Viatris, Inc. (VTRS) stands as a prominent global healthcare company, dedicated to empowering people worldwide to live healthier at every stage of life. Formed through the combination of Mylan and Upjohn, Pfizer’s off-patent branded and generics business, Viatris occupies a unique position in the pharmaceutical landscape. It focuses on providing access to medicines, advancing sustainable operations, and developing innovative solutions for patients. The company’s diverse portfolio spans various therapeutic areas, including cardiovascular, pain and inflammation, central nervous system, and anti-infectives, alongside a robust generics and biosimilars pipeline. As of June 5, 2025, Viatris’s stock is trading at $8.59 USD, a price point that warrants a closer look given the company’s recent strategic shifts and the dynamic nature of the global healthcare market.

Understanding the potential trajectory of Viatris’s stock requires a comprehensive analysis that considers its historical performance, the intricate factors shaping the pharmaceutical industry, and the insights derived from predictive modeling. This article aims to delve into these aspects, providing a detailed outlook on VTRS’s future price performance.

A Retrospective Look at Viatris’s Stock Performance (Last 12 Months)

The past year has been a period of notable volatility and significant developments for Viatris. Examining the daily historical data from the last 12 months provides crucial context for its current valuation and future projections. The stock experienced considerable fluctuations, reflecting broader market sentiment, company-specific news, and the inherent challenges and opportunities within the pharmaceutical sector.

Over the past year, Viatris’s stock traded within a wide range, illustrating periods of both investor optimism and caution. The provided historical data shows the stock starting around the $10.00 – $10.15 mark in early June 2024. Throughout the summer and early fall of 2024, VTRS largely maintained this price level, with some minor upticks reaching into the $11.00-$11.50 range. This relatively stable period suggested a baseline level of investor confidence, possibly underpinned by expectations around the company’s integration efforts and initial synergy realizations post-merger.

A significant surge was observed around late November to early December 2024, when the stock climbed markedly, peaking at approximately $13.01 USD. This high point represented a substantial gain from its earlier trading range and likely coincided with positive market sentiment, perhaps driven by specific company announcements, strong quarterly results, or broader sector tailwinds. Such peaks often indicate a period of heightened investor interest or anticipation of future growth.

However, following this peak, Viatris experienced a considerable downward correction. The stock began a consistent decline in early 2025, moving from its December highs back into the $10.00-$11.00 range, and then further dropping below $9.00 in late March 2025. This downturn culminated in the stock reaching its 12-month low of approximately $7.15 USD in mid-April 2025. This sharp decline could be attributed to a combination of factors: market reactions to financial reports, concerns over generic drug pricing pressures, divestiture news, or general macroeconomic headwinds impacting growth-oriented stocks.

Since hitting this low, Viatris’s stock has shown signs of stabilization and a modest recovery, trading within the $8.00-$9.00 range. Its current price of $8.59 USD on June 5, 2025, reflects this recent rebound, positioning it above its lowest point but significantly below its 12-month high. This historical trajectory underscores the inherent volatility of pharmaceutical stocks, influenced by R&D successes, regulatory hurdles, competitive pressures, and evolving healthcare policies. The current price sits at a crucial juncture, reflecting a period of adjustment after a significant dip, with investors now evaluating the company’s ability to execute its long-term strategy and deliver consistent performance. The journey from $10.00 to $13.00, down to $7.15, and now back to $8.59, paints a picture of a company navigating complex market dynamics and strategic transformations.

Key Factors Influencing Viatris’s Stock Price

The future price of Viatris’s stock is not determined in isolation; it is a complex interplay of internal company dynamics, industry-wide trends, and broader macroeconomic conditions. Understanding these influential factors is critical for any investor evaluating VTRS.

Company-Specific Factors

Viatris’s strategic roadmap, financial health, and operational efficiency are paramount to its stock performance.

