The stock market is a dynamic arena, constantly influenced by a myriad of factors ranging from company-specific performance to broader economic trends and geopolitical events. For investors tracking the healthcare sector, Cooper Companies (The) (NYSE: COO) represents a compelling entity, operating at the intersection of vision care and women’s healthcare. As of the current date, June 6, 2025, Cooper Companies’ stock stands at $71.18 USD. This analysis delves into the historical performance of COO, explores the driving forces behind its valuation, and provides a forward-looking perspective based on proprietary algorithmic projections.

A Closer Look at Cooper Companies: Business Segments and Market Position

Cooper Companies is a global medical device company with a rich history spanning over four decades. It distinguishes itself through two primary business units, each catering to significant and growing healthcare needs:

- CooperVision (CVI): This segment is a leading global manufacturer of contact lenses, offering a comprehensive portfolio designed to correct a wide range of vision conditions, including myopia, astigmatism, and presbyopia. CooperVision is renowned for its innovative daily disposable and monthly disposable lenses, as well as specialty lenses. The demand for contact lenses continues to grow globally, driven by factors such as an aging population, increasing screen time leading to visual strain, and rising awareness of vision correction solutions. CVI’s strong R&D pipeline and global distribution network position it as a key player in this essential market.

- CooperSurgical (CSI): This segment is a diversified leader in women’s healthcare, providing products and services that support reproductive health, fertility, and gynecology. Its offerings include fertility solutions (e.g., in vitro fertilization products), surgical instruments, and diagnostics. The women’s healthcare market is characterized by consistent demand, driven by demographic trends, advancements in reproductive medicine, and the ongoing need for preventative and interventional gynecological care. CooperSurgical plays a crucial role in empowering healthcare professionals to deliver high-quality care to women worldwide.

The dual-segment structure of Cooper Companies provides a degree of diversification, allowing the company to tap into different growth drivers within the healthcare industry. Both segments operate in markets with long-term tailwinds, supported by global demographic shifts and continuous innovation in medical technology. This strategic positioning is often a key consideration for investors evaluating the long-term viability and growth potential of Cooper Companies stock.

Analyzing Cooper Companies’ Historical Stock Performance (Last 12 Months)

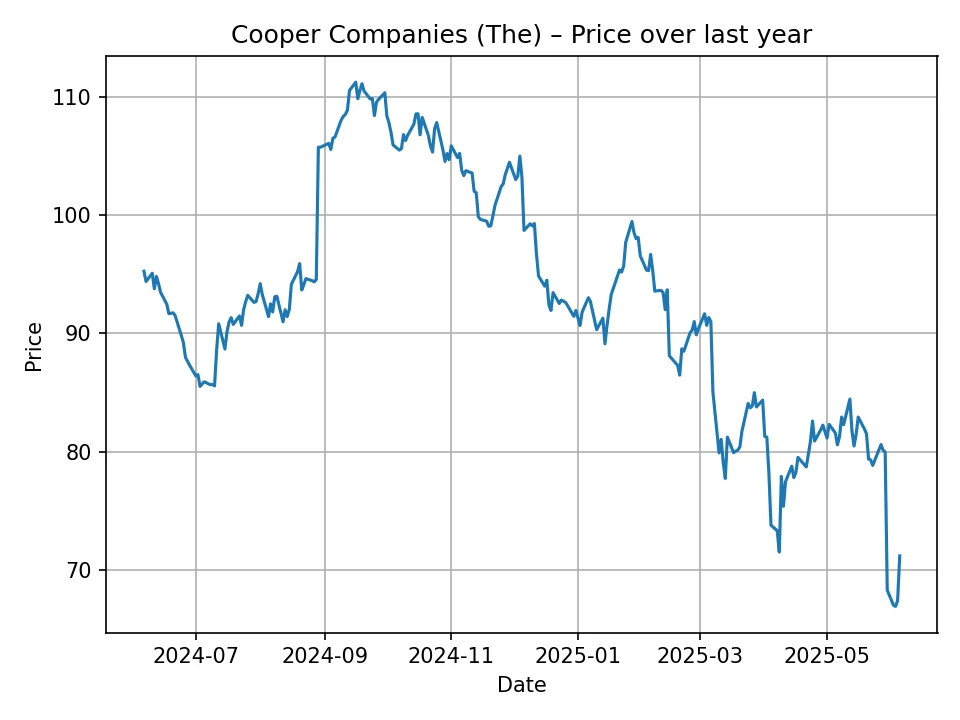

To understand the potential future trajectory of COO stock, it is crucial to analyze its recent past. Over the last 12 months, the stock has exhibited significant volatility, reflecting broader market sentiments, sector-specific dynamics, and possibly company-specific news.

