Exploring the trajectory of Netflix (NFLX) stock requires a comprehensive understanding of its historical performance, current market position, and strategic initiatives. As of June 4, 2025, Netflix shares are trading at $1217.94 USD, reflecting a remarkable surge over the past year. This analysis delves into the factors driving Netflix’s valuation and presents a detailed price forecast for the coming months and years.

Netflix’s Remarkable Journey: A Look Back at Recent Performance

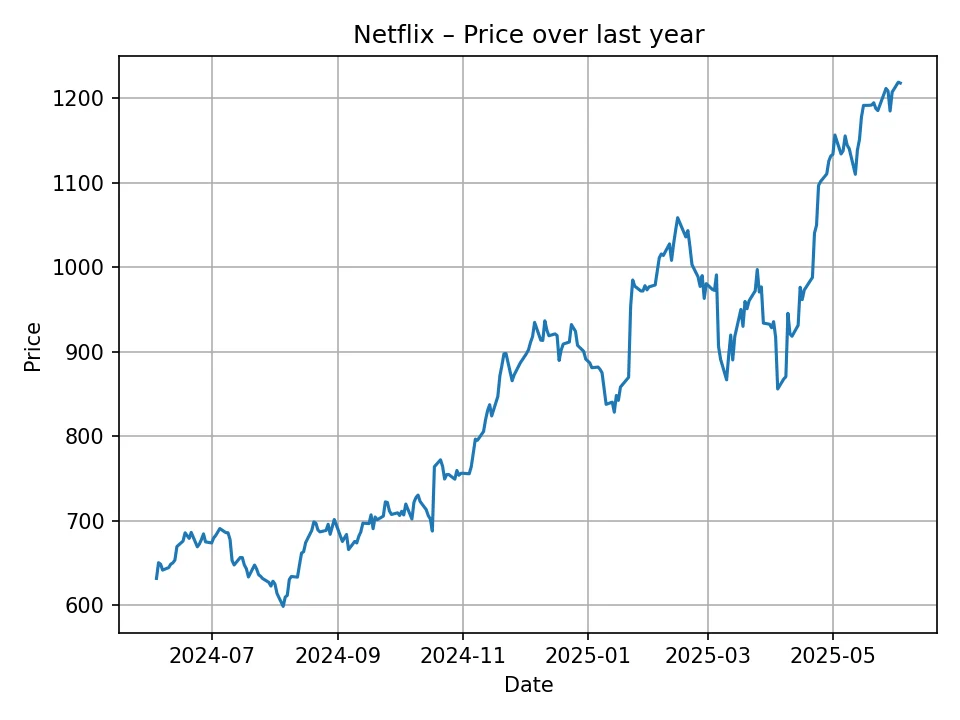

Over the last 12 months, Netflix stock has demonstrated exceptional resilience and growth. The historical data shows a powerful upward trend, starting from prices in the low $600s USD and steadily climbing to its current level of $1217.94 USD. This represents a significant appreciation in value, indicating strong investor confidence and a successful execution of key strategic initiatives. The consistent upward momentum, despite occasional market fluctuations, underscores Netflix’s robust market position and its ability to adapt to a dynamic industry landscape.

Key Drivers Behind Netflix’s Recent Success

- Paid Sharing Initiative: Netflix’s bold move to crack down on password sharing has proven to be a highly effective monetization strategy. By converting casual users into paying subscribers, the company successfully unlocked a new revenue stream, demonstrating its pricing power and ability to enforce subscription terms.

- Ad-Supported Tiers: The introduction and global expansion of lower-priced, ad-supported subscription plans have broadened Netflix’s market appeal. This strategy has attracted price-sensitive consumers, enabling the company to tap into a wider demographic and generate significant advertising revenue, diversifying its financial model beyond pure subscriptions.

- Content Prowess and Diversification: Netflix continues to invest heavily in a diverse range of original content, spanning critically acclaimed series, blockbuster films, documentaries, and even live events. This continuous pipeline of high-quality, exclusive content is crucial for subscriber acquisition and retention, ensuring Netflix remains a primary entertainment destination in a crowded market. The expansion into mobile gaming also adds another layer of value for subscribers.

- International Expansion and Localization: Netflix’s strategic focus on international markets, coupled with its ability to produce and acquire localized content, has fueled significant subscriber growth outside its traditional Western markets. This global footprint provides a vast addressable market for future expansion.

- Improved Financial Performance: The company has demonstrated improved profitability and generated stronger free cash flow, reassuring investors about its financial health. Efficient content spending and revenue diversification contribute to a more sustainable growth trajectory.