- Product Portfolio and Pipeline: Viatris boasts a robust portfolio of established brands, generics, and biosimilars. The success of its key products and the potential of its pipeline are crucial. Launches of new biosimilars, particularly in complex areas like ophthalmology or immunology, can drive significant revenue growth. Conversely, patent expirations on branded drugs and intensified competition in the generics space can exert downward pressure on prices and margins. Investors closely monitor the company’s R&D efforts and regulatory approvals for new therapeutic options.

- Strategic Divestitures and Acquisitions: Viatris has been actively optimizing its portfolio through divestitures, aiming to streamline operations and focus on higher-growth areas. The recent sale of its biosimilars business to Biocon Biologics and the planned sale of certain OTC assets are examples. While these moves can generate capital and simplify the business, the market’s reaction to the terms and the subsequent use of proceeds (e.g., debt reduction, share buybacks, reinvestment) significantly impacts stock valuation. Future strategic transactions, whether acquisitions to bolster key segments or further divestitures, will continue to shape investor perception.

- Financial Performance and Debt Management: The company’s revenue growth, profitability margins, and cash flow generation are fundamental. Viatris has a substantial debt load from its formation, and its ability to deleverage and improve its financial efficiency is a key focus for investors. Strong quarterly earnings, improved free cash flow, and prudent capital allocation can boost investor confidence. Conversely, missed earnings targets or concerns about debt repayment can lead to downward revisions in stock forecasts.

- Global Reach and Market Access: Viatris operates across more than 165 countries, providing it with a broad market footprint. Its ability to navigate diverse regulatory environments, healthcare systems, and pricing pressures in different regions is vital. Expanding access to essential medicines in emerging markets can be a long-term growth driver.

- Management Strategy and Execution: The leadership team’s ability to articulate a clear strategy and execute it effectively is paramount. This includes achieving synergy targets from the Mylan-Upjohn merger, successfully integrating acquired assets, and fostering innovation. Investor confidence is built on consistent messaging and tangible results.

Industry-Specific Factors

The broader pharmaceutical and healthcare industries present both opportunities and challenges for Viatris.

- Generics and Biosimilars Market Dynamics: As a leading player in generics and biosimilars, Viatris is highly sensitive to trends in this market. Pricing pressures, increased competition from other generic manufacturers, and the speed of regulatory approvals for biosimilars can impact profitability. However, the increasing demand for affordable medicines globally, coupled with a wave of blockbuster drug patent expirations, creates significant opportunities for biosimilar launches.

- Regulatory Landscape: Healthcare regulations worldwide play a significant role. Changes in drug approval processes, pricing controls, reimbursement policies, and intellectual property laws can directly affect Viatris’s operations and revenue. Regulatory hurdles or delays for new product launches can also impact performance.

- Healthcare Spending Trends: Global healthcare spending is influenced by aging populations, rising chronic disease prevalence, and advancements in medical science. Increased spending, particularly on essential medicines, can benefit Viatris. However, efforts by governments and insurers to control costs can lead to downward pressure on drug prices.

- Competition: The pharmaceutical industry is intensely competitive. Viatris faces competition from large multinational pharmaceutical companies, smaller biotech firms, and other generic manufacturers. The ability to differentiate its products, secure market share, and innovate is crucial for sustained growth.

Macroeconomic Factors

Broader economic conditions can significantly influence Viatris’s valuation.

- Inflation and Interest Rates: High inflation can increase operational costs for pharmaceutical companies, from raw materials to manufacturing. Rising interest rates can increase the cost of borrowing for companies with significant debt, like Viatris, potentially impacting profitability and investment capacity.

- Economic Growth and Consumer Spending: While healthcare is often considered a defensive sector, severe economic downturns can lead to reduced healthcare spending, particularly in out-of-pocket expenses for non-essential treatments. However, Viatris’s focus on essential medicines and generics may provide some resilience during economic slowdowns.

- Global Geopolitical Events: Geopolitical instability, trade disputes, and supply chain disruptions can impact Viatris’s global operations, raw material sourcing, and distribution networks. Events like the COVID-19 pandemic highlighted the importance of resilient supply chains and the ability to adapt to sudden market shifts.

