The Walt Disney Company (DIS) stands as a global titan in the entertainment industry, a multifaceted conglomerate whose influence spans across film, television, theme parks, consumer products, and direct-to-consumer streaming services. As of June 3, 2025, DIS shares are trading at $112.95 USD, a price point that reflects a period of significant strategic realignment and market adaptation for the venerable company. Investors and analysts keenly observe Disney’s trajectory, grappling with the interplay of its legacy businesses and its ambitious ventures into the digital streaming landscape. This comprehensive analysis delves into Disney’s recent performance, explores the pivotal factors shaping its financial outlook, and presents detailed price forecasts for both the short and long term, powered by our proprietary PriceCast algorithm. Understanding these dynamics is crucial for anyone considering an investment in this iconic American enterprise.

A Legacy of Innovation: Understanding The Walt Disney Company’s Core Businesses

The Walt Disney Company’s enduring strength derives from its diversified portfolio, which includes two primary segments: Disney Entertainment and Parks, Experiences and Products. Disney Entertainment encompasses the company’s vast content creation and distribution efforts, including its world-renowned film studios (Walt Disney Pictures, Pixar, Marvel Studios, Lucasfilm, 20th Century Studios, Searchlight Pictures), television networks (ABC, ESPN, Disney Channel), and its cornerstone streaming services: Disney+, Hulu, and ESPN+. This segment is at the forefront of Disney’s pivot towards a direct-to-consumer future, emphasizing subscriber growth and the eventual profitability of its streaming platforms.

The Parks, Experiences and Products segment represents Disney’s physical footprint and its ability to immerse consumers in its fantastical worlds. This includes its global portfolio of theme parks and resorts (Disneyland, Walt Disney World, international parks), Disney Cruise Line, and its extensive consumer products licensing operations. This segment has historically been a significant revenue driver, benefiting from robust consumer demand for unique, experiential entertainment and brand loyalty. The interplay between these segments – where beloved characters and stories created by Disney Entertainment are brought to life in its Parks and products – creates a powerful synergistic effect that few companies can replicate.

Navigating the Market: A Look at DIS Historical Performance (June 2024 – June 2025)

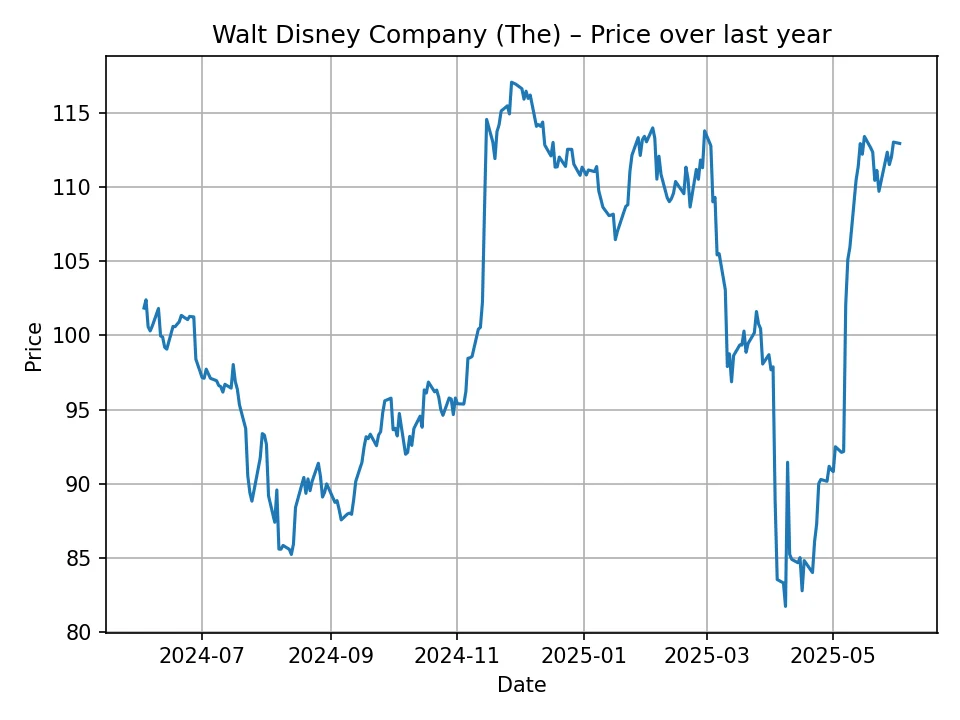

Over the past 12 months, The Walt Disney Company’s stock has experienced notable fluctuations, reflecting both broader market sentiment and specific company developments. The historical data provided, spanning daily closing prices from early June 2024 to early June 2025, reveals a journey from lows in the $80s USD to its current level above $110 USD.

