Evergy, a prominent name in the U.S. utility sector, serves a crucial role in delivering essential energy services to millions of customers across Kansas and Missouri. As of 2025-06-11, Evergy’s stock is trading at 67.96 USD. For investors and market watchers alike, understanding the potential future trajectory of a stock like Evergy is paramount. This comprehensive analysis delves into Evergy’s recent historical performance, examines the key drivers influencing its valuation, and provides a forward-looking price forecast generated by a sophisticated proprietary algorithm.

Evergy: A Snapshot of the Utility Giant

Evergy operates primarily as a regulated electric utility, meaning its rates are set by state commissions, providing a relatively stable and predictable revenue stream. The company’s core business revolves around electricity generation, transmission, and distribution. Its service territory spans key economic hubs and rural areas, ensuring a diverse customer base.

A significant aspect of Evergy’s strategy is its commitment to the energy transition. The company has set ambitious goals for increasing its renewable energy portfolio and modernizing its grid infrastructure. These initiatives are not only crucial for meeting evolving environmental standards and customer expectations but also represent substantial capital investment opportunities that can drive earnings growth, subject to regulatory approval. Evergy’s focus on integrating more clean energy, particularly wind power where the Midwest offers significant resources, positions it as a key player in the broader decarbonization efforts across the United States. Furthermore, ongoing investments in grid resilience and smart technologies are essential for enhancing reliability and preparing for future energy demands, which can attract long-term oriented investors.

Analyzing Evergy’s Recent Historical Performance

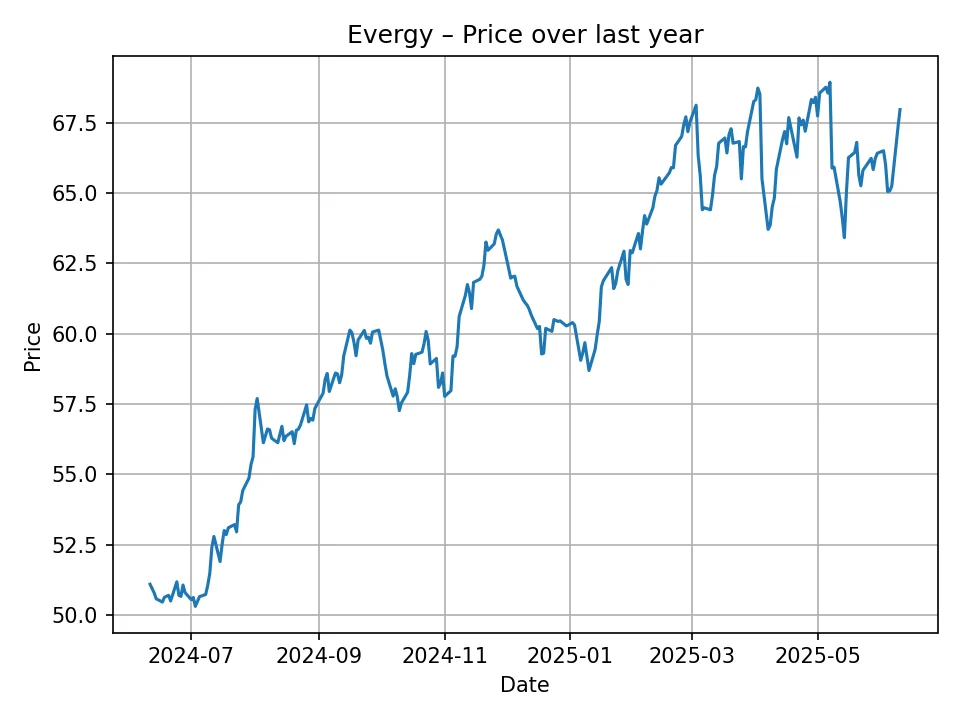

Over the past 12 months, Evergy’s stock has demonstrated a notable upward trend, though not without its characteristic utility sector fluctuations. Starting from a low of 50.31 USD recorded around July 2024, the stock has climbed steadily to its current price of 67.96 USD, representing a significant appreciation of approximately 35% within the year.