- Currency Fluctuations: As a global company, Viatris generates revenue in various currencies. Fluctuations in exchange rates can impact its reported earnings when converted back to USD. A strong USD can negatively affect international earnings.

Considering these multifaceted factors provides a robust framework for interpreting price predictions for Viatris.

Viatris (VTRS) Monthly Price Forecast: July 2025 – June 2026

The short-term outlook for Viatris (VTRS) stock, as projected by the AlphaForecast algorithm for the next 12 months, suggests a period of modest fluctuations, with the stock generally hovering around its current levels, while showing signs of potential gradual improvement towards the end of the period. This forecast provides a granular view of how VTRS might perform month-by-month, offering insights for short-term investors and those tracking the company’s immediate market response to unfolding events.

The current price of Viatris stands at $8.59 USD as of June 5, 2025. The monthly forecast begins in July 2025, anticipating a slight dip to $8.42 USD. This marginal decrease could reflect minor market adjustments or short-term headwinds. August 2025 projects a further dip to $8.03 USD, indicating a potential near-term low within this 12-month forecast window. This could be due to seasonal factors, specific market news, or a temporary re-evaluation by investors.

However, the forecast suggests a quick recovery. By September 2025, VTRS is predicted to rebound to $8.20 USD, followed by a stronger recovery to $8.42 USD in October 2025, bringing it back to the July level. November 2025 sees a slight consolidation at $8.34 USD, before climbing marginally to $8.46 USD in December 2025. This end-of-year prediction suggests a stable finish for 2025, with the stock holding its ground.

As we move into 2026, the forecast indicates a more positive trend. January 2026 is projected at $8.61 USD, slightly above the current price, hinting at renewed investor confidence or a positive start to the new fiscal year. This upward momentum continues into February 2026, with a forecast of $8.83 USD, which would represent the highest point in this monthly forecast period. This could be driven by anticipation of strong Q4 2025 earnings or positive industry developments.

Following this peak, the forecast suggests a slight pull-back. March 2026 is predicted at $8.46 USD, mirroring the December 2025 level. April 2026 projects a further slight decline to $8.33 USD, and May 2026 remains stable at $8.34 USD. This consolidation phase suggests a period where the market might digest recent performance or await further catalysts. The 12-month period concludes with a positive forecast for June 2026, predicting VTRS at $8.72 USD. This closing prediction indicates a net positive movement over the 12-month horizon compared to the current price, implying a gradual, albeit volatile, upward trajectory.

Overall, the monthly forecast portrays Viatris stock as navigating a somewhat choppy but ultimately improving path over the next year. Investors should anticipate short-term volatility, with opportunities for minor dips and recoveries. The consistent range, predominantly between $8.00 and $9.00, suggests that AlphaForecast predicts Viatris will remain within a relatively tight trading band in the short term, with fundamental factors likely playing a more significant role in any sustained movements.

Viatris (VTRS) Monthly Price Predictions (AlphaForecast)

