O’Reilly Auto Parts (NASDAQ: ORLY) stands as a prominent figure in the automotive aftermarket industry, a sector characterized by its resilience and consistent demand. As of June 7, 2025, the company’s stock trades at a strong USD 1377.72, reflecting robust performance and investor confidence. This article delves into a comprehensive price forecast for O’Reilly Auto Parts, drawing upon recent historical data and advanced algorithmic projections to provide insights into its potential future trajectory. We will explore the fundamental drivers behind ORLY’s valuation, analyze its recent market movements, and present detailed short-term and long-term price predictions.

Understanding O’Reilly Auto Parts: A Pillar in the Automotive Aftermarket

O’Reilly Automotive, Inc. operates as a leading specialty retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. With a vast network of stores, the company caters to both professional service providers (Do-It-For-Me, or DIFM) and do-it-yourself (DIY) customers. This dual market strategy provides a significant competitive advantage, allowing O’Reilly to capture a broad customer base and mitigate risks associated with reliance on a single segment. The company’s success is underpinned by several key factors: an extensive inventory of high-quality parts, strong supply chain management, knowledgeable staff, and a commitment to customer service.

The automotive aftermarket industry is generally considered stable, less susceptible to economic downturns than new car sales. As vehicles age, the demand for maintenance and repair parts naturally increases. The average age of vehicles on the road in the U.S. has been consistently rising, providing a durable tailwind for companies like O’Reilly Auto Parts. Furthermore, the increasing complexity of modern vehicles necessitates specialized parts and tools, often driving customers to reputable retailers with diverse inventories.

Analyzing O’Reilly’s Recent Historical Performance

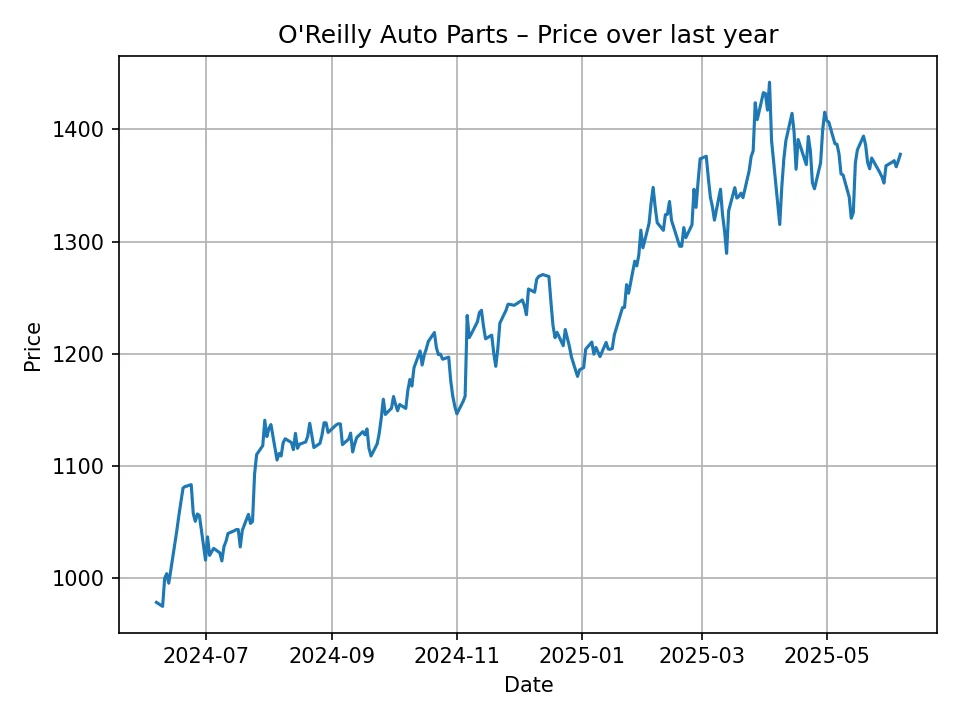

Over the past 12 months, O’Reilly Auto Parts has demonstrated a compelling growth trajectory, showcasing its ability to generate significant shareholder value. Looking back at the historical data, the stock began this period around USD 978.70. Despite typical market fluctuations, including periods of consolidation and minor pullbacks, the overarching trend has been decisively upward.

