In the dynamic world of financial markets, understanding the potential trajectory of a stock is crucial for investors. This comprehensive analysis delves into the price prediction for Erie Indemnity (ERIE), a prominent player in the insurance sector. As of June 2nd, 2025, ERIE’s stock stands at $358.51 USD, a pivotal point from which we will explore its recent historical performance and future price forecasts using an advanced proprietary algorithm.

Erie Indemnity (ERIE): A Company Overview

Erie Indemnity Company, trading under the ticker ERIE, primarily operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange. This unique business model sets it apart in the competitive insurance landscape. Essentially, ERIE manages the operations of the Erie Insurance Exchange, which provides a wide range of property and casualty insurance products, as well as life insurance, through a network of independent agents. The company’s focus on customer service, financial strength, and a disciplined underwriting approach has historically contributed to its stability and strong brand reputation.

The insurance industry, generally considered a defensive sector, is influenced by various macroeconomic factors, including interest rates, inflation, and the frequency and severity of catastrophic events. For ERIE, its core business of managing the Erie Insurance Exchange means its financial performance is closely tied to the underwriting results of the Exchange, as well as the investment income generated from policyholder premiums. This makes understanding the broader economic climate and specific industry trends vital for assessing ERIE’s future prospects.

Analyzing ERIE’s Historical Performance (Last 12 Months)

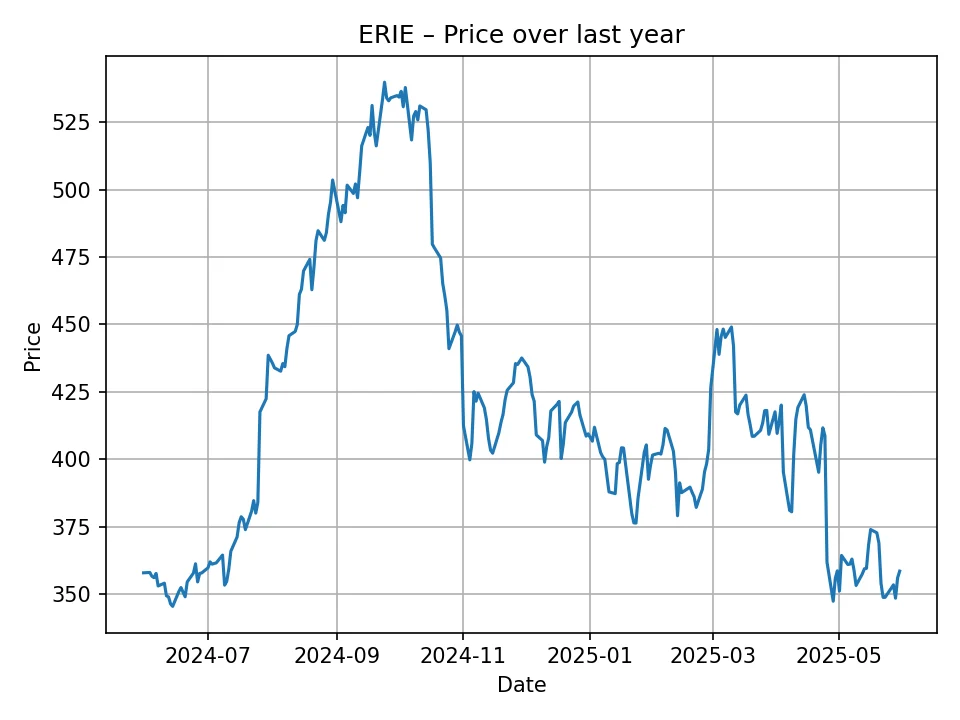

To contextualize our future predictions, it’s essential to review ERIE’s stock performance over the past year. Looking back at the daily historical data from approximately June 2024 to June 2025, ERIE’s journey has been marked by significant volatility, showcasing both impressive peaks and noticeable corrections. The data provided reveals a dynamic period for the stock:

- The stock began the period hovering around the $350-$360 mark.

- A notable upward trajectory commenced, with the price steadily climbing through the late summer and fall of 2024.

- ERIE experienced a substantial rally, reaching its peak within this 12-month window at approximately $539.86 USD. This peak was observed around late 2024 or early 2025, indicating strong investor confidence or positive market catalysts during that time.

- Following this peak, the stock underwent a significant correction, gradually retreating from its highs. This retracement brought the price back down, eventually settling near its current level of $358.51 USD. This correction highlights the inherent volatility even in traditionally stable sectors and could be attributed to various factors such as broader market downturns, specific industry headwinds, or profit-taking by investors after a strong run.

