PulteGroup (PHM), a prominent player in the residential construction sector, holds a significant position within the broader housing market. As of June 6, 2025, its stock trades at USD 101.64, a figure that captures the interplay of dynamic market forces, investor sentiment, and the fundamental strengths and challenges inherent to the homebuilding industry. For investors and market observers, understanding the intricate web of factors that shape PulteGroup’s valuation is crucial for informed decision-making. This comprehensive analysis delves into PHM’s recent historical performance, dissects the key drivers impacting its stock, and presents a detailed price forecast generated by a proprietary algorithmic model, providing both short-term and long-term perspectives.

PulteGroup: A Leading Force in Home Construction

PulteGroup, Inc. is one of the largest homebuilders in the United States, operating across more than 40 markets. The company’s diversified portfolio includes brands like Pulte Homes, Centex, Del Webb, DiVosta, and John Wieland Homes and Neighborhoods, catering to a wide spectrum of buyers – from first-time homeowners to move-up and active adult communities. This multi-brand strategy allows PulteGroup to address various demographic and geographic demands, providing a robust foundation for its operations.

The homebuilding industry is inherently cyclical, heavily influenced by macroeconomic conditions, interest rate fluctuations, consumer confidence, and the delicate balance of housing supply and demand. PulteGroup’s success hinges on its ability to navigate these cycles, effectively manage land acquisition and development, control construction costs, and efficiently market and sell homes. Its scale provides certain advantages, including strong relationships with suppliers, access to capital, and the ability to leverage economies of scale in construction and purchasing.

Analyzing PulteGroup’s Recent Historical Performance

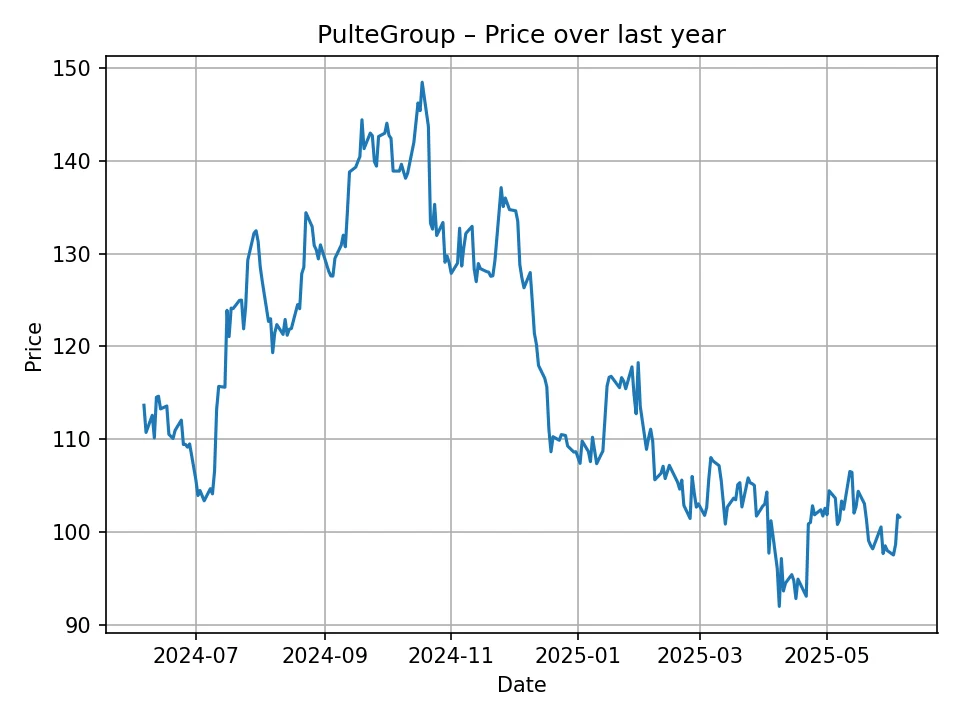

Over the past twelve months, PulteGroup’s stock has exhibited considerable volatility, reflecting the broader uncertainties and opportunities within the U.S. housing market. The daily historical price data reveals a range of values, demonstrating the dynamic nature of investor perceptions and market conditions.

The provided historical data points, encompassing 298 daily observations, show that PHM’s stock price has fluctuated significantly. The lowest recorded price during this period was approximately USD 92.02, while the highest reached approximately USD 148.44. The average price over the last year stands at approximately USD 107.68. At its current price of USD 101.64, PulteGroup is trading below its 12-month average, closer to the lower end of its historical range.