The daily historical prices illustrate a strong upward momentum, with the stock consistently setting higher lows and higher highs. Key milestones in this period include breaking past the USD 1000, then USD 1100, USD 1200, and eventually surpassing the USD 1300 mark. There have been notable surges, such as movements from the low USD 1100s to the high USD 1150s, and later from the USD 1200s to the USD 1300s. The stock even touched highs around USD 1441.89 before its current price of USD 1377.72. This performance reflects strong operational execution, favorable industry dynamics, and positive investor sentiment. The substantial increase from USD 978.70 to USD 1377.72 represents a growth of approximately 40.77% over the past year, indicating significant underlying strength and resilience in the company’s business model. This impressive growth highlights O’Reilly’s strong market position and its capacity to capitalize on the enduring demand within the automotive aftermarket.

Key Factors Influencing O’Reilly Auto Parts’ Stock Price

The future performance of O’Reilly Auto Parts, and consequently its stock price, will be shaped by a confluence of macroeconomic, industry-specific, and company-specific factors. Understanding these drivers is crucial for a nuanced price forecast.

Macroeconomic Environment and Consumer Behavior

- Disposable Income and Consumer Spending: While automotive maintenance is often non-discretionary, the timing of certain repairs can be influenced by consumers’ financial health. Higher disposable incomes generally support stronger spending on vehicle upkeep.

- Inflation and Interest Rates: Inflationary pressures can impact O’Reilly’s cost of goods sold and operating expenses, potentially squeezing margins. Rising interest rates can affect consumer financing for larger repairs and the company’s borrowing costs for expansion.

- Economic Stability: A stable economic environment typically encourages consumers to maintain their existing vehicles rather than purchasing new ones, benefiting the aftermarket. Conversely, a significant economic downturn could lead to delayed maintenance, though essential repairs would still be performed.

Automotive Aftermarket Industry Trends

- Aging Vehicle Fleet: The increasing average age of vehicles on the road is a primary driver for aftermarket demand. Older vehicles require more frequent and extensive repairs, providing a consistent revenue stream for O’Reilly.

- Vehicle Miles Traveled (VMT): More driving leads to increased wear and tear on vehicles, boosting demand for parts and services.

- E-commerce and Competition: The rise of online auto parts retailers presents a competitive challenge. O’Reilly’s ability to offer immediate availability, professional advice, and convenient in-store pickup and services remains a key differentiator against purely online players.

- Complexity of Modern Vehicles: As vehicles become more technologically advanced, repairs often require specialized parts and diagnostic tools. O’Reilly’s robust inventory and trained staff can cater to this growing complexity, solidifying its expert position.

- Electric Vehicle (EV) Adoption: While still a relatively small segment, the long-term shift towards EVs could impact the aftermarket. EVs generally have fewer moving parts requiring traditional maintenance (e.g., oil changes, spark plugs). However, they still need tires, brakes, suspension components, and specialized EV-specific parts. O’Reilly’s ability to adapt its inventory and expertise to cater to EV maintenance needs will be crucial in the long run.

Company-Specific Strengths and Strategies

- Store Expansion and Market Penetration: O’Reilly’s continued expansion into new markets and densification of existing ones drives revenue growth and market share.

- Supply Chain Efficiency: Effective inventory management and a robust distribution network ensure part availability, a critical factor for both DIY and professional customers.

- Professional Business Growth (DIFM): Investing in programs and services tailored for professional installers can capture a higher-value segment of the market, as DIFM customers often purchase more expensive or specialized parts.

- Customer Service and Brand Reputation: O’Reilly’s reputation for knowledgeable staff and strong customer service fosters loyalty and repeat business.

- Financial Health: Strong balance sheet, healthy cash flow, and effective capital allocation (e.g., share buybacks, strategic acquisitions) can boost investor confidence and intrinsic value.

- Technological Integration: Leveraging technology for inventory management, online ordering, and customer engagement can enhance operational efficiency and customer experience.

