Understanding the trajectory of energy sector equities requires a deep dive into both micro and macroeconomic factors. Marathon Petroleum Corporation (MPC) stands as a prominent entity within the global refining, marketing, and transportation of petroleum products. As of June 7, 2025, its stock trades at 160.12 USD, a valuation influenced by a complex interplay of global oil markets, refining margins, operational efficiencies, and the broader economic climate. Investors, analysts, and market observers are keenly interested in discerning the future performance of such integral companies. This analysis aims to provide a comprehensive price forecast for Marathon Petroleum, drawing upon historical performance and algorithmic projections, while also exploring the critical drivers that will shape its path forward.

Historical Performance Analysis: A Year in Review

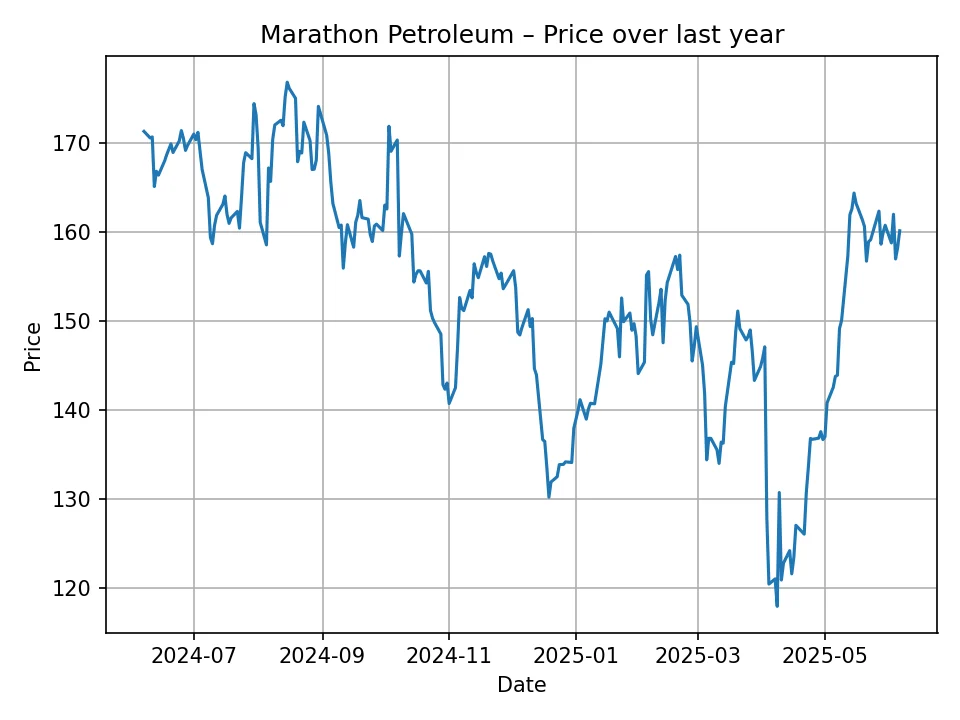

To contextualize the current valuation and future projections, a thorough examination of Marathon Petroleum’s stock performance over the past 12 months is essential. The daily historical data reveals a period characterized by significant volatility, typical of the energy sector. From a peak around 176.83 USD observed earlier in the period (around late February/early March in the provided data), the stock experienced notable fluctuations, including a discernible dip to approximately 117.88 USD (around late April/early May). This volatility underscores the sensitivity of refining stocks to external shocks, such as geopolitical events, shifts in global crude oil supply and demand dynamics, and broader economic sentiment.

The journey from its lowest point back towards the 160 USD mark demonstrates a degree of resilience and market confidence, potentially driven by improving refining margins, strategic operational decisions, or a stabilization in the energy commodity markets. Periods of strong upward momentum indicate favorable market conditions for refiners, likely linked to robust demand for refined products like gasoline, diesel, and jet fuel, coupled with manageable crude oil input costs. Conversely, downturns often correspond with an unfavorable spread between crude oil prices and refined product prices (known as “crack spreads”), or concerns over weakening demand, increased competition, or regulatory pressures. The recent stabilization around 160.12 USD suggests the market is currently pricing in a balanced outlook, reflecting both the company’s solid operational foundation and the inherent uncertainties of the energy landscape. Analyzing these past movements helps to establish a baseline understanding of MPC’s sensitivity to market forces and provides valuable context for the forthcoming price predictions.