This performance narrative suggests a period of adjustment for the stock. Earlier peaks, such as those seen closer to the USD 140-148 range, might have been driven by periods of robust housing demand, potentially lower interest rates, or optimistic market sentiment regarding the future of the housing sector. Subsequent declines, bringing the price down to its current level, could be attributed to rising mortgage rates, concerns over housing affordability, inflationary pressures impacting construction costs, or a general slowdown in economic growth. The residential construction sector is acutely sensitive to these shifts, as they directly influence buyer purchasing power and development feasibility.

Key Factors Influencing PulteGroup’s Stock Valuation

PulteGroup’s stock price is a complex reflection of numerous interconnected factors, ranging from broad macroeconomic trends to company-specific strategic decisions. Understanding these influences is paramount for any forward-looking analysis.

Macroeconomic Factors

- Interest Rates: Perhaps the most significant driver for homebuilders, interest rates directly impact mortgage affordability. Higher rates cool demand, leading to fewer new home sales and potentially lower prices, while lower rates stimulate the market. The Federal Reserve’s monetary policy, particularly its stance on the federal funds rate, is therefore a critical watchpoint.

- Inflation: Inflation affects both the demand side (eroding purchasing power) and the supply side (increasing material and labor costs). Persistent inflation can compress profit margins for homebuilders like PulteGroup, even if demand remains relatively stable.

- GDP Growth and Employment: A strong economy, characterized by robust GDP growth and low unemployment rates, generally supports housing demand. Consumers are more confident about making large purchases, like homes, when their job security and financial outlook is positive.

- Consumer Confidence: This metric reflects households’ optimism about their financial situation and the broader economic outlook. High consumer confidence often translates into increased willingness to invest in real estate.

- Demographic Shifts: Long-term trends such as population growth, household formation rates, and the aging of the population (e.g., demand for active adult communities served by Del Webb) play a crucial role in shaping housing demand across different segments.

Housing Market Specifics

- Housing Supply and Demand: The fundamental balance between available homes and buyer interest dictates price movements. A shortage of inventory tends to drive prices up, benefiting builders, while an oversupply can lead to price concessions.

- Building Permits and Housing Starts: These forward-looking indicators provide insight into the pace of future construction activity. A decline can signal a slowdown in the industry, while an increase suggests robust growth.

- Existing Home Sales: The volume of existing homes sold can influence the new home market. A sluggish resale market might mean fewer trade-up buyers for new homes.

- Land Availability and Costs: Access to desirable, developable land at reasonable costs is fundamental to a homebuilder’s profitability. Rising land costs can squeeze margins or necessitate higher selling prices, potentially dampening demand.

- Material and Labor Costs: Prices of construction materials (lumber, steel, concrete) and the availability and cost of skilled labor directly impact a homebuilder’s cost of goods sold. Supply chain disruptions can exacerbate these issues.

Company-Specific Factors

- Earnings Performance: Quarterly and annual earnings reports provide insights into PulteGroup’s profitability, revenue growth, order backlogs, and future outlook. Strong financial results typically boost investor confidence.

- Strategic Initiatives: Investments in new markets, product diversification, efficiency improvements, and digital sales platforms can enhance competitive positioning and future growth.

- Debt Levels and Financial Health: A company’s balance sheet strength, including its debt-to-equity ratio and liquidity, influences its ability to fund new projects and weather economic downturns.

- Geographic Diversification: PulteGroup’s presence across multiple regions mitigates risks associated with downturns in specific local markets. However, regional economic disparities can still impact overall performance.

- Dividend Policy and Share Buybacks: Returns to shareholders through dividends or share repurchases can signal financial health and commitment to shareholder value, attracting investors.

The ClearSight Algorithmic Prediction Methodology

Forecasting stock prices is an inherently complex endeavor, particularly in sectors as dynamic as homebuilding. The price predictions for PulteGroup presented in this article are derived from ClearSight, a proprietary algorithmic model designed to analyze vast amounts of historical data and identify patterns, trends, and correlations that may inform future price movements.

While the specifics of the ClearSight algorithm are proprietary, its core methodology typically involves a sophisticated blend of analytical techniques:

- Quantitative Analysis: This forms the backbone of the algorithm, incorporating various mathematical and statistical models. It processes historical stock prices, trading volumes, and potentially other quantitative market data to identify trends, momentum indicators, support and resistance levels, and volatility patterns.

- Time Series Analysis: The algorithm uses advanced time series models (e.g., ARIMA, GARCH, Prophet) to forecast future values based on past observations, accounting for seasonality, trends, and cyclical components inherent in stock data.