The historical daily price data provided for Cooper Companies illustrates a journey from higher valuations to its current standing of $71.18 USD. Beginning the period around the mid-$90s, with an early high of $95.25, the stock experienced initial fluctuations. There were periods where the price maintained levels in the low to mid-$90s, indicating a relatively stable but perhaps consolidating phase. For instance, values such as $94.38, $95.08, and $94.81 were observed early in the timeframe.

A notable uplift occurred, pushing the stock into a higher range, with several entries comfortably above $100. This upward momentum culminated in a peak around $111.23 (e.g., 111.2300033569336 and 110.52999877929688 around the 70th and 72nd data points from the beginning). This period of strength might have been fueled by positive earnings reports, optimistic market outlooks for the healthcare sector, or successful product launches within either CooperVision or CooperSurgical. Sustained levels around $105 to $110, such as $105.73, $106.06, $108.03, and $110.53, suggest investor confidence during that phase.

However, following this peak, the stock entered a distinct downtrend. Prices began to recede, initially holding around the $100-$105 range before accelerating their decline. Significant drops became more frequent, pushing the stock below $100, then into the $90s, and subsequently into the $80s and even the $70s. For example, a sharp fall from $104.98 to $98.70 occurred, followed by further depreciation. Values like $96.72, $94.85, $93.98, and $92.39 illustrate the steady erosion of value.

The decline continued, with the stock touching significantly lower points towards the end of the 12-month period. Notably, prices plunged into the low $80s and $70s, with entries such as $85.00, $79.89, $73.77, and critically, reaching a low point around $66.91 – $67.00. This late-stage severe drop suggests a significant shift in market perception or exposure to headwinds. The final closing price in the historical data, $71.18 USD, indicates a slight rebound from the lowest point but a substantial depreciation from its 12-month highs.

This historical performance paints a picture of a stock that experienced strong upward momentum in parts of the last year but ultimately faced considerable downward pressure, leading to a significant loss of value. Factors contributing to such a sharp decline could include broader market downturns, specific challenges within the medical device or women’s healthcare sectors (e.g., increased competition, supply chain issues, regulatory hurdles, or even negative analyst reports), or a re-evaluation of Cooper Companies’ growth prospects. Understanding these past movements is fundamental to evaluating the credibility of future price predictions for Cooper Companies (COO).

Key Factors Influencing Cooper Companies Stock Price

The future performance of Cooper Companies stock (COO) will be shaped by a complex interplay of internal and external factors. Investors looking to make informed decisions about their COO investment need to consider these drivers.

Industry-Specific Dynamics

- Global Demand for Vision Correction: The CooperVision segment benefits from persistent global demand for vision correction. Factors such as an aging global population, increased prevalence of myopia (especially among younger generations due to prolonged screen time), and growing awareness of eye health continue to drive the contact lens market. Any significant shifts in these demographic or lifestyle trends could impact CooperVision’s revenue and, consequently, COO’s stock price.

- Advancements in Women’s Healthcare: CooperSurgical operates in a market driven by continuous innovation in reproductive health and gynecology. Advances in fertility treatments, minimally invasive surgical procedures, and diagnostic tools create new opportunities. However, the pace of innovation and the ability to bring new products to market effectively will be critical.

- Competition: Both CooperVision and CooperSurgical face intense competition from established global players and emerging smaller companies. Price wars, aggressive marketing, and rapid product development by competitors could exert pressure on Cooper Companies’ market share and profit margins.

- Regulatory Environment: The medical device and healthcare industries are highly regulated. Changes in regulatory policies, approval processes for new products, or pricing controls (e.g., in major healthcare systems) can significantly impact the company’s operations and financial performance. Strict compliance and the ability to navigate complex regulatory landscapes are paramount.

Company-Specific Performance

- Product Innovation and R&D Pipeline: Cooper Companies’ ability to develop and commercialize innovative products in both contact lenses (e.g., extended wear, myopia management lenses) and women’s healthcare (e.g., new fertility treatments, surgical devices) is a primary growth driver. A robust R&D pipeline that addresses unmet patient needs can secure future revenue streams.