The interplay of these factors will dictate O’Reilly’s future financial performance and, by extension, its stock price. While the automotive aftermarket generally exhibits stability, O’Reilly’s proactive strategies and adaptability will be paramount in sustaining its growth trajectory.

O’Reilly Auto Parts: Monthly Price Forecast (ClearSight Algorithm)

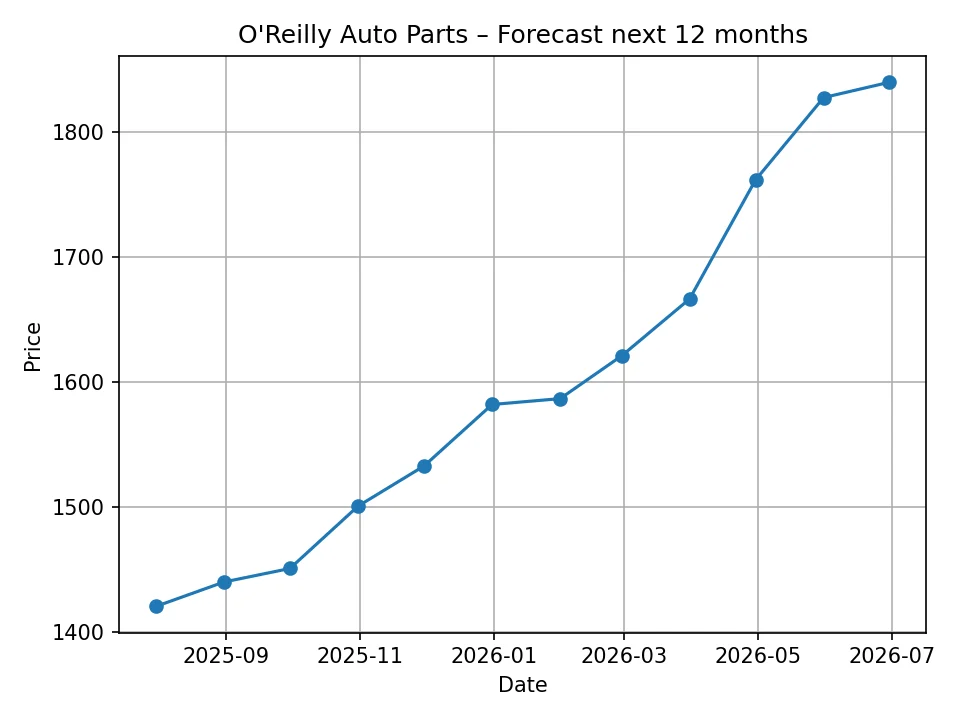

Our proprietary “ClearSight” algorithm has processed historical data and market indicators to generate a detailed 12-month price forecast for O’Reilly Auto Parts. This short-term outlook provides insights into the potential monthly progression of ORLY’s stock price.

The monthly forecast suggests a continuation of the upward trend observed over the past year. Starting from the current price of USD 1377.72, the ClearSight algorithm projects steady growth, with the stock expected to consistently increase in value month-over-month. By the end of 2025, the price is anticipated to approach USD 1582.16, indicating a significant appreciation from the current levels. The momentum is expected to carry into 2026, with the forecast showing continued robust performance, reaching an estimated USD 1839.97 by June 2026. This projection implies a confidence in O’Reilly’s operational strength, favorable industry conditions, and its ability to maintain its market leadership. Investors can observe the anticipated growth as a reflection of sustained demand in the automotive aftermarket and O’Reilly’s effective business strategies.

ORLY Monthly Price Forecast (June 2025 – June 2026)

| Month/Year | Projected Price (USD) |

|---|---|

| July 2025 | 1420.67 |

| August 2025 | 1440.18 |

| September 2025 | 1450.98 |

| October 2025 | 1500.84 |

| November 2025 | 1532.95 |

| December 2025 | 1582.16 |

| January 2026 | 1586.85 |

| February 2026 | 1621.09 |

| March 2026 | 1666.64 |

| April 2026 | 1761.78 |

| May 2026 | 1827.67 |

| June 2026 | 1839.97 |

O’Reilly Auto Parts: Long-Term Price Forecast (ClearSight Algorithm)