- Machine Learning Models: Techniques such as neural networks, random forests, and support vector machines are often employed to learn complex relationships within the data, identifying non-linear patterns that traditional statistical methods might miss. These models can adapt and improve their predictions as more data becomes available.

- Fundamental Data Integration (where available): While the primary input here is price data, advanced algorithms often attempt to indirectly factor in fundamental metrics or their market reaction, using historical correlations between financial reports and stock price movements.

- Market Sentiment Analysis: Some advanced models also incorporate proxies for market sentiment, although this is more challenging without specific textual data inputs. Price action itself often reflects aggregated market sentiment.

It is crucial to understand that while ClearSight employs rigorous statistical and computational methods, all price predictions are probabilistic in nature and inherently carry risk. They are based on past performance and extrapolated trends, which may not always hold true in unpredictable market conditions. Unexpected geopolitical events, sudden economic policy shifts, unprecedented technological disruptions, or unforeseen company-specific challenges can significantly alter a stock’s trajectory, rendering even the most sophisticated predictions inaccurate. Therefore, these forecasts should be viewed as informed projections within a range of possibilities, not as guaranteed outcomes.

PulteGroup Price Forecast: Short-Term Outlook (12 Months)

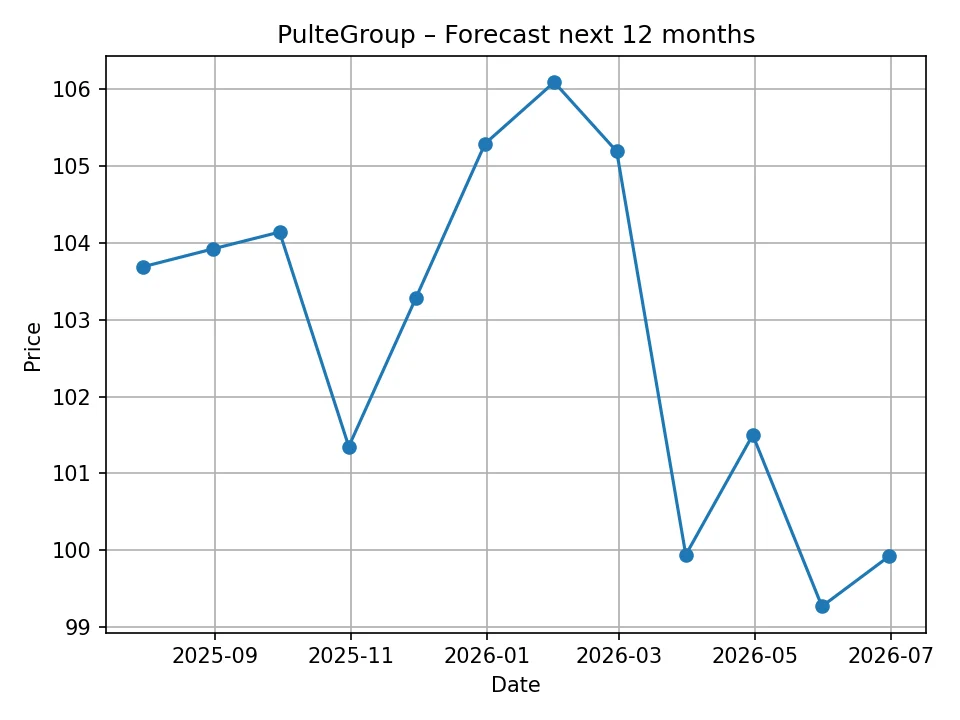

The short-term forecast, generated by the ClearSight algorithm, provides a granular view of PulteGroup’s projected monthly performance over the next year. This period is often influenced by current economic cycles, prevailing interest rate expectations, and immediate housing market dynamics.

Here is the detailed 12-month monthly price forecast for PulteGroup (PHM):

| Month | Forecast Price (USD) |

|---|---|

| July 2025 | 103.69 |

| August 2025 | 103.92 |

| September 2025 | 104.14 |

| October 2025 | 101.35 |

| November 2025 | 103.28 |

| December 2025 | 105.29 |

| January 2026 | 106.09 |

| February 2026 | 105.19 |

| March 2026 | 99.94 |

| April 2026 | 101.50 |

| May 2026 | 99.27 |

| June 2026 | 99.92 |

The monthly forecast indicates a relatively stable to slightly fluctuating period for PulteGroup over the coming year. Beginning in July 2025, the price is projected to see a modest increase from its current USD 101.64, reaching USD 103.69 and continuing a slight upward trend through September, hitting USD 104.14. A minor dip is projected for October 2025 to USD 101.35, followed by a recovery towards the end of 2025, culminating in USD 105.29 by December. The peak within this 12-month window appears to be in January 2026, reaching USD 106.09.