This pattern of strong ascent followed by a substantial pullback underscores the importance of a nuanced approach to forecasting, acknowledging that even fundamentally strong companies can experience periods of significant price swings. The current price of $358.51 USD places ERIE right back where it started roughly a year ago, erasing the gains made during its mid-period rally. This historical context provides a critical backdrop for evaluating the upcoming price predictions, indicating a stock that, while capable of strong growth, is also susceptible to significant corrections.

Forecasting Methodology: Leveraging AlphaForecast

The price predictions presented in this article are generated by AlphaForecast, a sophisticated, proprietary forecasting algorithm. This algorithm is designed to analyze vast quantities of historical data, identify complex patterns, and incorporate various market indicators to project future stock prices. While the precise mechanics of AlphaForecast remain proprietary, it typically considers factors such as past price movements, trading volumes, market sentiment indicators, and relevant economic data to construct its predictive models. It aims to provide a data-driven perspective on potential future price action, offering valuable insights for long-term and short-term investment planning.

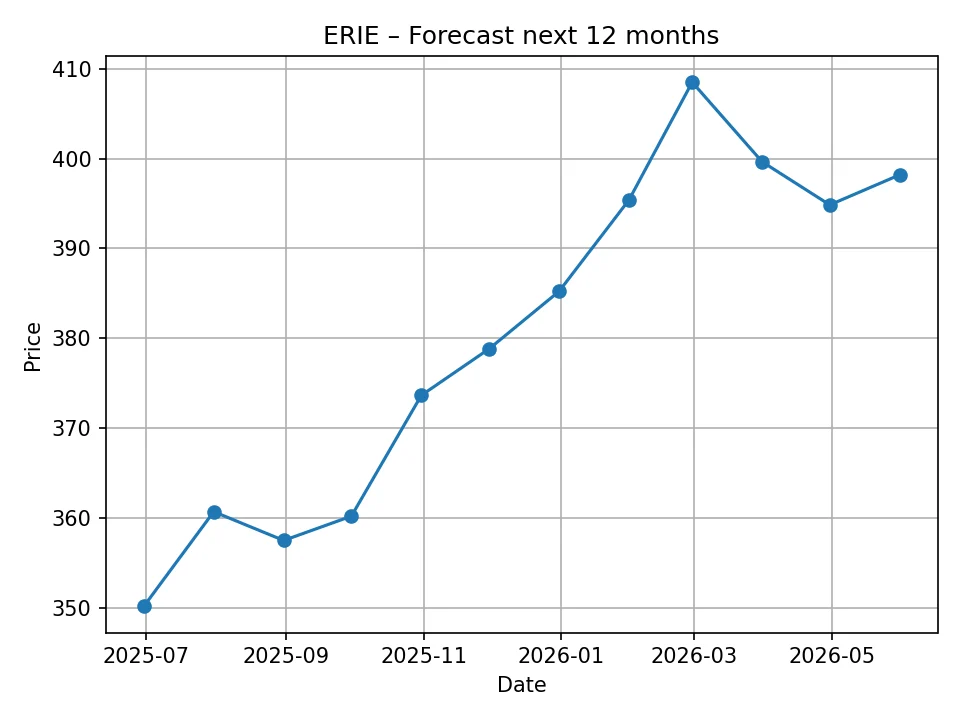

ERIE Price Prediction: Next 12 Months (Monthly Forecast)

Based on the analysis performed by the AlphaForecast algorithm, here is the projected monthly price trajectory for Erie Indemnity (ERIE) over the next 12 months, from June 2025 to May 2026:

| Month | Projected Price (USD) |

|---|---|

| 2025-06 | 350.15 |

| 2025-07 | 360.69 |

| 2025-08 | 357.49 |

| 2025-09 | 360.19 |

| 2025-10 | 373.64 |

| 2025-11 | 378.82 |

| 2025-12 | 385.22 |

| 2026-01 | 395.40 |

| 2026-02 | 408.50 |

| 2026-03 | 399.65 |

| 2026-04 | 394.84 |

| 2026-05 | 398.19 |

Analysis of the Monthly Forecast:

The monthly forecast indicates a period of initial stability followed by a gradual upward trend for ERIE. After a slight dip to $350.15 in June 2025 from its current $358.51, the stock is projected to recover quickly, reaching $360.69 by July. This immediate bounce back suggests that the current price may represent a temporary consolidation point or a minor market adjustment.

Throughout the remainder of 2025, the forecast points to a steady, albeit moderate, appreciation. Prices are anticipated to break above the $370 mark by October, climbing towards $385.22 by December. This consistent growth could be driven by positive quarterly earnings reports, favorable economic conditions for the insurance sector, or renewed investor confidence in ERIE’s business model. The stability shown through the latter half of 2025 suggests a period of healthy, controlled growth rather than speculative surges.