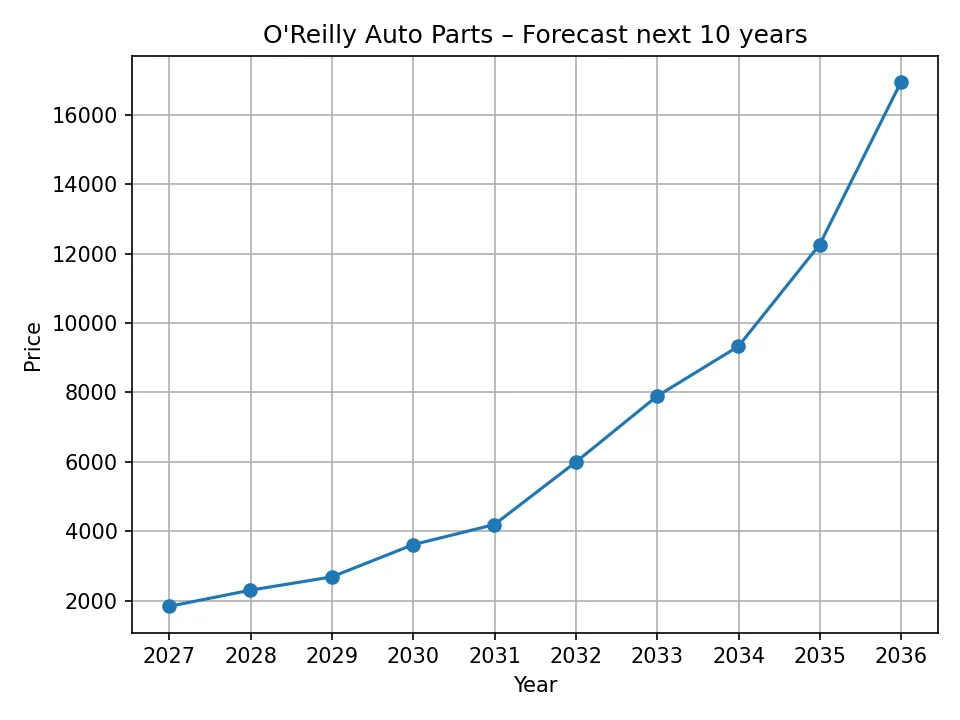

The long-term forecast, extending over the next decade, presents a highly optimistic outlook for O’Reilly Auto Parts, according to the ClearSight algorithm. These projections are built on the assumption that the company will continue to successfully execute its growth strategies, adapt to industry changes, and benefit from the enduring trends in the automotive aftermarket.

The annual forecast paints a picture of significant compounding growth. From an estimated USD 1839.97 at the close of 2026, the ClearSight algorithm projects ORLY’s stock price to reach substantial levels by the end of the forecast period. By 2030, the price is predicted to exceed USD 4000, reaching USD 4195.36. The projections continue to show accelerated growth, with the stock potentially soaring to over USD 9000 by 2033 (USD 9326.39), and ultimately breaking the USD 10,000 barrier, with a forecast of USD 16932.37 by 2035. This ambitious long-term outlook underscores the potential for O’Reilly Auto Parts to generate exceptional returns for long-term investors, premised on sustained operational excellence, market expansion, and the fundamental strength of the automotive aftermarket. It suggests that ORLY could remain a dominant player, continuing to capture a significant share of a growing market.

ORLY Annual Price Forecast (2026 – 2035)

| Year | Projected Price (USD) |

|---|---|

| 2026 | 1839.97 |

| 2027 | 2305.60 |

| 2028 | 2689.06 |

| 2029 | 3616.23 |

| 2030 | 4195.36 |

| 2031 | 5989.64 |

| 2032 | 7893.25 |

| 2033 | 9326.39 |

| 2034 | 12255.67 |

| 2035 | 16932.37 |

Key Considerations for Investors

While the price forecasts for O’Reilly Auto Parts present a compelling picture of growth, it is crucial for investors to approach these projections with a balanced perspective. Stock market investments inherently carry risks, and future performance is subject to various factors that can deviate from even the most sophisticated models.