The Broader Energy Sector Landscape

Marathon Petroleum operates within a dynamic and often unpredictable global energy market. Several overarching trends and factors significantly influence its financial performance and, consequently, its stock price.

Global Crude Oil Prices: As a significant refiner, MPC’s profitability is intrinsically linked to the price of crude oil, its primary feedstock. While lower crude prices can reduce input costs, ultimately the refining margin, or “crack spread,” is more critical. This spread represents the difference between the price of crude oil and the wholesale price of refined products. Wide crack spreads typically lead to higher profitability for refiners. Factors impacting crude prices include OPEC+ production policies, geopolitical tensions (e.g., conflicts in key oil-producing regions), U.S. shale production levels, and global economic growth forecasts that dictate future demand.

Refined Product Demand: Demand for gasoline, diesel, and jet fuel is heavily influenced by global economic activity, travel patterns, and industrial output. A robust global economy generally translates to higher demand for transportation fuels, benefiting refiners like MPC. Conversely, economic slowdowns or shifts in consumer behavior (e.g., increased adoption of electric vehicles, remote work trends) can dampen demand. Seasonal factors also play a role, with summer driving season typically boosting gasoline demand.

Geopolitical Environment: The stability of major oil-producing regions and global trade routes can create supply disruptions or uncertainties, impacting crude oil prices and, by extension, refining economics. Sanctions, trade disputes, and international conflicts can all introduce significant volatility into the energy markets.

Regulatory and Environmental Policies: The global push towards decarbonization and stricter environmental regulations poses both challenges and opportunities for refiners. Compliance costs, investments in cleaner fuels, and the long-term outlook for fossil fuel demand are crucial considerations. MPC, like other refiners, must adapt to evolving standards, which can involve significant capital expenditure for facility upgrades or shifts in product portfolios. This includes policies related to carbon emissions, fuel standards, and renewable energy mandates.

Economic Outlook: Inflationary pressures, interest rate movements by central banks, and overall GDP growth rates profoundly affect consumer spending and industrial activity, which in turn dictate energy consumption. High inflation can increase operational costs for refiners, while rising interest rates can make capital projects more expensive. A strong economic environment generally supports higher demand for refined products, contributing positively to refiners’ profitability.

Competitive Landscape: The refining industry is highly competitive, with numerous players vying for market share. Factors such as refinery capacity utilization, technological advancements in refining processes, and competitive pricing strategies among refiners also influence profitability. Overcapacity in the refining sector can lead to compressed margins, even if crude prices are favorable.

Understanding these broader dynamics is critical for interpreting the specific forecasts for Marathon Petroleum, as its performance is inextricably linked to the health and evolution of the global energy sector.

Monthly Price Forecast: The Next 12 Months

Utilizing the proprietary FutureLens algorithm, a 12-month forward-looking price forecast for Marathon Petroleum has been generated. This short-term projection provides insight into the anticipated price movements over the coming year, reflecting immediate market trends and near-term economic indicators.