However, the forecast suggests a subsequent downturn in the spring of 2026. The price is projected to decline significantly in March 2026 to USD 99.94, dipping below the current price of 101.64 and reaching its lowest point in this 12-month forecast at USD 99.27 in May 2026. The period concludes in June 2026 with a projected price of USD 99.92, which is slightly below the current trading level.

This short-term volatility could be influenced by seasonal housing market trends, anticipated shifts in interest rate policy by central banks, or evolving investor sentiment regarding the residential construction outlook. For instance, the dip in spring 2026 might reflect a period of anticipated higher interest rates or a slowdown in homebuyer activity following a potentially strong winter season. Conversely, the gradual recovery projected towards the end of 2025 suggests a period where the market might anticipate a more favorable economic environment or continued demand. Investors should consider these potential short-term swings when evaluating entry or exit points within this timeframe.

PulteGroup Price Forecast: Long-Term Outlook (10 Years)

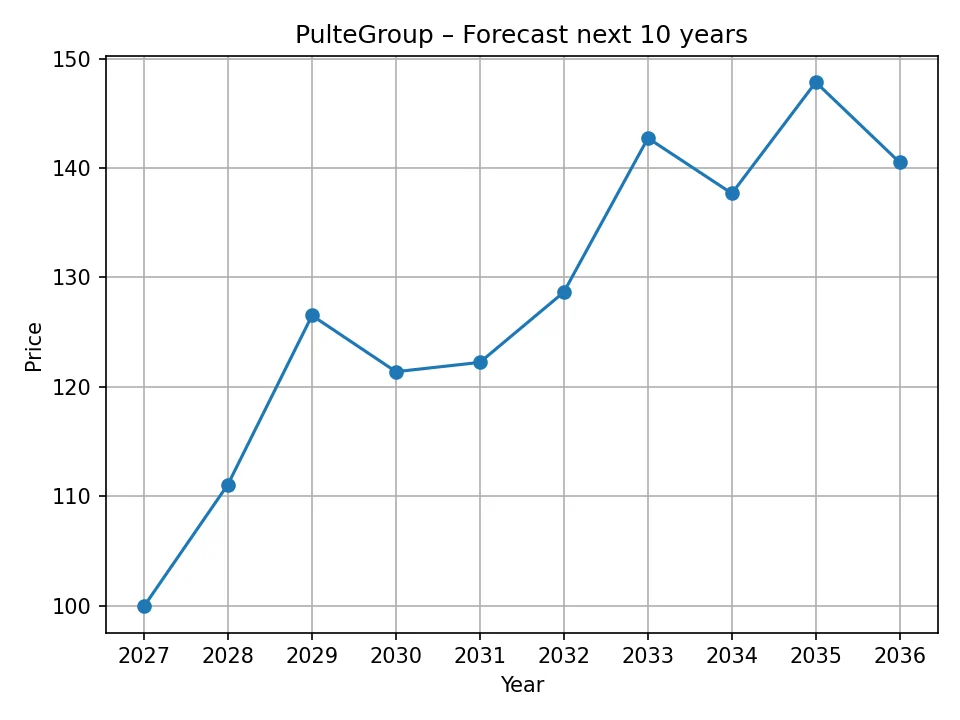

The long-term forecast provides a broader perspective on PulteGroup’s potential stock trajectory over the next decade. These projections tend to factor in larger economic cycles, demographic shifts, and the company’s sustained competitive advantages.

Here is the detailed 10-year annual price forecast for PulteGroup (PHM):

| Year | Forecast Price (USD) |

|---|---|

| 2026 | 99.92 |

| 2027 | 111.06 |

| 2028 | 126.52 |

| 2029 | 121.38 |

| 2030 | 122.23 |

| 2031 | 128.65 |

| 2032 | 142.74 |

| 2033 | 137.68 |

| 2034 | 147.85 |

| 2035 | 140.51 |

The long-term forecast paints a generally optimistic picture for PulteGroup, projecting significant growth from its current price of USD 101.64, albeit with periods of consolidation or slight correction. The year 2026 is projected to close at USD 99.92, aligning with the end of the monthly forecast and indicating a near-term dip from the current price. However, from 2027 onwards, the algorithm forecasts a strong recovery and consistent upward trend.