Understanding Forecast Limitations

- Algorithmic Assumptions: The ClearSight algorithm, like any predictive model, operates based on historical patterns and assumptions about future conditions. Unforeseen market shifts, disruptive technologies, or significant changes in consumer behavior could impact the accuracy of these long-term projections.

- Market Volatility: Even fundamentally strong companies experience price fluctuations due to broader market sentiment, geopolitical events, or economic data releases. Short-term volatility can be significant, regardless of long-term trends.

- Competitive Landscape: While O’Reilly is a leader, the automotive aftermarket is competitive. Aggressive strategies from competitors like AutoZone or Advance Auto Parts, or the emergence of new business models, could affect market share and profitability.

Risks and Opportunities

- Economic Headwinds: A severe recession could reduce discretionary spending on vehicle maintenance, although essential repairs would likely continue. High inflation or prolonged supply chain issues could also impact profitability.

- Technological Disruption: The accelerating shift towards electric vehicles (EVs) and autonomous driving could fundamentally alter the aftermarket. While O’Reilly is adapting, the pace and extent of this transition remain key variables. Investors should monitor the company’s strategies for EV parts and service capabilities.

- Regulatory Changes: New regulations related to vehicle safety, emissions, or environmental standards could affect the types of parts required and the cost of doing business.

- Acquisition Strategy: O’Reilly has historically grown through strategic acquisitions. Future acquisitions could be accretive or dilutive depending on their success and integration.

Investor Due Diligence

- Fundamental Analysis: Investors should conduct their own thorough fundamental analysis, examining O’Reilly’s financial statements, earnings reports, debt levels, and cash flow to assess its intrinsic value and operational health.

- Industry Analysis: Stay informed about the broader automotive aftermarket trends, including vehicle demographics, repair cycles, and emerging technologies.

- Competitive Analysis: Monitor the performance of O’Reilly’s key competitors to understand the competitive dynamics and market positioning.

- Risk Tolerance: Align investment decisions with personal financial goals and risk tolerance. Long-term investments in growth stocks like ORLY typically require patience and a willingness to withstand short-term volatility.

- Diversification: No single stock, regardless of its strong outlook, should constitute an excessively large portion of an investment portfolio. Diversification across various assets and sectors is crucial for managing risk.

Considering these points, O’Reilly Auto Parts appears well-positioned to leverage its strengths in a stable industry. However, continuous monitoring of market conditions, industry evolution, and company performance will be essential for investors aiming to capitalize on its potential growth.

Conclusion

O’Reilly Auto Parts has demonstrated remarkable resilience and growth over the past year, solidifying its position as a dominant force in the automotive aftermarket. With a current price of USD 1377.72 as of June 7, 2025, the company has shown impressive upward momentum driven by an aging vehicle fleet, consistent demand for maintenance, and effective operational strategies.

The ClearSight algorithm’s monthly forecast indicates a continued positive trajectory, with ORLY’s stock price projected to reach approximately USD 1839.97 by June 2026. This short-term outlook reflects confidence in the company’s immediate future performance and its ability to capitalize on favorable industry conditions.

Looking further ahead, the long-term annual forecast is even more ambitious, with projections reaching USD 16932.37 by 2035. This significant growth potential is predicated on O’Reilly’s sustained market leadership, its adaptability to evolving automotive technologies, and its consistent ability to meet the needs of both DIY and professional customers.

While these forecasts highlight a strong outlook, it is imperative for investors to exercise due diligence. The automotive aftermarket, like any sector, is subject to economic shifts, technological advancements, and competitive pressures. O’Reilly’s ability to navigate these dynamics will be crucial to realizing these impressive long-term projections. For investors seeking exposure to a robust and stable industry with significant growth potential, O’Reilly Auto Parts presents a compelling case, backed by both historical performance and algorithmic projections.

Please note: This article is based on a proprietary forecasting algorithm (“ClearSight”) and does not constitute financial advice. The projections provided are for informational purposes only and are subject to market volatility and unforeseen events. We are not responsible for the accuracy of these price predictions, and investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.