Entering 2026, the momentum appears to accelerate, with a projected peak of $408.50 in February. This could coincide with strong year-end results for Erie Indemnity or positive outlooks provided by management. However, the forecast then suggests a slight pullback in March and April, stabilizing around the $398.19 mark by May 2026. This minor correction is common after periods of strong gains and could be attributed to profit-taking or minor market adjustments. Overall, the 12-month outlook for ERIE is cautiously optimistic, predicting a net gain of approximately 11% from its current price by May 2026, demonstrating a solid recovery from its recent correction.

ERIE Price Prediction: Next 10 Years (Annual Forecast)

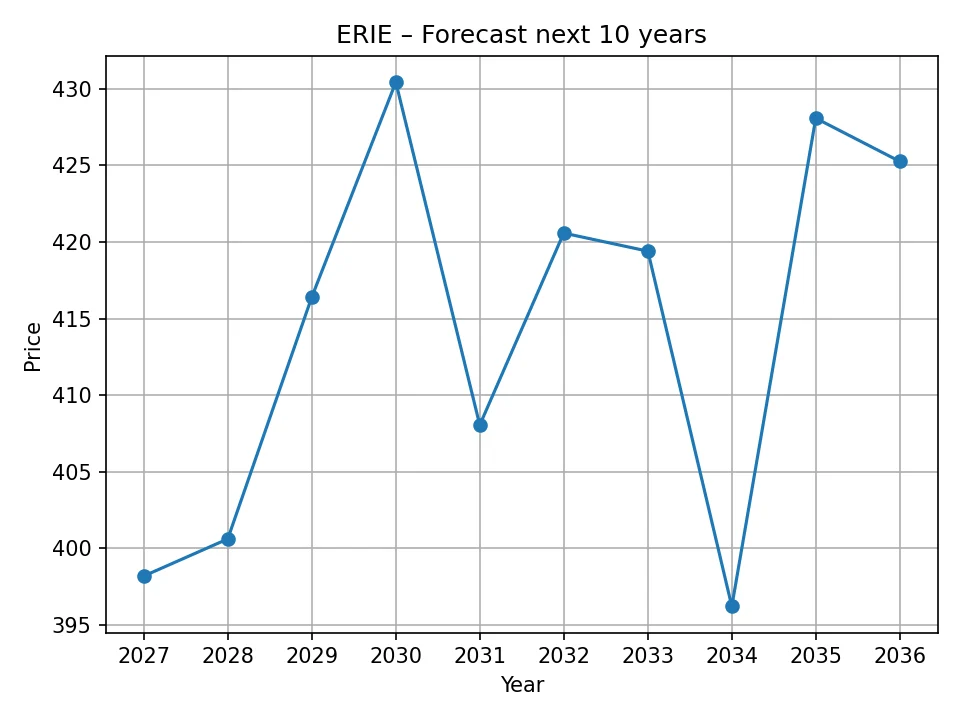

Extending our analysis into the long term, the AlphaForecast algorithm provides an annual price prediction for ERIE over the next decade, offering a broader perspective on its potential growth trajectory:

| Year | Projected Price (USD) |

|---|---|

| 2026 | 398.19 |

| 2027 | 400.61 |

| 2028 | 416.42 |

| 2029 | 430.43 |

| 2030 | 408.05 |

| 2031 | 420.58 |

| 2032 | 419.40 |

| 2033 | 396.21 |

| 2034 | 428.08 |

| 2035 | 425.26 |

Analysis of the Annual Forecast:

The 10-year annual forecast for ERIE suggests an overall positive, yet non-linear, growth path. The price is predicted to consolidate around $398.19 by the end of 2026, aligning with the monthly forecast’s conclusion. This sets a new, higher baseline for long-term growth compared to the current price.

From 2027 to 2029, ERIE is projected to experience a steady and strong upward trend, reaching $430.43 by 2029. This sustained growth could be fueled by consistent profitability, expansion into new markets, or an overall favorable environment for the insurance sector characterized by stable interest rates and manageable catastrophe losses. This period of robust performance highlights ERIE’s potential as a long-term holding.

However, the forecast introduces two significant corrective periods:

- A noticeable dip in 2030, with the price falling to $408.05. This could represent a cyclical downturn in the broader economy, increased competition, or perhaps a period of higher-than-average claims for the insurance industry.

- Another correction is projected in 2033, bringing the price down to $396.21. Similar to 2030, this suggests that the long-term journey for ERIE will not be without its challenges, likely influenced by macro-economic headwinds or specific industry pressures.

Despite these corrections, the algorithm anticipates strong recoveries following each dip. The price is forecast to rebound to $420.58 by 2031 and then impressively to $428.08 by 2034. By 2035, ERIE is predicted to settle at $425.26. This long-term outlook suggests that ERIE, despite intermittent periods of volatility, is expected to deliver positive returns over the decade, reflecting its inherent stability as an insurance provider and its ability to navigate economic cycles.