- Financial Results and Earnings Outlook: Quarterly and annual financial reports are pivotal. Strong revenue growth, healthy profit margins, effective cost management, and positive earnings surprises can boost investor confidence. Conversely, missed earnings expectations, declining sales in key segments, or reduced profitability will likely put downward pressure on the stock.

- Market Expansion: Expanding into new geographical markets, particularly emerging economies with growing middle classes and improving healthcare infrastructure, offers significant growth potential for both segments. Successful execution of market entry strategies can enhance COO’s long-term prospects.

- Mergers & Acquisitions (M&A): Cooper Companies has a history of strategic acquisitions to expand its product portfolio, market reach, and technological capabilities. Future M&A activities can either create significant shareholder value or introduce integration risks and financial burdens.

- Supply Chain Resilience: Given its global operations, COO is susceptible to supply chain disruptions. The ability to manage global supply chains efficiently, ensuring timely delivery of raw materials and finished products, is crucial for maintaining operational continuity and meeting demand.

Broader Economic and Market Factors

- Interest Rates and Inflation: Rising interest rates can increase borrowing costs for companies and make equity investments less attractive compared to fixed-income alternatives. Inflation can also impact raw material costs and consumer spending on non-essential items, potentially affecting demand for some of CooperVision’s products.

- Consumer Spending and Healthcare Expenditures: Economic downturns can lead to reduced consumer spending on elective vision care products or delay non-urgent gynecological procedures, impacting Cooper Companies’ revenue. Conversely, increased healthcare spending, driven by government policies or private insurance coverage, can benefit the company.

- Currency Fluctuations: As a global company, Cooper Companies generates revenue and incurs costs in various currencies. Significant fluctuations in exchange rates can impact reported financial results when translated back into USD.

- Overall Market Sentiment: Broader market trends, investor risk appetite, and sector-specific sentiment (e.g., towards healthcare or medical devices) can heavily influence COO stock price. During periods of market uncertainty, even fundamentally sound companies might experience stock depreciation.

Understanding these interwoven factors provides a comprehensive framework for assessing the current valuation and future potential of Cooper Companies stock.

Insights from the FutureLens Algorithm: A Forward-Looking Perspective

To provide a data-driven outlook on Cooper Companies stock price prediction, we have utilized the FutureLens algorithm. This proprietary forecasting model processes extensive historical financial data, market trends, and a multitude of quantitative indicators. It leverages advanced statistical methods and machine learning techniques to identify patterns and project future price movements. It’s important to note that while sophisticated, such algorithmic predictions are based on probabilities and historical correlations, and do not account for unforeseen market disruptions or sudden shifts in company fundamentals.

Cooper Companies Stock Price Prediction: Monthly Outlook (July 2025 – June 2026)

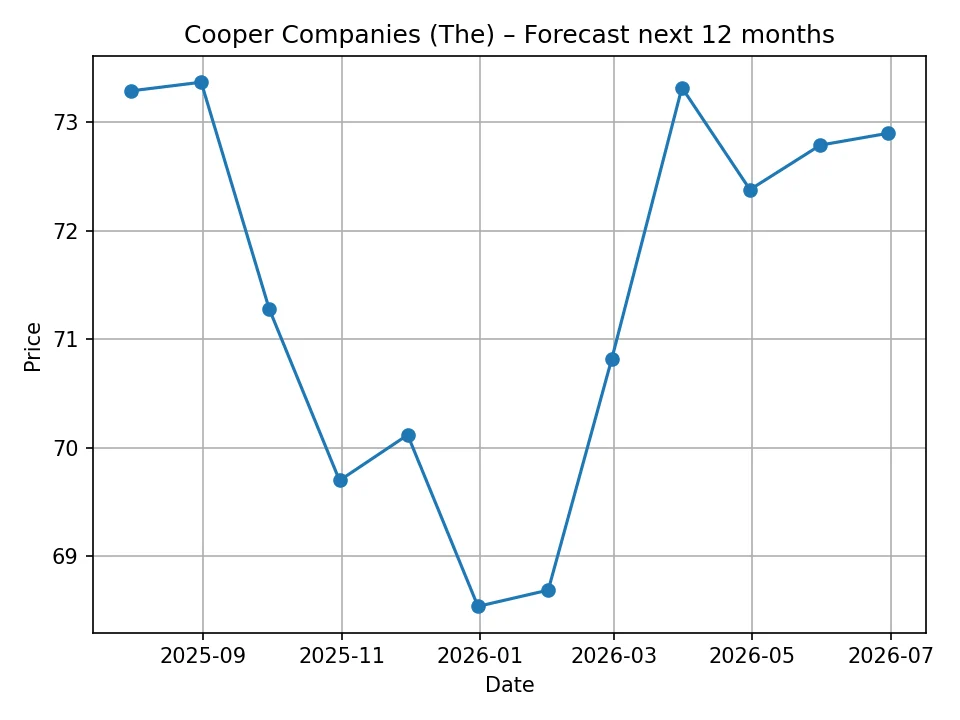

The monthly forecast from the FutureLens algorithm for the next 12 months presents a nuanced picture for COO stock. After the recent significant decline, the algorithm projects a period of relative stability with minor fluctuations.