Initially, during the summer and early fall of 2024, DIS shares traded within a relatively tight range, often dipping into the low $90s and even hitting an annual low around $81.72 USD. This period was characterized by investor concerns surrounding the profitability of its streaming segment, declining linear TV revenues, and broader economic uncertainties impacting consumer spending on leisure and entertainment. The company was also undergoing significant leadership changes and strategic reviews under the re-instated CEO, Bob Iger, which initially added a layer of uncertainty.

However, a discernible upward trend began to emerge in late 2024 and accelerated into early 2025. Prices saw a significant rebound, breaking above the $100 USD mark and reaching peaks around $117 USD. This recovery was largely fueled by more positive quarterly earnings reports, particularly improved profitability trends in the direct-to-consumer segment, stronger-than-expected performance from Parks & Resorts, and a more defined strategic roadmap for the company’s future. Announcements regarding cost-cutting measures, dividend reinstatement, and strategic partnerships (such as the ESPN joint venture) also contributed to increased investor confidence. The stock’s current price of $112.95 USD on June 3, 2025, positions it well above its 12-month low, indicating a positive shift in market perception following its strategic adjustments and renewed focus on profitability across all its segments.

Key Drivers and Headwinds: Factors Influencing Disney’s Stock Price

The future trajectory of DIS stock is intricately linked to a multitude of internal strategies and external market forces. Understanding these factors is paramount for any forward-looking price analysis.

Streaming Profitability and Growth

The success of Disney’s direct-to-consumer (DTC) segment, primarily Disney+, Hulu, and ESPN+, remains a central determinant of investor confidence. The company has made significant strides towards achieving streaming profitability, driven by price increases, tighter content spending, and improved subscriber management. Future growth in subscribers, especially internationally, and the ability to maintain or accelerate the path to sustained profitability for these platforms will be key catalysts for stock appreciation. Content strategy, including the balance of original productions and library content, also plays a crucial role.

Performance of Parks, Experiences and Products

Disney’s theme parks and resorts are vital cash cows, but their performance is sensitive to consumer discretionary spending, travel trends, and global economic health. Factors such as attendance levels, per-capita spending, new attractions, and the company’s ability to manage operational costs will directly impact this segment’s profitability. International parks, particularly those in Asia, offer significant growth potential as global travel continues to normalize and expand.

Studio Entertainment and Content Pipeline

The box office performance of new film releases from Disney’s powerful studios (Marvel, Pixar, Lucasfilm, etc.) continues to influence revenue and brand strength. While streaming has changed consumption habits, successful theatrical releases still drive cultural relevance and feed into merchandise and park attendance. A robust and well-received content pipeline across both film and television is essential for maintaining Disney’s competitive edge and attracting subscribers to its DTC services.

Linear Networks Challenges

The ongoing cord-cutting trend poses a significant challenge for Disney’s traditional linear television networks, including ESPN and the ABC network. While efforts are underway to transition these assets into the digital age (e.g., ESPN’s direct-to-consumer ambitions), managing the decline of traditional TV while building new digital revenue streams is a delicate balance. Any unexpected acceleration of linear network decline or difficulties in their DTC pivot could weigh on the stock.

Macroeconomic Environment

Broader economic conditions, such as inflation, interest rates, and consumer confidence, directly impact Disney. High inflation can reduce consumer discretionary spending, affecting park visits and streaming subscriptions. Conversely, a strong economy with stable consumer spending provides a favorable environment for Disney’s diverse offerings.

Competition and Innovation

Disney operates in highly competitive markets. In streaming, it faces formidable rivals like Netflix, Amazon Prime Video, and Warner Bros. Discovery. In theme parks, competition comes from other entertainment destinations. Disney’s ability to innovate, adapt to changing consumer preferences, and maintain its unique brand appeal will be critical in sustaining its market leadership.

Management and Strategic Decisions

Investor confidence often hinges on the clarity and effectiveness of management’s strategic vision. Decisions regarding capital allocation, M&A activity, cost efficiencies, and talent management under Bob Iger’s leadership will profoundly shape the company’s financial performance and investor sentiment.

Short-Term Horizon: Monthly Price Forecast for DIS (Next 12 Months)