The historical data reveals a pattern of gradual gains interspersed with periods of consolidation. For instance, the stock moved from the low 50s in July 2024 to the mid-50s by late August, then saw a stronger surge into the upper 50s and low 60s towards the end of 2024. The ascent continued into 2025, with prices pushing into the mid-60s and eventually reaching peaks around 68.75 USD in late May 2025, before settling slightly below that.

This performance can be attributed to several factors. Utilities are often considered defensive investments, appealing during periods of economic uncertainty due to their stable earnings and dividend payments. As interest rates began to stabilize or show signs of potential future reductions, the appeal of dividend-paying stocks like Evergy increased, drawing more capital into the sector. Additionally, consistent execution on infrastructure projects, favorable regulatory outcomes for rate cases, and positive sentiment around the company’s clean energy transition likely contributed to this upward momentum. Investors may have viewed Evergy’s strategic investments in renewables and grid modernization as long-term growth catalysts, reinforcing its position as a reliable income generator with growth potential. The stability of its regulated business model, which provides a predictable revenue stream less susceptible to economic downturns than other sectors, also played a crucial role in its relatively strong performance compared to more cyclical industries.

Key Drivers of Evergy’s Valuation

The valuation of a utility company like Evergy is influenced by a unique set of factors, distinct from those impacting technology or manufacturing firms. Understanding these drivers is critical for any investor considering Evergy.

Regulatory Framework and Rate Cases

As a regulated utility, Evergy’s profitability is heavily dependent on the decisions made by state utility commissions in Kansas and Missouri. These commissions approve the rates Evergy can charge its customers and determine the allowed return on equity (ROE) for its investments. Favorable regulatory environments, characterized by timely rate case approvals and constructive ROE allowances, are crucial for the company’s financial health and its ability to fund necessary capital expenditures. Conversely, regulatory lag or unfavorable rate decisions can constrain earnings and impact investor confidence. Investors closely monitor regulatory proceedings as they provide a clear indication of the company’s future revenue potential.

Capital Expenditure and Infrastructure Modernization

Evergy has significant ongoing capital expenditure programs focused on grid modernization, enhancing reliability, and integrating new energy sources. These investments, often recovered through customer rates, are essential for maintaining and improving the aging infrastructure. Successful deployment of capital projects on time and within budget, along with securing regulatory approval for these investments, directly contributes to Evergy’s rate base growth, which in turn drives earnings. The ability to invest wisely in advanced grid technologies, such as smart meters and distribution automation, also plays a role in operational efficiency and customer satisfaction.

Renewable Energy Transition

Evergy is actively pursuing a cleaner energy portfolio, with substantial investments in wind and solar generation. This transition aligns with broader industry trends, government incentives, and increasing investor focus on Environmental, Social, and Governance (ESG) factors. The successful integration of more renewables, coupled with the retirement of older fossil fuel plants, can improve Evergy’s environmental footprint, potentially unlock new revenue streams from renewable energy credits, and enhance its appeal to ESG-conscious investors. The financial viability of these projects, however, relies on cost-effective development and supportive regulatory frameworks.

Interest Rate Environment

Utility companies are often considered bond proxies due to their stable dividends. Therefore, they are particularly sensitive to interest rate fluctuations. When interest rates rise, the appeal of fixed-income investments like bonds increases, potentially diverting investor capital away from utilities. Higher interest rates also increase Evergy’s borrowing costs, which can compress margins unless adequately recovered through rate increases. Conversely, a declining or stable low-interest-rate environment tends to bolster utility stock valuations, as their dividends become more attractive relative to other income-generating assets.

Economic Stability and Customer Growth

The economic health of Kansas and Missouri, along with population trends in Evergy’s service areas, directly impacts electricity demand. Steady economic growth, increasing commercial and industrial activity, and population expansion can lead to higher electricity consumption, boosting Evergy’s sales volumes. While regulated utilities have a baseline demand, robust regional economic conditions can support sustained revenue growth and justify new infrastructure investments.