| Month/Year | Predicted Price (USD) |

|---|---|

| July 2025 | $8.42 |

| August 2025 | $8.03 |

| September 2025 | $8.20 |

| October 2025 | $8.42 |

| November 2025 | $8.34 |

| December 2025 | $8.46 |

| January 2026 | $8.61 |

| February 2026 | $8.83 |

| March 2026 | $8.46 |

| April 2026 | $8.33 |

| May 2026 | $8.34 |

| June 2026 | $8.72 |

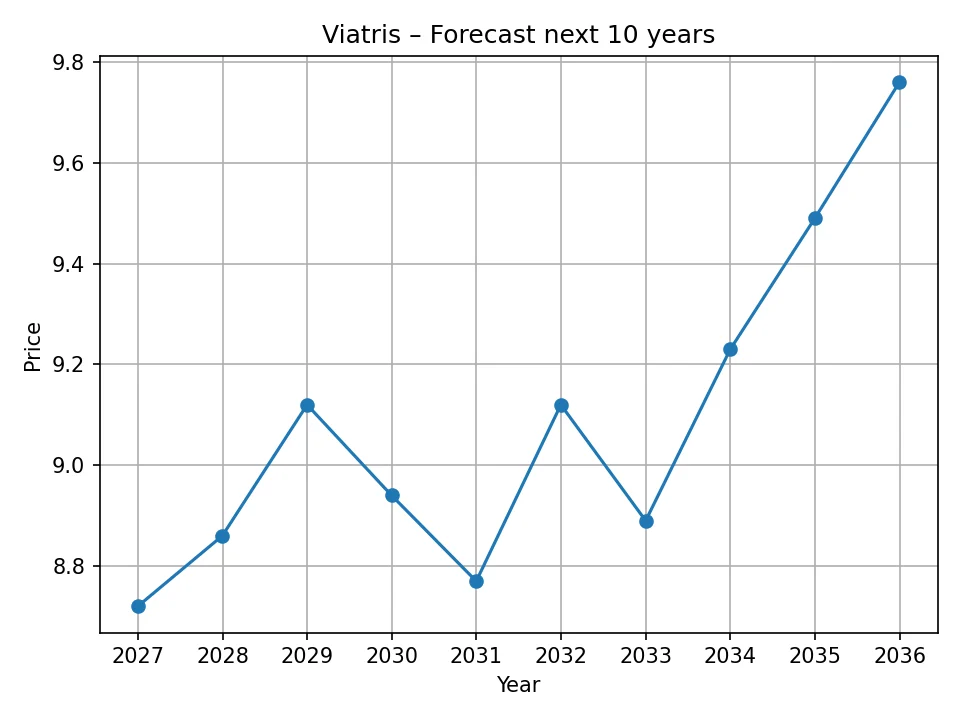

Viatris (VTRS) Annual Price Forecast: 2026 – 2035

The long-term price prediction for Viatris (VTRS) stock, extending over the next decade from 2026 to 2035, offers a compelling perspective on the company’s potential trajectory. According to the AlphaForecast algorithm, VTRS is expected to experience a gradual upward trend over this period, punctuated by some consolidations, ultimately reaching a higher valuation by 2035. This long-term view implies that while short-term volatility may persist, the underlying fundamentals and strategic direction of Viatris are anticipated to support a stronger stock performance over time.

The forecast for 2026 aligns with the conclusion of the monthly predictions, projecting Viatris at $8.72 USD. This serves as a baseline for the annual outlook, indicating a modest improvement from the current price of $8.59 USD. Moving forward, the algorithm anticipates continued growth in the immediate years. In 2027, the price is predicted to reach $8.86 USD, followed by a more significant increase to $9.12 USD in 2028. Crossing the $9.00 threshold would signify a notable recovery from its recent lows and a return to price levels last seen in its earlier historical trading range. This ascent could be driven by the successful execution of its strategic transformation, including portfolio optimization, debt reduction, and the launch of new, high-value products.

However, the forecast also suggests periods of re-evaluation or consolidation. In 2029, the price is predicted to dip slightly to $8.94 USD, followed by a further decline to $8.77 USD in 2030. These projected dips could reflect anticipated market cycles, increased competition in certain therapeutic areas, or the impact of external economic pressures. Such fluctuations are common in long-term stock predictions, as market conditions and company performance are rarely linear. These could also represent periods where the market digests past growth or prepares for future catalysts.

Following the potential consolidation in 2029-2030, the AlphaForecast algorithm predicts a renewed upward trajectory for Viatris. In 2031, the stock is expected to rebound strongly to $9.12 USD, reaching its 2028 high again. This rebound underscores the algorithm’s confidence in Viatris’s long-term resilience and growth drivers. A slight decline is projected for 2032, down to $8.89 USD, before another period of sustained growth begins.