| Month | Projected Price (USD) |

|---|---|

| 2025-07 | $73.29 |

| 2025-08 | $73.37 |

| 2025-09 | $71.28 |

| 2025-10 | $69.70 |

| 2025-11 | $70.12 |

| 2025-12 | $68.54 |

| 2026-01 | $68.69 |

| 2026-02 | $70.82 |

| 2026-03 | $73.32 |

| 2026-04 | $72.38 |

| 2026-05 | $72.79 |

| 2026-06 | $72.90 |

The forecast suggests a modest recovery and stabilization in the immediate months after the current price of $71.18. The price is projected to slightly increase to $73.29 in July 2025 and $73.37 in August 2025. This could indicate a short-term rebound as the market absorbs the recent dip. However, the projection for September 2025 shows a slight retreat to $71.28, and a further dip to $69.70 in October and $68.54 in December, potentially indicating continued short-term volatility or a period of consolidation at a lower baseline.

Towards the end of this 12-month period, there appears to be a renewed upward trend, with February 2026 showing $70.82, and March 2026 reaching $73.32. The projection concludes at $72.90 for June 2026. This monthly trend implies that while the stock might not experience a dramatic surge in the short term, it is expected to find a floor and potentially begin a gradual recovery or stabilization within the current price range over the next year. Investors should be prepared for continued price fluctuations rather than a clear breakout or breakdown in the near term. This suggests that the algorithm anticipates a period of market re-evaluation and adjustment for Cooper Companies following its recent performance.

Cooper Companies Stock Price Prediction: Annual Outlook (2026 – 2035)

The long-term annual forecast for Cooper Companies stock (COO), extending to 2035, offers a more dynamic perspective compared to the short-term monthly outlook. This projection hints at potential long-term growth, albeit with periods of consolidation or slight retracements.

| Year | Projected Price (USD) |

|---|---|

| 2026 | $72.90 |

| 2027 | $82.30 |

| 2028 | $79.54 |

| 2029 | $79.12 |

| 2030 | $76.35 |

| 2031 | $78.95 |

| 2032 | $79.99 |

| 2033 | $90.45 |

| 2034 | $104.09 |

| 2035 | $95.85 |

Starting with a projected $72.90 for 2026 (aligning with the end of the monthly forecast), the algorithm predicts a significant increase in 2027, with the price reaching $82.30. This initial growth suggests that the market may start to re-evaluate Cooper Companies more positively beyond the immediate future, potentially acknowledging its fundamental strengths or overcoming some of the recent headwinds.

However, the forecast for 2028 and 2029 shows a slight pullback and consolidation around the high $70s, at $79.54 and $79.12 respectively. This could indicate a period where initial recovery momentum slows, perhaps due to market corrections or specific competitive pressures. The predicted dip to $76.35 in 2030 suggests another phase of slight weakness or sideways movement before a potential rebound.

The longer-term outlook, from 2031 to 2034, suggests a more sustained and robust upward trend. The price is projected to recover to $78.95 in 2031 and approach the $80 mark again in 2032 at $79.99. A more significant breakout is projected for 2033, reaching $90.45, and an even stronger surge in 2034, hitting $104.09. This substantial long-term growth implies that the FutureLens algorithm identifies strong underlying fundamentals or anticipated market conditions that could significantly benefit Cooper Companies over the decade. This could be driven by the continued expansion of global vision care markets, breakthroughs in women’s healthcare, or successful strategic initiatives by the company.

Finally, the projection for 2035 shows a slight decline to $95.85. This might suggest a period of profit-taking, a slight market correction, or the emergence of new challenges at that distant point in time. Overall, the annual forecast paints a picture of long-term potential for COO stock price, but it is not a linear climb. Instead, it suggests a path with intermittent periods of growth, consolidation, and slight corrections, characteristic of a healthy but dynamic long-term market performance. The strong projected growth into the early 2030s indicates potential for investors willing to adopt a long-term perspective.