Operational Efficiency and Cost Management

Effective management of operating costs, including fuel expenses, maintenance, and administrative overheads, is crucial for Evergy to optimize its profitability. Utilities are inherently capital-intensive, and operational efficiency plays a significant role in maintaining healthy margins and maximizing the return on their regulated assets. Measures to reduce outages, improve system resilience, and enhance customer service also contribute to operational excellence and stakeholder satisfaction.

Dividend Yield and Stability

Evergy, like many utilities, is an attractive investment for income-seeking investors due to its consistent dividend payments. The stability and growth of its dividend are key components of its total return profile and a major draw for a significant portion of its investor base. The company’s ability to maintain and potentially grow its dividend is a strong indicator of its financial health and predictable cash flows.

Methodology Behind the Forecast: The Visionary Algorithm

The price forecasts presented for Evergy are generated using a proprietary analytical tool referred to as the “Visionary” algorithm. This advanced algorithm is designed to process and interpret a vast array of financial data points, market indicators, and macroeconomic trends to project future stock prices.

The “Visionary” algorithm integrates several sophisticated quantitative techniques. It begins by analyzing historical price data, identifying patterns, trends, and cyclical behaviors that might not be immediately apparent to the human eye. This includes scrutinizing volatility, trading volumes, and various technical indicators to understand market sentiment and momentum. Beyond purely technical analysis, the algorithm also incorporates a consideration of fundamental company data, such as revenue growth, earnings stability, capital expenditure plans, and the company’s financial health, where applicable and publicly available.

Furthermore, “Visionary” often takes into account broader market dynamics and macroeconomic factors relevant to the utility sector. This could include prevailing interest rate outlooks, energy commodity prices, regulatory developments, and national energy policy trends. By synthesizing these diverse inputs, the algorithm constructs probabilistic models to forecast potential price movements over specified time horizons. While the exact intricacies of the “Visionary” algorithm remain proprietary, its core strength lies in its ability to identify complex relationships within the data that might otherwise be overlooked, providing a data-driven perspective on future price trajectories. It operates on the principle that past data and identifiable patterns, when combined with relevant external factors, can offer valuable insights into future market behavior, though it is important to acknowledge that no algorithm can predict the future with absolute certainty.