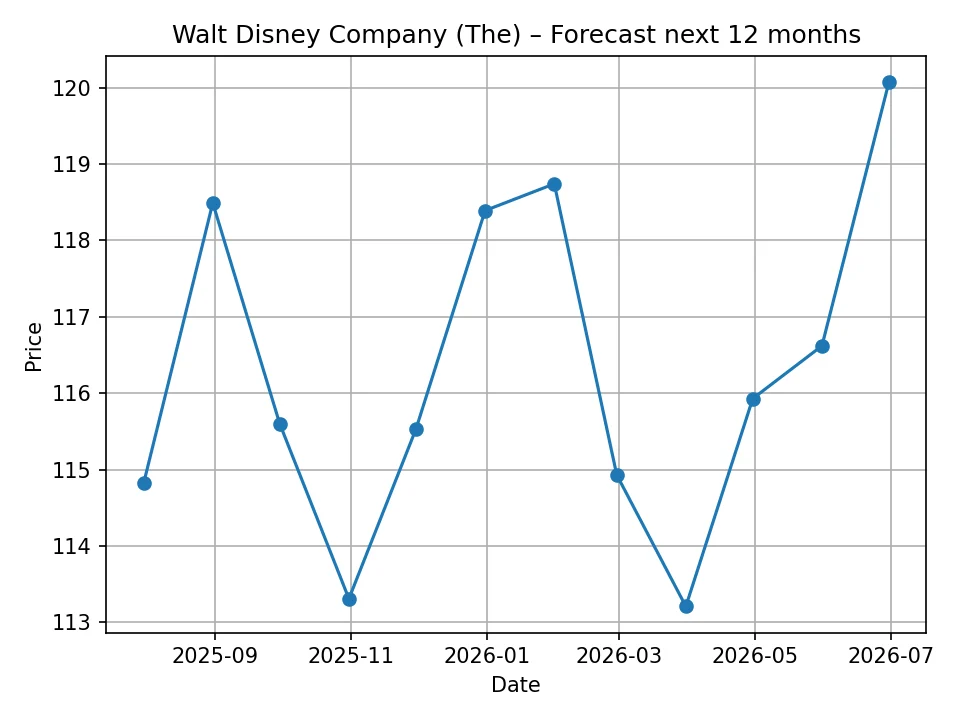

Our proprietary PriceCast algorithm, leveraging historical data and sophisticated predictive models, offers a detailed outlook for The Walt Disney Company’s stock over the coming 12 months. The forecast indicates a generally positive trajectory, with some expected monthly fluctuations.

DIS Monthly Price Forecast (June 2025 – June 2026)

| Month | Forecasted Price (USD) |

|---|---|

| 2025-07 | 114.82 |

| 2025-08 | 118.49 |

| 2025-09 | 115.60 |

| 2025-10 | 113.31 |

| 2025-11 | 115.53 |

| 2025-12 | 118.39 |

| 2026-01 | 118.74 |

| 2026-02 | 114.93 |

| 2026-03 | 113.21 |

| 2026-04 | 115.93 |

| 2026-05 | 116.62 |

| 2026-06 | 120.07 |

The monthly forecast suggests that DIS could experience a gradual upward trend, potentially reaching $120.07 USD by June 2026. There are anticipated periods of consolidation or slight pullbacks, such as in September-October 2025 and February-March 2026, which are common in stock market cycles. These minor dips could represent healthy corrections before further upward momentum. The overall positive outlook for the next year indicates increasing confidence in Disney’s ongoing strategic initiatives and its ability to improve profitability in key segments.

Long-Term Vision: Annual Price Forecast for DIS (Next 10 Years)