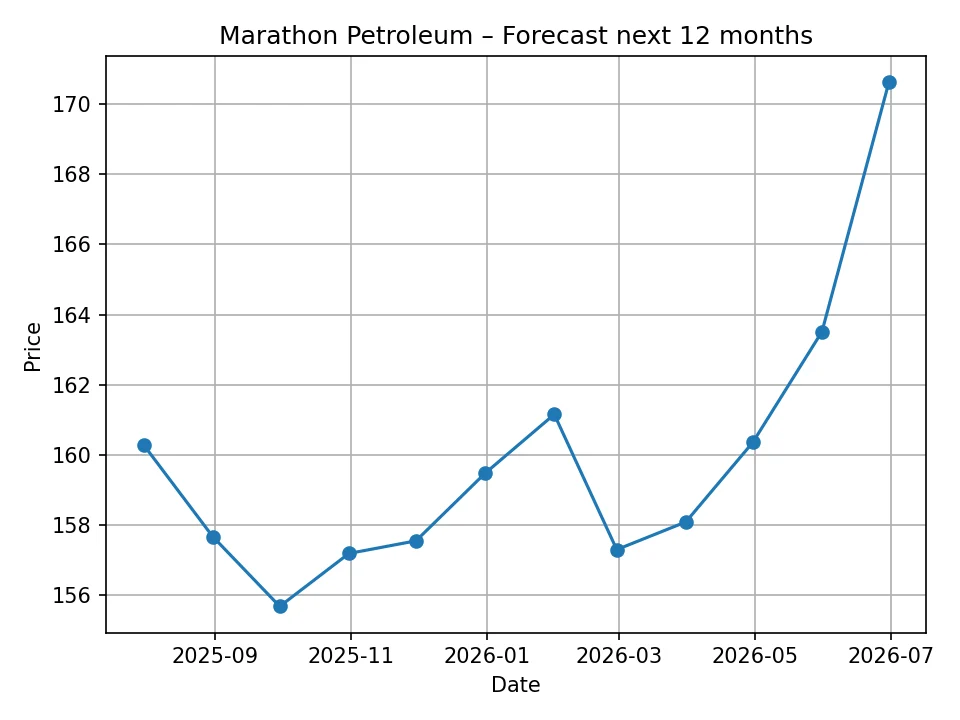

The monthly forecast suggests a period of relative stability with a gradual upward trend toward the end of the 12-month period.

Here is the detailed monthly projection:

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-07 | 160.28 |

| 2025-08 | 157.66 |

| 2025-09 | 155.67 |

| 2025-10 | 157.18 |

| 2025-11 | 157.54 |

| 2025-12 | 159.47 |

| 2026-01 | 161.15 |

| 2026-02 | 157.29 |

| 2026-03 | 158.08 |

| 2026-04 | 160.35 |

| 2026-05 | 163.51 |

| 2026-06 | 170.63 |

The forecast indicates that Marathon Petroleum’s stock is expected to remain relatively flat in the immediate short term, with minor fluctuations, before showing more noticeable growth towards the second half of 2026. The initial months (July to September 2025) show a slight dip, possibly reflecting seasonal demand shifts or minor economic headwinds. However, a recovery and steady climb are projected from October 2025 onwards, culminating in a price of 170.63 USD by June 2026. This suggests that the algorithm anticipates either a stabilization of refining margins, a sustained recovery in global demand, or effective operational management within the company to drive value. Factors that could influence this short-term outlook include quarterly earnings reports, announcements regarding refinery utilization rates, or unforeseen supply chain disruptions impacting crude input or refined product distribution. Investors might interpret this as a period of consolidation, offering potential entry points before the anticipated upward movement.

Annual Price Forecast: The Next Decade

Extending the horizon, the FutureLens algorithm also provides a 10-year annual price forecast for Marathon Petroleum, offering a longer-term perspective on the company’s potential valuation. This projection considers broader macro trends, long-term energy transition dynamics, and the company’s strategic positioning within the evolving energy landscape.

Here is the detailed annual projection for the next decade:

| Year | Projected Price (USD) |

|---|---|

| 2026 | 170.63 |

| 2027 | 204.56 |

| 2028 | 224.83 |

| 2029 | 207.50 |

| 2030 | 199.34 |

| 2031 | 217.84 |

| 2032 | 220.45 |

| 2033 | 240.66 |

| 2034 | 251.63 |

| 2035 | 231.80 |

The long-term forecast for Marathon Petroleum paints a generally optimistic picture, indicating significant growth potential over the next decade. The projected price for 2026 is 170.63 USD, building on the monthly forecast’s upward trend. Subsequently, the stock is expected to continue its ascent, reaching 204.56 USD in 2027 and peaking at 224.83 USD in 2028. This growth trajectory suggests that the algorithm anticipates sustained favorable conditions for refiners, possibly due to steady global energy demand, effective management of supply chains, and strong operational performance by MPC.

However, the forecast also reveals periods of consolidation or slight retraction. A notable dip is projected from 2028 to 2030, with prices receding to 207.50 USD in 2029 and 199.34 USD in 2030. This could reflect anticipated cyclical downturns in the energy market, increased pressure from energy transition initiatives, or broader economic slowdowns impacting demand. Following this period, the forecast resumes a strong upward trend, climbing steadily to a peak of 251.63 USD in 2034, before a modest retraction to 231.80 USD in 2035. This suggests that while the long-term outlook remains positive, the journey will likely not be linear, with periods of strong performance interspersed with corrections.