Evergy’s Short-Term Outlook: The Next 12 Months

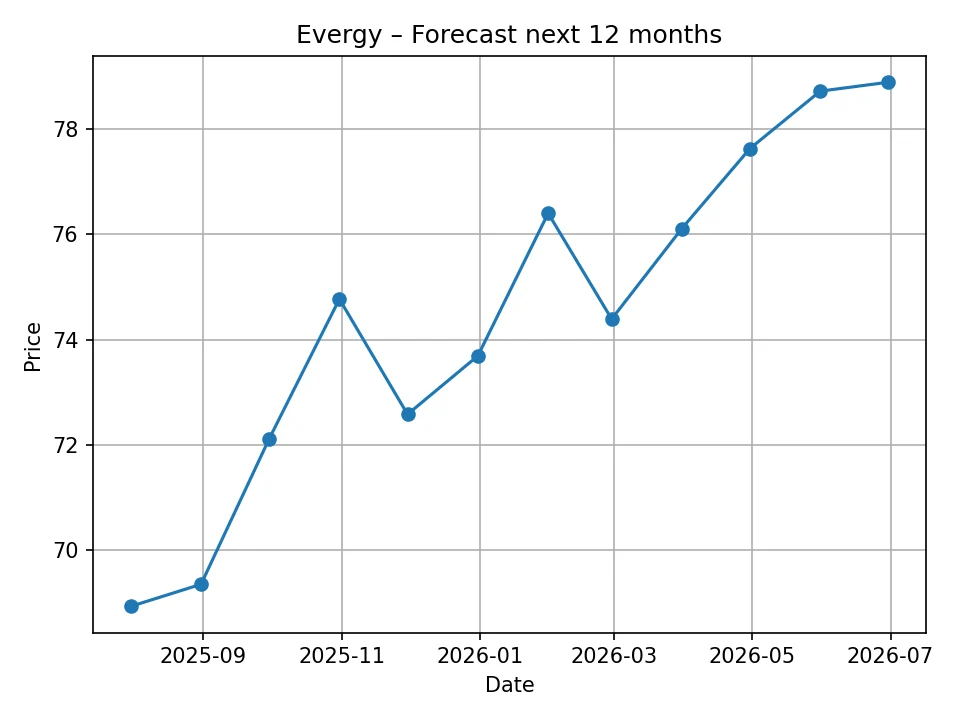

The “Visionary” algorithm provides a compelling monthly price forecast for Evergy, indicating a generally positive trajectory over the coming year.

| Month | Forecast Price (USD) |

|---|---|

| 2025-07 | 68.93 |

| 2025-08 | 69.35 |

| 2025-09 | 72.11 |

| 2025-10 | 74.77 |

| 2025-11 | 72.58 |

| 2025-12 | 73.69 |

| 2026-01 | 76.40 |

| 2026-02 | 74.39 |

| 2026-03 | 76.11 |

| 2026-04 | 77.63 |

| 2026-05 | 78.72 |

| 2026-06 | 78.89 |

The monthly forecast suggests that Evergy’s price is expected to continue its upward trend. From its current price of 67.96 USD, the algorithm predicts a rise to 68.93 USD by July 2025, and a gradual ascent through the remainder of the year. Notably, there are predicted significant jumps to 72.11 USD in September 2025 and then to 74.77 USD in October 2025. This could indicate a period where the algorithm anticipates favorable conditions, possibly related to anticipated regulatory outcomes or seasonal demand peaks.

While there are minor pullbacks predicted, such as in November 2025 and February 2026, the overarching trend is one of steady growth. By June 2026, the algorithm forecasts Evergy’s price to reach 78.89 USD. This represents a potential gain of approximately 16.1% from the current price over the next 12 months.

Short-term influences that could align with or challenge these predictions include upcoming quarterly earnings reports, which provide updates on the company’s financial performance and capital expenditure progress. Regulatory announcements regarding rate cases or new energy policies in Kansas and Missouri could also significantly sway market sentiment. Additionally, seasonal electricity demand, which typically peaks during summer (for cooling) and winter (for heating), can impact short-term revenue and operational costs, potentially influencing investor perceptions. Geopolitical events or shifts in the broader economic outlook, such as changes in inflation expectations or central bank interest rate decisions, could also introduce volatility not explicitly captured in historical patterns.