The final years of the forecast demonstrate increasingly positive momentum. In 2033, Viatris is projected to reach $9.23 USD, surpassing previous highs within this long-term outlook. This positive trend is expected to continue, with the stock climbing to $9.49 USD in 2034 and finally reaching $9.76 USD by 2035. This steady climb towards the end of the decade suggests that Viatris’s long-term strategies, including its focus on biosimilars, complex generics, and key therapeutic areas, are expected to bear fruit, leading to enhanced shareholder value. The predicted price of nearly $10.00 by 2035 places the stock back in the range where it was trading a year prior to its current price, indicating a full recovery and steady growth beyond its current valuation.

In summary, the annual forecast paints a picture of a company that, despite expected near-term fluctuations, is poised for long-term value creation. The projected growth, particularly in the latter half of the decade, implies that Viatris’s efforts to optimize its portfolio, enhance operational efficiency, and capitalize on market opportunities in the pharmaceutical sector are likely to be successful over the extended horizon. This outlook may appeal to long-term investors willing to weather intermittent volatility for potential capital appreciation.

Viatris (VTRS) Annual Price Predictions (AlphaForecast)

| Year | Predicted Price (USD) |

|---|---|

| 2026 | $8.72 |

| 2027 | $8.86 |

| 2028 | $9.12 |

| 2029 | $8.94 |

| 2030 | $8.77 |

| 2031 | $9.12 |

| 2032 | $8.89 |

| 2033 | $9.23 |

| 2034 | $9.49 |

| 2035 | $9.76 |

Risks and Opportunities for Viatris (VTRS)

Investing in Viatris, like any pharmaceutical company, comes with a unique set of risks and opportunities that can significantly impact its stock performance. Understanding these elements is crucial for a balanced investment perspective.

Key Opportunities

Viatris has several avenues for potential growth and value creation that could lead to an upside in its stock price:

- Biosimilars Market Growth: The global biosimilars market is projected for significant growth, driven by patent expirations of blockbuster biologics and increasing demand for cost-effective therapeutic alternatives. Viatris has established itself as a key player in this space, with a robust portfolio and pipeline. Successful launches of new biosimilars, especially in complex areas like oncology and immunology, could provide substantial revenue streams and margin expansion. Its partnership with Biocon Biologics positions it well to capitalize on this trend.

- Portfolio Optimization and Debt Reduction: Viatris’s ongoing strategy of divesting non-core assets aims to streamline its business, reduce complexity, and free up capital. These divestitures, along with strong cash flow generation, are targeted at reducing its substantial debt load. Successful deleveraging will improve the company’s financial flexibility, reduce interest expenses, and potentially lead to credit rating upgrades, making the stock more attractive to investors.

- Emerging Markets Expansion: Viatris has a strong global footprint, particularly in emerging markets, where healthcare spending is growing and there’s a significant need for affordable, quality medicines. Expanding its presence and product offerings in these regions could unlock new growth opportunities. The increasing prevalence of chronic diseases in these markets also plays to Viatris’s strength in established medicines.

- Strategic Partnerships and Collaborations: Collaborations in R&D, manufacturing, or distribution can enhance Viatris’s capabilities and reach. Strategic partnerships can help accelerate product development, access new markets, or mitigate risks associated with large-scale projects.

- Shareholder Returns: As the company continues to optimize its portfolio and reduce debt, there is potential for increased shareholder returns through dividends or share buyback programs, which can boost investor confidence and demand for the stock.

Key Risks

Despite the opportunities, Viatris faces notable risks that could impede its growth and negatively impact its stock price:

- Generic Pricing Pressure: The generics industry is inherently competitive, characterized by intense pricing pressure. Increased competition, accelerated ANDA (Abbreviated New Drug Application) approvals, and consolidation among purchasers can drive down prices and erode profit margins for Viatris’s generic products. This is a perpetual challenge for generic drug manufacturers.

- Patent Expirations and Competition: While patent expirations on branded drugs create opportunities for generics and biosimilars, Viatris also holds patents on some of its established brands. The loss of patent protection for these products, coupled with aggressive generic competition, can lead to significant revenue erosion.