These long-term projections are underpinned by several potential assumptions: a continued need for traditional refined products even amidst the energy transition, Marathon Petroleum’s ability to adapt its operations and product mix, its success in managing capital allocation (e.g., through shareholder returns or strategic investments), and its resilience against increasing regulatory scrutiny or competition from alternative energy sources. The overall trend suggests that Marathon Petroleum is positioned to benefit from sustained, albeit evolving, global energy consumption patterns.

Key Factors Influencing Marathon Petroleum’s Stock Price

Marathon Petroleum’s stock valuation is not solely dependent on general market trends but is also significantly influenced by a confluence of company-specific and industry-wide factors.

Refining Margins (Crack Spreads): This is perhaps the single most critical driver of MPC’s profitability. The crack spread is the difference between the price of crude oil (input) and the prices of refined products (output). Favorable crack spreads, driven by strong product demand and adequate crude supply, directly translate to higher earnings and, consequently, a higher stock price. Global supply-demand imbalances for crude, as well as for specific refined products like gasoline, diesel, and jet fuel, constantly affect these margins.

Crude Oil Acquisition and Supply: The ability to source diverse crude oil types efficiently and cost-effectively is crucial. Access to various grades of crude and effective logistics (pipelines, rail, barges) can provide a competitive advantage. Disruptions in crude supply chains due to geopolitical events, natural disasters, or infrastructure issues can increase input costs and compress margins.

Operational Efficiency and Utilization Rates: MPC’s profitability is also tied to the operational efficiency of its refineries and their utilization rates. High utilization rates spread fixed costs over a larger volume of output, improving profitability. Maintenance downtimes, unplanned outages, or operational inefficiencies can negatively impact output and margins. Investing in technology and optimizing processes to reduce energy consumption and improve yields are ongoing efforts.

Product Demand and Market Share: Demand for refined products varies by region and season. MPC’s ability to anticipate and meet this demand, coupled with its market share in key regions, directly impacts its sales volumes. Shifts in consumer behavior, such as increased adoption of electric vehicles or changes in travel patterns, will influence long-term demand for traditional fuels.

Capital Allocation and Shareholder Returns: Investors closely monitor MPC’s capital allocation strategy. This includes investments in its refining and pipeline assets (capital expenditures), mergers and acquisitions, debt management, share buyback programs, and dividend policies. A strong commitment to returning capital to shareholders, alongside prudent investments in future growth, can enhance investor confidence and stock valuation.

Midstream Segment Performance: Marathon Petroleum’s ownership of MPLX LP (a master limited partnership) provides a stable source of earnings through its midstream assets (pipelines, terminals, storage). The fee-based nature of these operations offers a degree of insulation from the volatility of refining margins, providing a more predictable earnings stream that supports the overall company valuation. Growth in the midstream segment, through expansion projects or acquisitions, can be a significant value driver.

Environmental, Social, and Governance (ESG) Factors: Increasingly, investors are scrutinizing energy companies based on their ESG performance. MPC’s efforts to reduce carbon emissions, improve safety records, and engage with communities can impact its reputation, access to capital, and long-term sustainability. Compliance with evolving environmental regulations also influences operational costs and investment decisions.

Macroeconomic Conditions: Beyond specific energy market dynamics, broader macroeconomic factors such as global GDP growth, inflation, interest rates, and currency fluctuations indirectly influence demand for refined products, operational costs, and investment attractiveness. A strong global economy generally correlates with higher energy consumption.

Potential Risks and Opportunities

Investing in the energy sector, particularly in refining, inherently involves navigating a landscape of both significant risks and compelling opportunities. For Marathon Petroleum, these factors will play a crucial role in validating or deviating from the forecasted price paths.

Risks:

- Volatile Crude Oil and Product Prices: The most immediate risk is the inherent volatility of crude oil prices and refined product prices. Sudden increases in crude costs without corresponding rises in product prices, or sharp declines in demand for refined products, can severely compress refining margins, directly impacting profitability.

- Economic Downturns: A global or regional economic recession would significantly reduce demand for transportation fuels and industrial lubricants, leading to lower sales volumes and reduced refinery utilization.

- Regulatory and Policy Changes: Stricter environmental regulations, carbon taxes, or mandates favoring renewable fuels could increase operational costs, necessitate significant capital expenditures for compliance, or limit future growth in traditional refining activities. The political landscape around energy transition poses long-term uncertainty.