Key Factors Influencing ERIE’s Stock Price

ERIE’s stock performance is influenced by a combination of internal operational factors and broader external market dynamics. Understanding these can provide a deeper context for the projected price movements.

Internal Factors:

- Underwriting Performance: The profitability of Erie Insurance Exchange’s core insurance business is paramount. This includes factors like claims frequency and severity, premium pricing, and underwriting discipline. Strong underwriting results translate directly into better financial health for ERIE.

- Investment Income: As an insurer, ERIE holds significant investment portfolios backed by policyholder premiums. The returns generated from these investments are highly sensitive to interest rate changes. Higher interest rates generally boost investment income, positively impacting ERIE’s profitability.

- Operational Efficiency: The ability to manage expenses, leverage technology for efficient operations, and streamline processes directly impacts the company’s bottom line and, by extension, its stock price.

- Management Strategy: Strategic decisions regarding market expansion, product diversification, and capital allocation play a crucial role in long-term growth and shareholder value.

- Dividend Policy: ERIE is known for its consistent dividend payments. A stable or growing dividend can attract income-focused investors and provide support for the stock price.

External Factors:

- Interest Rate Environment: This is perhaps one of the most critical external factors. Fluctuations in interest rates directly affect the investment income generated from ERIE’s substantial fixed-income portfolios.

- Catastrophic Events: Major natural disasters (hurricanes, wildfires, severe storms) can lead to significant insured losses, impacting underwriting profitability and potentially the stock price.

- Regulatory Landscape: Changes in insurance regulations at the state or federal level can affect pricing, capital requirements, and competitive dynamics.

- Economic Growth and Inflation: A strong economy generally leads to more insurable assets and higher demand for insurance products. Conversely, inflation can increase claims costs and operating expenses for insurers.

- Competition: The insurance industry is highly competitive. New entrants, technological advancements, and aggressive pricing strategies from competitors can pressure ERIE’s market share and profitability.

- Technological Disruption: The rise of InsurTech, AI, and advanced data analytics can reshape the industry. ERIE’s ability to adapt and integrate new technologies will be vital for its long-term relevance.

Investment Considerations and Risks

Erie Indemnity has historically been viewed as a relatively stable investment, often attractive to investors seeking consistent dividends and a less volatile presence than other sectors. Its unique business model and focus on a specific geographic region (primarily the Mid-Atlantic and Midwest U.S.) give it a distinct market position. The monthly and annual forecasts suggest a generally positive outlook, with the stock expected to recover and build upon its current valuation over the coming years.

However, all investments carry inherent risks. While the AlphaForecast algorithm provides a data-driven projection, it cannot account for unforeseen market shocks, sudden economic downturns, significant regulatory changes, or exceptionally severe and frequent catastrophic events that could disproportionately impact the insurance sector. The predicted corrections in 2030 and 2033 in the long-term forecast serve as a reminder that even a generally upward trend can involve periods of pullback.

Therefore, investors should consider ERIE as part of a diversified portfolio. It is crucial to conduct your own comprehensive due diligence, incorporating fundamental analysis, industry research, and your personal risk tolerance before making any investment decisions. Relying solely on price predictions, no matter how advanced, is not a substitute for thorough research and professional financial advice.

Conclusion

As of June 2nd, 2025, Erie Indemnity (ERIE) stands at a crossroads, having experienced a significant rally and subsequent correction over the past year. The AlphaForecast algorithm projects a cautiously optimistic future for the stock. In the short term (12 months), ERIE is expected to stabilize and then gradually appreciate, potentially reaching over $400 USD by early 2026 before a minor consolidation. Over the long term (10 years), the forecast suggests a continued upward trajectory, albeit with anticipated periods of correction in 2030 and 2033, ultimately reaching prices over $425 USD by 2035.

ERIE’s intrinsic strengths, including its unique business model, strong customer relationships, and disciplined underwriting, position it well to navigate the complexities of the insurance market. However, external factors such as interest rate fluctuations, the impact of climate change on catastrophic events, and the evolving regulatory landscape will continue to shape its performance. These predictions offer a valuable data-driven perspective but should be used as one component of a broader, well-informed investment strategy.

Disclaimer: The content provided in this article, including all price predictions for ERIE (Erie Indemnity), is for informational purposes only and does not constitute financial advice. Stock price forecasts are inherently speculative and are based on analysis performed by a proprietary forecasting algorithm, AlphaForecast. Past performance is not indicative of future results. The market is subject to rapid and unpredictable changes, and actual outcomes may differ significantly from any projections or estimates. We are not responsible for any investment decisions made by readers based on this information. Readers are strongly advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.