- Regulatory and Litigation Risks: The pharmaceutical industry is heavily regulated. Changes in healthcare policies, drug approval processes, pricing regulations, and reimbursement rules can impact Viatris’s operations and profitability. Additionally, the company faces ongoing litigation risks, including those related to product liability, patent infringement, or antitrust issues, which can result in significant legal costs and financial penalties.

- Integration Challenges and Strategic Execution: While the Mylan-Upjohn merger brought Viatris into existence, the integration process, and the ongoing portfolio optimization, are complex. Failure to fully realize anticipated synergies, execute divestitures smoothly, or effectively reinvest proceeds could negatively impact financial performance and investor confidence.

- Supply Chain Disruptions: As a global company, Viatris relies on a complex supply chain for raw materials and finished products. Geopolitical events, natural disasters, or public health crises (like pandemics) can disrupt supply chains, leading to manufacturing delays, increased costs, and product shortages, which can harm revenue and reputation.

- Economic Headwinds and Interest Rates: A global economic slowdown could impact healthcare spending and demand for certain products. Furthermore, Viatris’s significant debt means it is sensitive to interest rate fluctuations. Rising rates could increase debt servicing costs, impacting profitability and financial flexibility.

A comprehensive assessment of Viatris’s investment potential requires careful consideration of both these promising opportunities and formidable risks. Its ability to navigate these dynamics will largely determine its long-term success.

Conclusion and Disclaimer

Viatris (VTRS) currently trades at $8.59 USD as of June 5, 2025, a price reflecting a period of significant strategic transformation and market volatility over the past year. Historical data revealed a journey from around $10.00 to a peak of $13.01, followed by a sharp decline to a low of $7.15, before stabilizing around its current level. This illustrates the dynamic environment in which Viatris operates, heavily influenced by its ongoing portfolio optimization, the competitive generics and biosimilars landscape, and broader economic factors.

The monthly price forecast for Viatris, generated by the AlphaForecast algorithm, suggests a period of short-term fluctuations. While dips to around $8.03 are anticipated in August 2025, the stock is generally expected to consolidate and show gradual recovery, reaching approximately $8.72 USD by June 2026. This indicates that while immediate significant gains are not projected, the stock is expected to hold its ground and show a modest upward trajectory over the next 12 months.

Looking further ahead, the long-term annual forecast from AlphaForecast for the period 2026 to 2035 paints a cautiously optimistic picture. Despite expected periods of consolidation or slight dips, the algorithm predicts an overall upward trend for Viatris. The stock is projected to slowly but steadily climb, reaching $9.12 USD by 2028, and then demonstrating a more consistent growth in the latter half of the decade, ultimately reaching approximately $9.76 USD by 2035. This long-term outlook suggests that Viatris’s strategic efforts to streamline its business, reduce debt, and capitalize on the growing biosimilars market are anticipated to yield positive returns over the extended horizon.

However, investors must weigh these predictions against inherent risks, including persistent generic pricing pressures, patent expirations, regulatory challenges, and the complexities of integrating large-scale divestitures. Opportunities in the expanding biosimilars market, effective debt reduction, and a strong global presence provide potential upside. The forecast suggests that Viatris, a company navigating a complex post-merger environment, is poised for a gradual recovery and long-term value creation, provided it successfully executes its strategic initiatives amidst a challenging industry landscape.

Disclaimer: This article contains price predictions generated by a proprietary algorithm, AlphaForecast, based on historical data and current market information. Please note that stock market predictions are inherently uncertain and subject to numerous unforeseen variables, including market volatility, economic conditions, regulatory changes, and company-specific developments. The forecasts provided herein are for informational purposes only and do not constitute financial advice. We are not responsible for any investment decisions made based on the information presented in this article. Investing in stocks involves significant risks, and individuals should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

Michael Carter holds a BA in Economics from the University of Chicago and is a CFA charterholder. With over a decade of experience at top financial publications, he specializes in equity markets, mergers & acquisitions, and macroeconomic trends, delivering clear, data-driven insights that help readers navigate complex market movements.