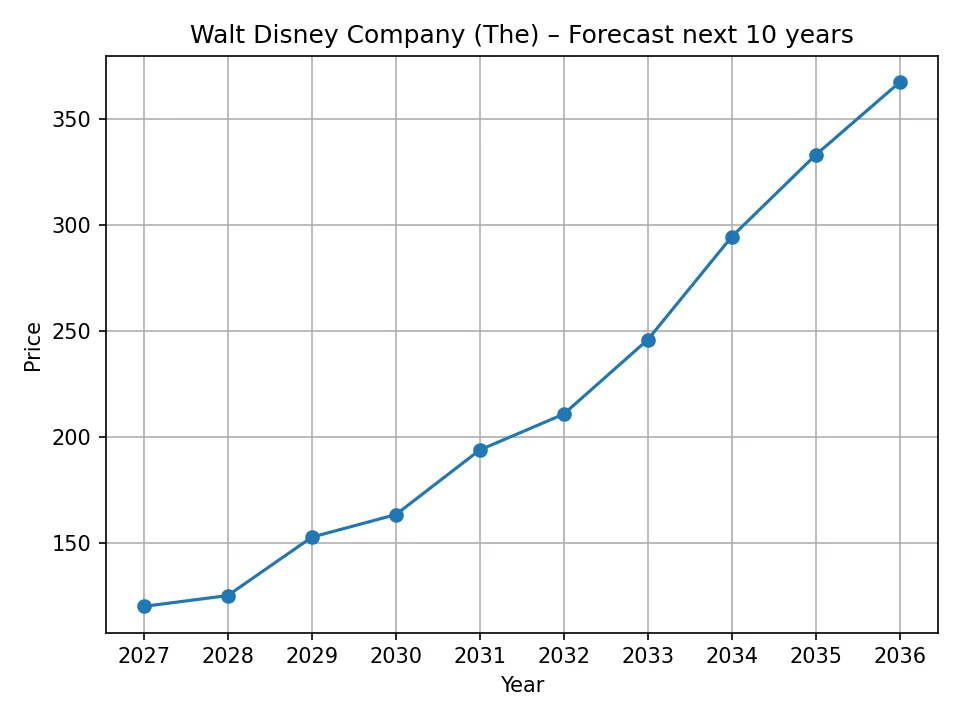

Extending our analysis, the PriceCast algorithm provides a compelling long-term price forecast for The Walt Disney Company, stretching out to 2035. This longer-term view reflects the compounding effects of strategic growth, market expansion, and the sustained power of Disney’s intellectual property.

DIS Annual Price Forecast (2026 – 2035)

| Year | Forecasted Price (USD) |

|---|---|

| 2026 | 120.07 |

| 2027 | 125.16 |

| 2028 | 152.70 |

| 2029 | 163.33 |

| 2030 | 193.79 |

| 2031 | 210.69 |

| 2032 | 245.83 |

| 2033 | 294.38 |

| 2034 | 332.89 |

| 2035 | 367.15 |

The annual forecast paints a highly optimistic picture for Disney’s long-term value. The PriceCast algorithm projects a consistent and substantial appreciation in DIS stock, culminating in a forecasted price of $367.15 USD by 2035. This projection is predicated on the assumption that Disney successfully executes its strategic transformation, particularly achieving sustained profitability and growth in its streaming services, continuing to innovate within its parks segment, and effectively leveraging its unparalleled content library globally. The significant jump observed from 2027 to 2028 and subsequent years could reflect the market fully pricing in the success of these long-term initiatives, potentially including the realization of new revenue streams or successful international expansions. Such a long-term outlook underscores Disney’s potential as a compounder of wealth, assuming continued operational excellence and favorable market conditions.

Potential Risks and Challenges on the Horizon

While the outlook appears promising, Disney’s path is not without its challenges. Investors should remain mindful of potential headwinds. The highly competitive streaming landscape demands continuous investment in content, which can pressure margins. Economic downturns could significantly impact theme park attendance and consumer product sales. Furthermore, the company faces ongoing pressure to manage its debt load effectively and adapt to evolving consumer preferences. The success of future content releases is never guaranteed, and potential box office disappointments or streaming subscriber plateaus could temper enthusiasm. Regulatory scrutiny, particularly regarding market dominance or content guidelines, also presents an ongoing consideration.

Opportunities for Sustained Growth and Innovation

Despite the challenges, Disney is exceptionally well-positioned to capitalize on several growth opportunities. The transition of ESPN into a direct-to-consumer offering represents a significant potential new revenue stream, appealing to a vast sports audience. Continued investment in its theme parks, including new attractions and technological enhancements, can drive per-capita spending and repeat visits. The global appeal of Disney’s vast intellectual property, from Marvel to Star Wars and classic animation, provides an unparalleled foundation for cross-platform monetization across streaming, merchandise, and live experiences. Furthermore, Disney’s commitment to innovation, exploring technologies like virtual reality and AI to enhance consumer experiences, could unlock entirely new growth avenues. Strategic partnerships and potential acquisitions could also bolster its market position and diversify its offerings.

Conclusion

The Walt Disney Company, with its current stock price of $112.95 USD, stands at a pivotal juncture, balancing its storied legacy with aggressive strategic pivots towards a digital-first future. The analysis of its historical performance reveals a company that has navigated recent challenges and begun to regain investor confidence through decisive actions. Our PriceCast algorithm’s forecasts suggest a cautiously optimistic short-term trajectory, with monthly fluctuations leading to a projected price of approximately $120.07 USD by June 2026. The long-term outlook, however, paints a significantly more bullish picture, with projections reaching $367.15 USD by 2035. This anticipated long-term growth is underpinned by the potential for streaming profitability, continued strength in its theme parks, and the enduring, synergistic power of its beloved global brands and intellectual property. While success is contingent on effective execution of its strategic initiatives and navigating competitive and macroeconomic pressures, Disney’s unique position in the global entertainment landscape suggests a compelling investment case for the long-term horizon.

Disclaimer: The price forecasts presented in this article are generated by a proprietary algorithmic model, PriceCast, and should be considered as speculative. Stock market predictions are inherently uncertain and subject to numerous unpredictable factors, including but not limited to economic conditions, industry trends, company-specific developments, and global events. We do not guarantee the accuracy or completeness of these forecasts, and they should not be construed as financial advice. Investing in the stock market carries risks, and individuals should conduct their own thorough research or consult with a qualified financial advisor before making any investment decisions. We are not responsible for any investment outcomes based on the information provided herein.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.