Unpacking the Future: Factors Shaping Netflix’s Valuation

Looking ahead, Netflix’s stock performance will continue to be influenced by a complex interplay of industry dynamics, company-specific strategies, and broader macroeconomic conditions. The trajectory observed over the past year suggests a company well-positioned for future growth, but vigilance against potential headwinds is always prudent.

Subscriber Growth and Engagement Strategies

While the initial boost from paid sharing may normalize, sustained subscriber growth remains a critical metric. Future growth drivers are likely to include:

- Global Market Penetration: Opportunities persist in regions with lower streaming penetration, particularly in developing economies, where Netflix can leverage its extensive content library and localized offerings.

- Value Proposition Enhancement: Continuously enhancing the value proposition through innovative features, exclusive content, and potential bundled offerings with other services (e.g., telecommunications, gaming platforms) could attract new subscribers and reduce churn.

- User Experience Optimization: Leveraging advanced data analytics and AI to personalize content recommendations and optimize the user interface will be key to maintaining high engagement levels and subscriber satisfaction.

Evolving Content Strategy and Monetization

Netflix’s evolution from a DVD rental service to a global streaming behemoth has been driven by its foresight in content strategy. The future will likely see:

- Further Revenue Diversification: Beyond subscriptions and advertising, Netflix may explore other monetization avenues, such as transactional video-on-demand (TVOD) for specific premium content, merchandising, or even deeper ventures into interactive experiences.

- Optimized Content ROI: An increased focus on the return on investment for content spending will be crucial. This involves prioritizing productions that efficiently drive subscriber acquisition, retention, and engagement, rather than solely focusing on sheer volume.

- Strategic Content Partnerships: Collaborations with other studios, creators, or even competitors on specific projects could help mitigate content costs while expanding the library and reach.

Competitive Landscape and Industry Trends

The streaming wars remain intense. Netflix operates in a highly competitive environment with major players like Disney+, Max, Amazon Prime Video, Peacock, and Apple TV+. Key considerations include:

- Consolidation: The media industry may see further consolidation, which could alter the competitive balance and create new market dynamics. Netflix’s strong position allows it to be a consolidator or a resilient competitor.

- Technological Innovation: Continued leverage of artificial intelligence (AI) for various aspects, including content recommendation, production efficiency, and personalized user experiences, will be a differentiator. The rise of new streaming technologies could also present both opportunities and challenges.

- Pricing Power: Netflix’s ability to implement strategic price adjustments without significant subscriber attrition will be a testament to its perceived value and market leadership, particularly for its premium and ad-free tiers.

NovaCast Algorithm: A Predictive Outlook for Netflix (NFLX)

