.78 |

| 2026-02 | 115.55 |

| 2026-03 | 111.08 |

| 2026-04 | 108.69 |

| 2026-05 | 110.63 |

| 2026-06 | 111.97 |

The forecast begins with a predicted price of $115.22 USD for July 2025, which is slightly above the last historical price of $112.96 USD. This initial uptick suggests a potential for a modest rebound or stabilization in the very short term. The subsequent months show a gentle upward trend, reaching $116.62 USD in August 2025, before a slight dip in September and October 2025. This short-term oscillation might reflect seasonal construction patterns, where activity can slow down in late autumn.

As the forecast moves into the winter months (November-December 2025) and early spring (January-February 2026), the prices are predicted to remain relatively stable, hovering around the $113-$116 USD range. This stability could indicate that the algorithm anticipates a period of consolidation for BLDR’s stock, possibly reflecting a balanced view on the housing market, where continued demand is tempered by economic uncertainties like interest rates.

A noticeable dip is projected for March and April 2026, with prices reaching lows of $111.08 USD and $108.69 USD, respectively. This period might coincide with renewed concerns about economic conditions, or a seasonal lull that persists longer than usual, or perhaps a delayed impact of previous market factors. However, the forecast suggests a recovery in May and June 2026, ending the 12-month period at $111.97 USD. This concluding price is quite close to the current price, implying that the ClearSight algorithm predicts a largely sideways movement over the next year, with the stock oscillating within a relatively narrow band. This suggests that while significant growth might not be imminent, a sharp, prolonged decline is also not the primary expectation. Investors should prepare for a period of consolidation and potential short-term tactical trading opportunities rather than sustained directional trends.

10-Year Price Forecast for Builders FirstSource (BLDR)

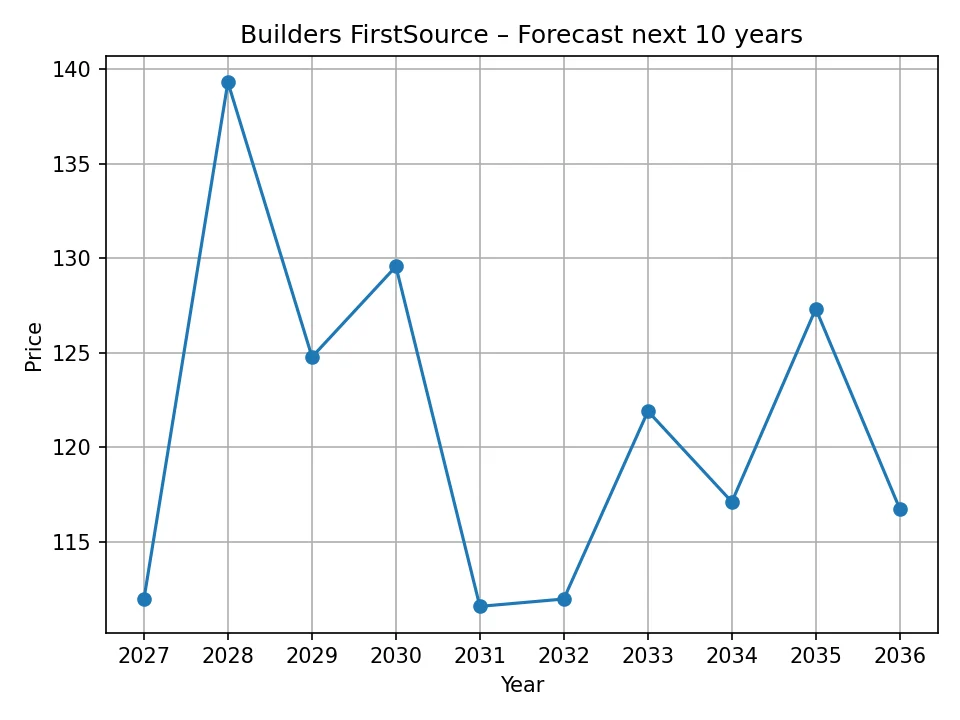

Looking further into the future, the ClearSight algorithm provides a 10-year annual price forecast for Builders FirstSource, extending from 2026 to 2035. This long-term outlook provides insights into the potential trajectory of the company’s valuation amidst evolving economic landscapes and industry dynamics.

Here is the detailed annual forecast:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 111.97 |

| 2027 | 139.32 |

| 2028 | 124.78 |

| 2029 | 129.57 |

| 2030 | 111.58 |

| 2031 | 111.97 |

| 2032 | 121.91 |

| 2033 | 117.11 |

| 2034 | 127.33 |

| 2035 | 116.75 |

The long-term forecast suggests a non-linear but generally stable to slightly upward trend with significant fluctuations. Starting from $111.97 USD in 2026 (the end of the 12-month forecast period), the algorithm projects a substantial increase to $139.32 USD in 2027. This sharp rise could be indicative of the algorithm anticipating a strong recovery in the housing market or a period of accelerated growth for Builders FirstSource, possibly driven by favorable demographic trends, declining interest rates, or successful strategic initiatives.

However, this growth appears to be followed by a notable correction, with the price declining to $124.78 USD in 2028 and then modestly recovering to $129.57 USD in 2029. This pattern of a strong surge followed by a partial pullback is common in cyclical industries like construction, where periods of boom are often followed by consolidation or slight downturns.