Evergy’s Long-Term Trajectory: A Decade Ahead

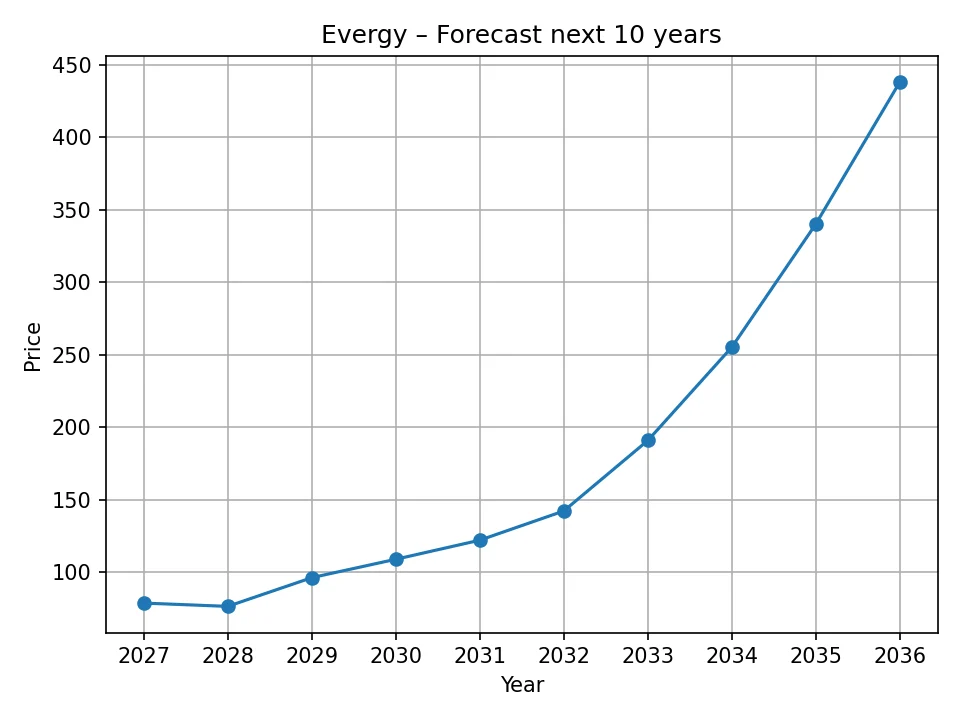

Looking further into the future, the “Visionary” algorithm projects a remarkable long-term growth trajectory for Evergy over the next decade.

| Year | Forecast Price (USD) |

|---|---|

| 2026 | 78.89 |

| 2027 | 76.63 |

| 2028 | 96.44 |

| 2029 | 109.10 |

| 2030 | 122.24 |

| 2031 | 142.35 |

| 2032 | 190.99 |

| 2033 | 255.27 |

| 2034 | 340.09 |

| 2035 | 437.88 |

The annual forecast paints a highly optimistic picture for Evergy’s stock. After reaching 78.89 USD by 2026, the forecast shows a slight dip to 76.63 USD in 2027, which could be an algorithmic adjustment for a short-term market correction or specific regulatory cycle. However, this is quickly followed by substantial growth, with a predicted jump to 96.44 USD in 2028 and surpassing the 100 USD mark by 2029 (109.10 USD).

The growth accelerates significantly in the latter half of the decade. By 2032, Evergy is projected to reach nearly 191 USD, and by the end of the forecast period in 2035, an astonishing 437.88 USD. This represents a potential compounded annual growth rate that would transform Evergy from a solid utility holding into a high-growth investment over the long term.

Such robust long-term growth could be driven by a combination of powerful trends. The successful and timely execution of Evergy’s ambitious clean energy transition plan, coupled with sustained capital investments in its regulated asset base, would be fundamental. Continued population and economic growth in its service territories would ensure consistent demand for electricity. Furthermore, a consistently favorable regulatory environment that supports prudent investments and allows for appropriate returns would be crucial. Technological advancements in grid management, energy storage, and potentially new revenue streams from innovative energy services could also contribute significantly to long-term value creation. Policies supporting decarbonization and grid resilience at federal and state levels would also provide a tailwind. However, it is vital to acknowledge that long-term forecasts inherently carry a higher degree of uncertainty, as they are susceptible to unforeseen economic shifts, geopolitical events, and disruptive technological changes that are difficult to predict years in advance.

Potential Risks and Opportunities for Evergy Investors

Investing in any company, including a regulated utility like Evergy, involves navigating a landscape of both risks and opportunities.

Risks

- Regulatory Headwinds: Unfavorable rate case outcomes, stricter environmental regulations, or regulatory lag (delay in recouping investments through rates) can significantly impact Evergy’s profitability and financial flexibility.

- Rising Interest Rates: A prolonged period of rising interest rates could increase Evergy’s borrowing costs for its extensive capital projects and make its dividend yield less attractive compared to fixed-income alternatives, potentially putting downward pressure on its stock price.

- Operational Challenges: Severe weather events, equipment failures, or cybersecurity breaches could lead to significant operational disruptions, service outages, and substantial repair costs, impacting both financial performance and public perception.

- Commodity Price Volatility: While Evergy is transitioning to renewables, it still relies on traditional fuel sources. Volatility in natural gas or coal prices can affect generation costs if not adequately hedged or passed through to customers via approved mechanisms.

- Technological Disruption: While less immediate, rapid advancements in distributed energy resources (e.g., rooftop solar, battery storage) or residential energy efficiency could eventually reduce demand for grid-delivered electricity, though regulated utilities typically adapt through new business models.