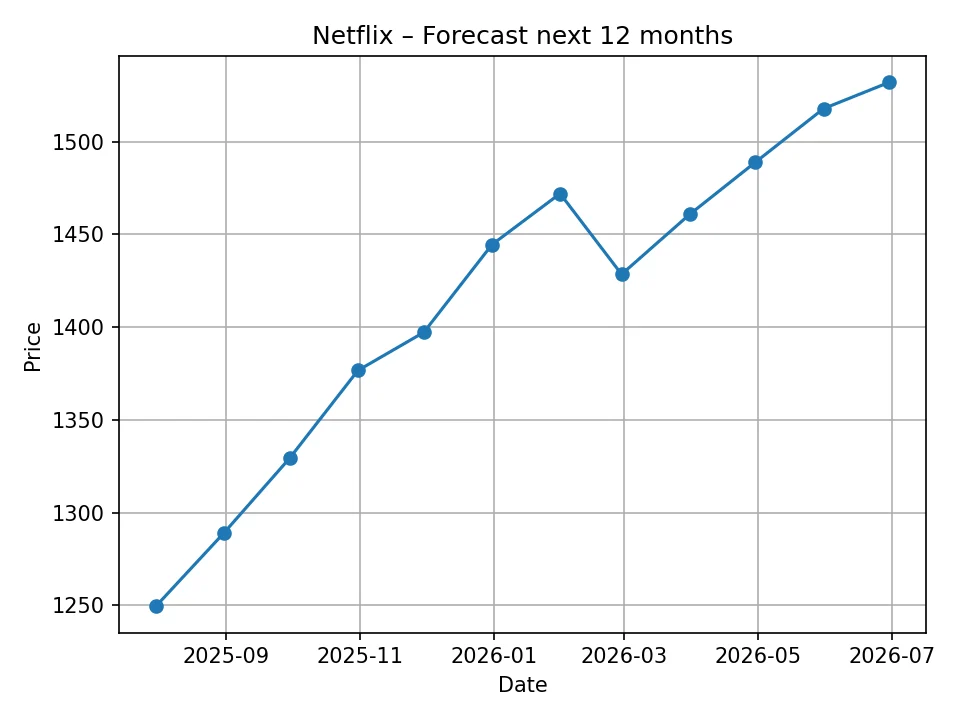

Our proprietary NovaCast algorithm, designed to analyze extensive historical data and identify underlying market patterns, provides a detailed projection for Netflix’s stock price. The algorithm considers various factors, including volume trends, volatility, and historical price movements, to generate its forward-looking estimates. It’s important to note that these are projections based on current data and algorithmic analysis, and market conditions can change rapidly.

Netflix (NFLX) Monthly Price Forecast: July 2025 – June 2026

The NovaCast algorithm projects continued positive momentum for Netflix over the next 12 months. The monthly forecast suggests a steady appreciation in value, building on the strong performance observed recently. The slight dips predicted in certain months are typical market fluctuations within a general upward trend.

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-07 | 1249.47 |

| 2025-08 | 1289.04 |

| 2025-09 | 1329.45 |

| 2025-10 | 1376.66 |

| 2025-11 | 1397.26 |

| 2025-12 | 1444.52 |

| 2026-01 | 1472.05 |

| 2026-02 | 1428.52 |

| 2026-03 | 1460.79 |

| 2026-04 | 1488.98 |

| 2026-05 | 1517.85 |

| 2026-06 | 1532.09 |

This monthly outlook suggests that Netflix is expected to maintain its growth trajectory, potentially crossing the $1500 mark within the next year. This projection indicates sustained investor confidence and operational efficiency in the short to medium term.

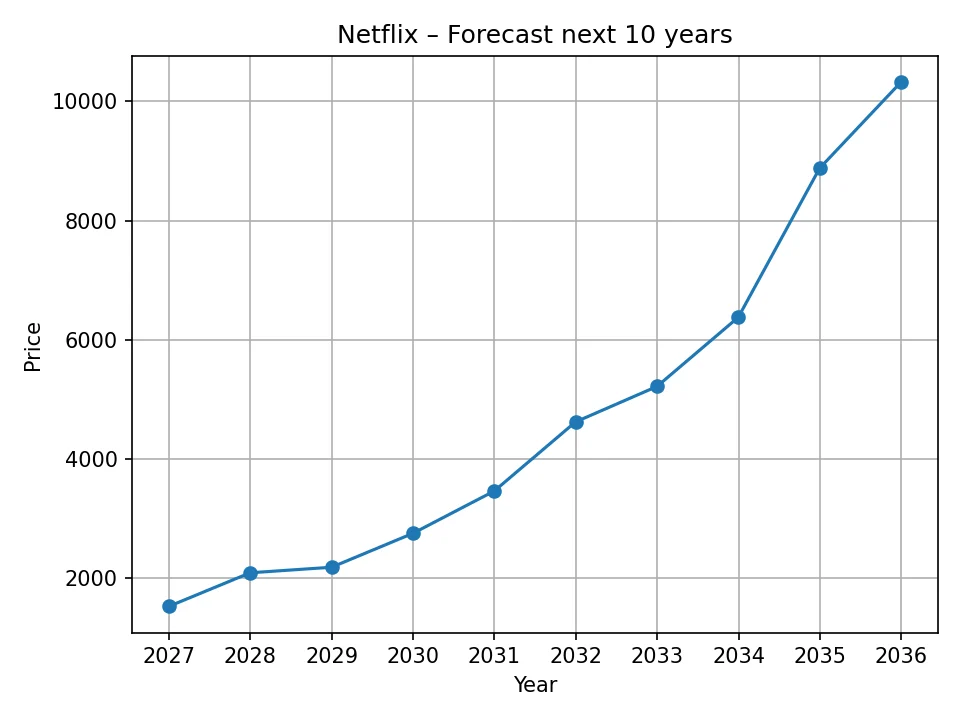

Netflix (NFLX) Annual Price Forecast: 2026 – 2035

The long-term forecast generated by the NovaCast algorithm paints an even more bullish picture for Netflix, projecting significant growth over the next decade. This forecast assumes continued innovation, successful strategic execution, and a generally favorable market environment, where Netflix continues to lead and adapt.