A significant dip is predicted for 2030, with the price falling to $111.58 USD, a level almost identical to the 2026 forecast. This could suggest the algorithm foresees a potential recession or a significant slowdown in the construction sector around that time, possibly due to economic cycles or prolonged periods of high interest rates impacting demand. The price then stabilizes at $111.97 USD in 2031, mirroring the 2026 level, implying a base level of valuation that the stock tends to revert to after periods of volatility.

The latter half of the decade shows renewed, albeit moderate, growth. Prices are projected to climb to $121.91 USD in 2032 and $127.33 USD in 2034, with a slight dip in 2033 to $117.11 USD before settling at $116.75 USD in 2035. This longer-term recovery suggests that despite cyclical downturns, the underlying demand for building materials and the strategic positioning of Builders FirstSource might allow it to achieve gradual appreciation over the decade. The overall picture is one of resilience and cyclical growth, where periods of expansion are interspersed with corrections. The target price for 2035 at $116.75 USD indicates that while the stock might not see exponential growth from its current levels, it is expected to maintain its value and offer modest returns over the long haul, assuming the ClearSight algorithm’s patterns hold.

Risks and Opportunities for Builders FirstSource

Investing in any company, particularly one in a cyclical industry like construction, involves assessing both potential risks and opportunities. Builders FirstSource is no exception.

Key Risks

- Economic Downturn: A severe economic recession or a significant slowdown can drastically reduce demand for new housing and renovation projects, directly impacting BLDR’s revenues and profitability.

- Persistent High Interest Rates: If the Federal Reserve maintains higher interest rates for an extended period, mortgage rates will remain elevated, continuously eroding housing affordability and suppressing demand for new homes.

- Material Price Volatility: Sharp increases or unpredictable fluctuations in the prices of key building materials (e.g., lumber, steel) can squeeze profit margins if the company cannot pass on these costs to customers.

- Labor Shortages: The construction industry often faces skilled labor shortages. If this issue intensifies, it can hinder construction project completion, leading to project delays and reduced demand for materials.

- Intense Competition: The building materials supply industry is fragmented and competitive. Aggressive pricing or expansion by rivals could pressure BLDR’s market share and profitability.

- Supply Chain Disruptions: Geopolitical events, natural disasters, or global logistical challenges can disrupt the supply chain, leading to material delays and higher operational costs.

- Regulatory Changes: New building codes, environmental regulations, or trade policies could introduce compliance costs or alter demand for specific materials.

Significant Opportunities

- Continued Housing Demand: Despite current headwinds, underlying demand for housing remains strong due to demographic trends (millennials forming households, migration patterns) and a persistent national housing shortage. This fundamental demand provides a long-term tailwind.

- Infrastructure Boom: Government-backed infrastructure spending initiatives could indirectly stimulate demand for construction materials, benefiting BLDR’s broader market.

- Technological Adoption and Prefabrication: BLDR’s emphasis on value-added services like prefabricated components aligns with the industry’s shift towards more efficient, less labor-intensive construction methods. This segment offers higher margins and growth potential.

- Strategic Acquisitions: The company’s history of successful acquisitions demonstrates its ability to consolidate the fragmented market, expand its geographic reach, and enhance its product portfolio, leading to market share gains and economies of scale.

- Operational Improvements: Continued focus on optimizing its supply chain, improving distribution efficiencies, and leveraging technology can lead to sustained margin expansion, even in challenging environments.

- Repair and Remodeling Market Resilience: The repair and remodeling segment tends to be more resilient during economic downturns than new construction, as homeowners opt to improve existing properties rather than move. BLDR’s strong presence in this area offers a stable revenue stream.

- Focus on Sustainability: As the construction industry moves towards more sustainable practices, BLDR’s ability to offer green building materials and solutions could open new market opportunities.

Conclusion

Builders FirstSource (BLDR) occupies a critical position within the U.S. construction industry, acting as a crucial link in the supply chain for new home construction and remodeling projects. Our analysis of the past 12 months reveals a stock that has experienced considerable volatility, reflecting the cyclical nature of the housing market and broader economic influences. The stock has retreated from its 52-week highs, indicating a cautious market sentiment in the lead-up to mid-2025.

Looking ahead, the ClearSight algorithm’s 12-month forecast suggests a period of relative stability, with prices oscillating within a narrow range around its current levels. While this indicates no immediate surge in value, it also implies a potential floor for the stock after its recent decline, suggesting a period of consolidation. The long-term 10-year forecast paints a picture of cyclical growth, characterized by significant peaks and troughs, ultimately concluding at a price slightly above its current valuation. This projection underscores the belief that despite intermittent challenges, the fundamental demand drivers for building materials will allow Builders FirstSource to maintain and modestly grow its value over the coming decade. Factors such as interest rates, housing starts, material costs, and overall economic health will continue to be paramount in shaping BLDR’s future performance. Investors should remain attentive to these macroeconomic and industry-specific indicators.

Disclaimer: This article contains price predictions generated by the proprietary ClearSight algorithm. These predictions are based on historical data analysis and algorithmic models, and they do not constitute financial advice. The stock market is inherently unpredictable, and actual prices may vary significantly from these forecasts due to unforeseen market events, economic shifts, company-specific developments, or other factors. We are not responsible for the accuracy of these price predictions or any investment decisions made based on this information. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.