Risks and Opportunities for Cooper Companies Investors

Understanding the potential future of Cooper Companies (COO) stock involves not just reviewing price predictions but also acknowledging the inherent risks and opportunities that can either support or hinder its trajectory.

Potential Risks

- Economic Downturns: Severe economic recessions or prolonged periods of low consumer confidence could negatively impact both segments. Demand for contact lenses might soften as consumers cut discretionary spending, and elective procedures in women’s healthcare could be delayed.

- Intensified Competition: The medical device and healthcare markets are highly competitive. Aggressive pricing strategies, rapid technological advancements from rivals, or the entry of new formidable players could erode Cooper Companies’ market share and profitability.

- Regulatory Changes and Pricing Pressure: The healthcare industry is subject to strict and evolving regulations. Unfavorable changes in government healthcare policies, drug and device approval processes, or pressure to reduce healthcare costs could impact revenue and margins.

- Product Recalls or Litigation: As a manufacturer of medical devices, Cooper Companies faces the risk of product recalls due to defects, which can lead to significant financial costs, reputational damage, and potential lawsuits.

- Supply Chain Disruptions: Global supply chains are vulnerable to geopolitical events, natural disasters, or pandemics. Any significant disruption could lead to increased costs, production delays, and inability to meet market demand.

- Currency Volatility: A strong USD can negatively impact the reported earnings of international companies like Cooper Companies when foreign revenues are converted back to USD.

Potential Opportunities

- Aging Global Population and Myopia Epidemic: These demographic trends provide strong tailwinds for CooperVision, ensuring sustained and growing demand for contact lenses and other vision correction solutions. Specifically, the rising prevalence of myopia globally presents a significant growth area for specialized lenses.

- Innovation in Specialty Lenses and Women’s Health: Continuous investment in R&D, particularly in areas like myopia management contact lenses or advanced fertility treatments, can lead to new product launches that capture significant market share and drive revenue growth.

- Expansion in Emerging Markets: As healthcare infrastructure and disposable incomes grow in emerging economies, Cooper Companies has ample opportunity to expand its presence and capture new customer bases for both its vision and women’s healthcare products.

- Strategic Acquisitions and Partnerships: The company’s history of successful acquisitions demonstrates its ability to grow through inorganic means. Future strategic M&A can enhance its technological capabilities, broaden its product portfolio, and expand its market reach.

- Focus on Preventative and Personalized Healthcare: A growing emphasis on preventative health and personalized medicine could create new avenues for CooperSurgical, particularly in diagnostics and early intervention tools for women’s health.

For investors, these risks and opportunities highlight the importance of continuous monitoring of the company’s operational performance, strategic initiatives, and the broader market and regulatory landscapes.

Conclusion and Investment Outlook

The journey of Cooper Companies (The) (COO) stock over the past year has been characterized by significant volatility, including a notable decline from its highs. This recent performance sets the stage for current investor sentiment and the outlook provided by algorithmic forecasting models. With the stock currently trading at $71.18 USD as of June 6, 2025, the market is evidently reassessing its valuation.

The FutureLens algorithm provides a detailed perspective on potential future price movements. The monthly forecast for the next 12 months suggests a period of stabilization and minor fluctuations around the current price point, with some modest attempts at recovery, indicating that the immediate future might involve consolidation rather than a dramatic breakout.

Looking further ahead, the annual forecast stretching to 2035 paints a more optimistic long-term picture. While not without periods of slight pullback, the algorithm projects a significant growth trajectory for COO stock price, particularly reaching into the $90s and even over $100 by 2033-2034. This long-term potential likely stems from the fundamental strength of Cooper Companies’ core businesses in vision care and women’s healthcare, which benefit from long-term demographic trends and continuous innovation. The company’s dual-segment strategy provides diversification, while ongoing global demand for its products underpins its growth prospects.

Investors considering Cooper Companies stock should weigh the potential for long-term recovery and growth against the short-term volatility and the inherent risks associated with the medical device and healthcare industries. These include intense competition, regulatory challenges, and broader economic influences. As with any investment, a thorough due diligence process, combining fundamental analysis of the company’s financials and strategic initiatives with a broader understanding of market conditions, is paramount.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The price predictions presented herein are generated by the proprietary FutureLens algorithm and are based on historical data and statistical models. Stock market forecasts are inherently uncertain and past performance is not indicative of future results. We are not responsible for any investment decisions made based on the information provided in this article. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.