| Year | Projected Price (USD) |

|---|---|

| 2026 | 1532.09 |

| 2027 | 2095.19 |

| 2028 | 2188.56 |

| 2029 | 2756.82 |

| 2030 | 3466.18 |

| 2031 | 4624.64 |

| 2032 | 5220.47 |

| 2033 | 6380.91 |

| 2034 | 8878.71 |

| 2035 | 10321.98 |

The annual forecast suggests a compelling compounding growth effect, with Netflix potentially reaching well over $10,000 USD per share by 2035. This ambitious projection highlights the market’s long-term belief in the company’s ability to dominate the entertainment landscape and continuously innovate its business model, securing its position as a global leader in digital entertainment.

Strategic Outlook and Long-Term Potential

Netflix’s strategic direction appears robust, focusing on maximizing monetization while expanding its global reach and content offerings. The success of its ad-supported tiers and efforts to curb password sharing have demonstrated the company’s ability to adapt and find new avenues for revenue growth, even in a maturing market. These initiatives are not merely short-term fixes but fundamental shifts that broaden the company’s addressable market and revenue streams.

Looking further out, Netflix’s competitive advantages lie in its massive global subscriber base, extensive and continually growing content library, and sophisticated data-driven personalization capabilities. These assets allow the company to continually refine its offerings, enhance user engagement, and produce content that resonates with diverse global audiences. Potential areas for future growth and competitive differentiation include further expansion into interactive gaming, live sports broadcasting, and experimental interactive content, which could broaden its appeal beyond traditional scripted programming and create entirely new entertainment experiences.

Moreover, as the global middle class expands, especially in emerging markets, so too does the addressable market for premium streaming services. Netflix’s strong international presence, coupled with its proven ability to produce localized content that resonates with diverse cultural audiences, positions it uniquely to capitalize on this significant demographic and economic shift. This global perspective is a critical long-term strength that differentiates Netflix from many regional competitors.

Potential Headwinds and Risk Factors

- Intensifying Competition: The streaming landscape remains fiercely competitive, with well-funded competitors continually vying for market share. New entrants, aggressive content strategies from existing rivals, or unexpected market shifts could impact subscriber acquisition and retention rates.

- Content Cost Inflation: The cost of producing high-quality original content and acquiring valuable licensing rights continues to escalate. This rising cost base could potentially squeeze profit margins if not managed effectively through increased subscriptions or advertising revenue.

- Subscriber Saturation: In highly saturated markets (e.g., North America), acquiring new subscribers becomes more challenging and costly, shifting the focus primarily to retention and maximizing monetization per existing user.

- Regulatory Scrutiny: As a dominant global player, Netflix could face increased regulatory oversight in various jurisdictions. This might concern content guidelines, data privacy regulations, or even antitrust investigations, potentially impacting its operations and profitability.

- Macroeconomic Volatility: Broader economic downturns, persistent inflation, or reduced consumer discretionary spending could impact subscription numbers, advertising revenue, and overall investor sentiment towards growth stocks.

- Technological Disruption: While Netflix is an innovator, unforeseen technological shifts in content distribution or consumption patterns (e.g., widespread adoption of metaverse entertainment, new AR/VR platforms) could pose a risk if the company is slow to adapt.

Conclusion: A Bullish Trajectory with Strategic Nuances

Netflix’s journey from a disruptor to an industry titan is well-documented. The recent impressive stock performance, climbing from the $600s USD to over $1200 USD within a year, underscores its resilience and successful strategic adjustments. The NovaCast algorithm’s projections indicate a continuation of this strong upward trend, suggesting Netflix is poised for significant further growth in both the short and long term, potentially exceeding $10,000 USD by 2035.

This optimistic outlook is underpinned by Netflix’s proven ability to innovate its business model, effectively monetize its user base through initiatives like paid sharing and ad-supported tiers, and maintain its lead in premium content creation. While the competitive landscape and rising content costs present ongoing challenges, Netflix’s established global presence, data-driven approach, and commitment to diversification position it strongly for continued success. Investors will likely watch for sustained subscriber growth, efficient content spending, further diversification of revenue streams, and its strategic response to emerging technologies as key indicators of its long-term health and valuation.

***

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Price forecasts are based on current data and the proprietary NovaCast algorithmic analysis. The stock market is subject to inherent risks, and actual results may differ significantly from projections. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for the accuracy of price predictions, as they are generated by a proprietary forecasting algorithm and are subject to market volatility and unforeseen events.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.