Opportunities

- Clean Energy Expansion: Evergy’s continued investment in wind and solar power aligns with national and regional clean energy mandates, potentially opening up new avenues for growth and enhancing its appeal to ESG-focused investors. Government incentives and tax credits for renewable energy projects could further boost profitability.

- Grid Modernization Funding: Federal and state initiatives aimed at modernizing aging energy infrastructure and enhancing grid resilience could provide significant funding opportunities or supportive policies that benefit Evergy’s capital investment plans.

- Population and Economic Growth: Continued economic development and population growth within Evergy’s service territories could lead to increased demand for electricity, supporting higher sales volumes and justifying further infrastructure investments.

- Favorable Regulatory Environment: Constructive regulatory relationships and a willingness by commissions to approve necessary rate increases and adequate returns on investment are paramount. Positive regulatory outcomes can solidify Evergy’s financial footing and support its long-term growth strategy.

- Technological Innovation: Adoption of smart grid technologies, advanced analytics, and energy storage solutions can lead to improved operational efficiency, reduced costs, and enhanced customer service, all contributing to better financial performance.

Investment Perspective: Is Evergy a Good Fit for Your Portfolio?

Evergy, like most regulated utilities, traditionally appeals to investors seeking stability, consistent income through dividends, and defensive characteristics during economic downturns. Its regulated business model provides a degree of predictability in earnings, making it a potentially valuable component of a diversified portfolio.

For income-focused investors, Evergy’s historical commitment to dividend payments makes it an attractive consideration, especially when interest rates are low or stable. Its steady cash flows, supported by a monopolistic service area and regulatory oversight, often allow for consistent dividend distribution and gradual increases.

Growth-oriented investors might initially overlook utilities, but Evergy’s strategic pivot towards renewable energy and significant infrastructure investments introduce an element of regulated growth. The long-term forecasts, in particular, suggest a substantial potential for capital appreciation, positioning Evergy as a utility that could offer more than just income. This blend of stability with growth potential can appeal to investors seeking a balanced risk-reward profile.

However, prospective investors should carefully consider their personal risk tolerance and investment objectives. While the “Visionary” algorithm projects strong growth, particularly in the long term, these are forecasts based on current data and patterns. Market conditions, regulatory shifts, and unexpected events can always alter a company’s trajectory. Due diligence, including a thorough review of Evergy’s financial statements, regulatory filings, and management’s strategic plans, is always recommended before making any investment decisions. Evergy’s performance is closely tied to its ability to execute its capital plans and secure favorable regulatory treatment, making these critical areas for investor monitoring.

Conclusion

Evergy stands as a cornerstone utility in the Midwest, playing an essential role in powering homes and businesses across Kansas and Missouri. Its recent historical performance shows a steady upward trend, reflecting its defensive qualities and strategic initiatives. Looking ahead, the “Visionary” algorithm forecasts a generally positive outlook, with a consistent increase projected over the next 12 months, culminating in a price around 78.89 USD by June 2026. The long-term forecast paints an even more compelling picture, predicting substantial growth for Evergy’s stock over the coming decade, potentially reaching 437.88 USD by 2035.

This optimistic projection is underpinned by Evergy’s strategic focus on renewable energy integration and ongoing grid modernization, coupled with the inherent stability of its regulated utility business model. While risks such as regulatory headwinds and interest rate fluctuations persist, the company’s commitment to clean energy and infrastructure investment presents significant opportunities for sustained growth. For investors seeking a blend of stability, income, and potentially significant long-term capital appreciation, Evergy warrants close consideration as a valuable component of a diversified investment portfolio.

Disclaimer: This article provides a price forecast for Evergy stock based on an analysis conducted using a proprietary algorithm, referred to as “Visionary.” The information contained herein is for informational purposes only and does not constitute financial advice. Stock prices are subject to market risks, and past performance is not indicative of future results. We are not responsible for any investment decisions made based on the forecasts or information presented in this article. Readers are strongly advised to conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.