By 2027, the price is expected to rebound to USD 111.06, followed by substantial growth to USD 126.52 in 2028. A slight correction is projected for 2029, dipping to USD 121.38, before resuming an upward trajectory to USD 122.23 in 2030 and USD 128.65 in 2031. The forecast indicates a significant leap in 2032, reaching USD 142.74, nearing its 12-month historical high. While a modest dip to USD 137.68 is expected in 2033, the peak of this 10-year forecast is set for 2034, with a projected price of USD 147.85, very close to its recent 12-month high. The decade concludes in 2035 at USD 140.51, reflecting a strong overall long-term appreciation from current levels.

This long-term outlook suggests that the ClearSight algorithm anticipates a resilient housing market in the coming years, likely driven by factors such as demographic tailwinds (e.g., millennials entering prime homebuying years), sustained demand for housing, and PulteGroup’s ability to adapt to changing market conditions. While the cyclical nature of the industry means some downturns are expected (as seen in 2029 and 2033), the overall trend points towards a robust recovery and expansion for the homebuilding giant. Such a trajectory would require favorable economic conditions, manageable interest rates, and PulteGroup’s continued operational efficiency and strategic prowess in land acquisition and new home development.

Investment Considerations and Risks

Investing in PulteGroup, or any homebuilder, requires a thorough understanding of the industry’s specific opportunities and inherent risks.

Opportunities for Growth

- Underlying Housing Demand: Despite recent volatility, long-term housing demand in the U.S. remains strong, fueled by population growth, household formation, and an aging housing stock needing replacement or upgrades.

- Demographic Tailwinds: The large millennial generation is increasingly reaching peak homebuying age, potentially providing a sustained demand base for new homes.

- Supply-Demand Imbalance: In many markets, there’s still a structural undersupply of housing units relative to demand, which could support higher prices and sales volumes for builders.

- Operational Efficiency: PulteGroup’s scale allows for efficient supply chain management, bulk purchasing, and streamlined construction processes, which can help mitigate cost pressures.

- Strategic Land Position: The company’s disciplined approach to land acquisition in desirable growth markets positions it well for future development.

Potential Risks and Challenges

- Interest Rate Sensitivity: The most significant risk remains the Federal Reserve’s monetary policy. Sustained high interest rates or further increases could severely dampen housing demand and affordability.

- Economic Downturns: A recession would lead to job losses, reduced consumer confidence, and tightened credit conditions, all of which negatively impact the housing market.

- Inflationary Pressures: Rising costs for labor, land, and building materials can erode profit margins, even if demand remains stable.

- Supply Chain Disruptions: Global and domestic supply chain issues can cause delays, increase costs, and impact the timely delivery of homes.

- Regulatory Environment: Changes in zoning laws, building codes, environmental regulations, or land use policies can increase development costs and timelines.

- Labor Shortages: A persistent shortage of skilled construction labor can drive up wages and slow down construction progress.

- Competition: The homebuilding market is competitive, with numerous national and regional players vying for market share.

Conclusion

PulteGroup (PHM) operates within a vital yet cyclical sector of the U.S. economy. Its historical performance over the past year highlights the volatility intrinsic to the homebuilding industry, with significant fluctuations influenced by a myriad of macroeconomic and sector-specific factors. The current trading price of USD 101.64 sits below its 12-month average, suggesting a period of market adjustment.

The ClearSight algorithmic forecast offers a detailed glimpse into potential future price movements. In the short term (next 12 months), the outlook suggests some initial modest gains followed by a notable dip in spring 2026, bringing the price slightly below its current level. This indicates a period of potential near-term headwinds or market corrections.

However, the long-term forecast (next 10 years) paints a more optimistic picture, projecting significant growth for PulteGroup’s stock. Despite anticipating some cyclical corrections, the overall trend points towards substantial appreciation, with the price potentially reaching new highs close to USD 148 by 2034. This long-term optimism is likely predicated on the enduring demand for housing, demographic shifts, and the company’s ability to capitalize on these underlying drivers while navigating market challenges.

For investors, understanding PulteGroup’s position within these projected trends requires careful consideration of the complex interplay between interest rates, economic growth, housing supply and demand, and the company’s strategic execution. As with all investments, the journey of PulteGroup’s stock price will be shaped by a continuous evolution of market conditions and unforeseen events.

Disclaimer: This article provides a price forecast for PulteGroup (PHM) based on an analysis conducted using the proprietary ClearSight algorithmic model. Please note that stock price predictions are inherently uncertain and speculative. Past performance is not indicative of future results. The information provided in this article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves significant risks, including the potential loss of principal. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any investment losses that may arise from reliance on the forecasts or information presented herein.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.