- Geopolitical Instability: Conflicts, trade wars, or political unrest in major oil-producing or consuming regions can disrupt supply chains, escalate crude prices, or reduce demand, creating market uncertainty and impacting MPC’s operations.

- Technological Disruption and Energy Transition: While not an immediate threat to the refining sector’s existence, the long-term shift towards electric vehicles, hydrogen, and other alternative energy sources could gradually erode demand for traditional petroleum products. MPC must adapt its strategy to remain relevant in a decarbonizing world.

- Operational Risks: Refinery operations carry inherent risks such as fires, explosions, or unexpected outages, which can lead to significant financial losses, environmental damage, and reputational harm.

- Competition: The refining industry is highly competitive, and overcapacity in certain regions can lead to price wars and squeezed margins.

Opportunities:

- Strong Refining Margins: Periods of robust global demand for refined products combined with manageable crude oil supply can lead to very favorable crack spreads, driving significant profitability for MPC.

- Strategic Investments and Acquisitions: MPC’s strong balance sheet allows for potential strategic acquisitions of complementary assets (e.g., pipelines, terminals, or even other refineries) or investments in efficiency improvements and sustainable fuels technologies, enhancing its competitive position.

- Shareholder Returns: Consistent and substantial shareholder returns through dividends and share buybacks can attract and retain investors, providing support for the stock price, especially during periods of high profitability.

- Midstream Growth: Expansion of its midstream segment (MPLX LP) provides a more stable, fee-based earnings stream, diversifying its revenue and adding resilience to its overall business model. Investments in new pipelines or storage facilities can unlock significant value.

- Adaptation to Energy Transition: While a risk, the energy transition also presents opportunities. MPC can invest in producing lower-carbon fuels (e.g., renewable diesel, sustainable aviation fuel), carbon capture technologies, or explore new business lines that align with a greener energy future. This proactive adaptation can ensure long-term viability.

- Operational Excellence: Continuous focus on improving refinery efficiency, reducing operating costs, and optimizing product yields can enhance profitability regardless of market conditions.

- International Demand Growth: While demand might plateau in developed markets, growing economies in Asia, Africa, and Latin America could continue to drive demand for refined products, offering new export opportunities for MPC.

Conclusion

Marathon Petroleum Corporation, a key player in the global refining and marketing sector, operates within a complex and dynamic energy landscape. The analysis of its historical performance reveals a stock prone to volatility, reflecting the inherent uncertainties of its industry, yet also capable of significant recovery and growth. The current price of 160.12 USD reflects a market that has recently seen both considerable highs and lows.

The FutureLens algorithm’s monthly forecast suggests a relatively stable short-term outlook for MPC, with some minor fluctuations, before demonstrating a gradual upward trend towards 170.63 USD by June 2026. This indicates an expectation of market stabilization and potentially improving operational conditions. Looking further ahead, the 10-year annual forecast paints a generally optimistic picture, projecting significant growth for the stock over the next decade, with a peak around 251.63 USD in 2034. However, this trajectory is not linear, with anticipated periods of correction, underscoring the cyclical nature of the energy market.

These projections are underpinned by a multitude of factors, including the critical refining margins (crack spreads), global crude oil prices, refined product demand, macroeconomic conditions, and the company’s strategic capital allocation. Risks such as economic downturns, geopolitical instability, and the evolving energy transition present challenges, while opportunities lie in robust refining margins, strategic investments, midstream growth, and proactive adaptation to new energy demands.

Ultimately, Marathon Petroleum’s future performance will depend on its ability to navigate these complex dynamics, optimize its extensive refining and midstream assets, and adapt to the long-term shifts in global energy consumption. For investors, understanding these intertwined factors is crucial in assessing the company’s potential as a long-term holding.

Please note that this article contains price forecasts generated by our proprietary FutureLens algorithm. These forecasts are based on historical data and complex computational models, but they are not guarantees of future performance. The energy market is subject to significant volatility due to geopolitical events, supply-demand imbalances, economic shifts, and other unforeseen circumstances. Investing in the stock market carries inherent risks, and actual results may differ materially from those projected. We are not responsible for any investment decisions made based on the information presented herein. Investors should conduct their own due diligence and consider consulting with a qualified financial advisor before making any investment choices.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.